Bitcoin [BTC]: Short products for the win as investors shy away from long positions

- Investors are funnelling funds into Short-BTC products after fourth consecutive week of outflows

- With the Shanghai Upgrade coming soon, investors will be cautious with ETH

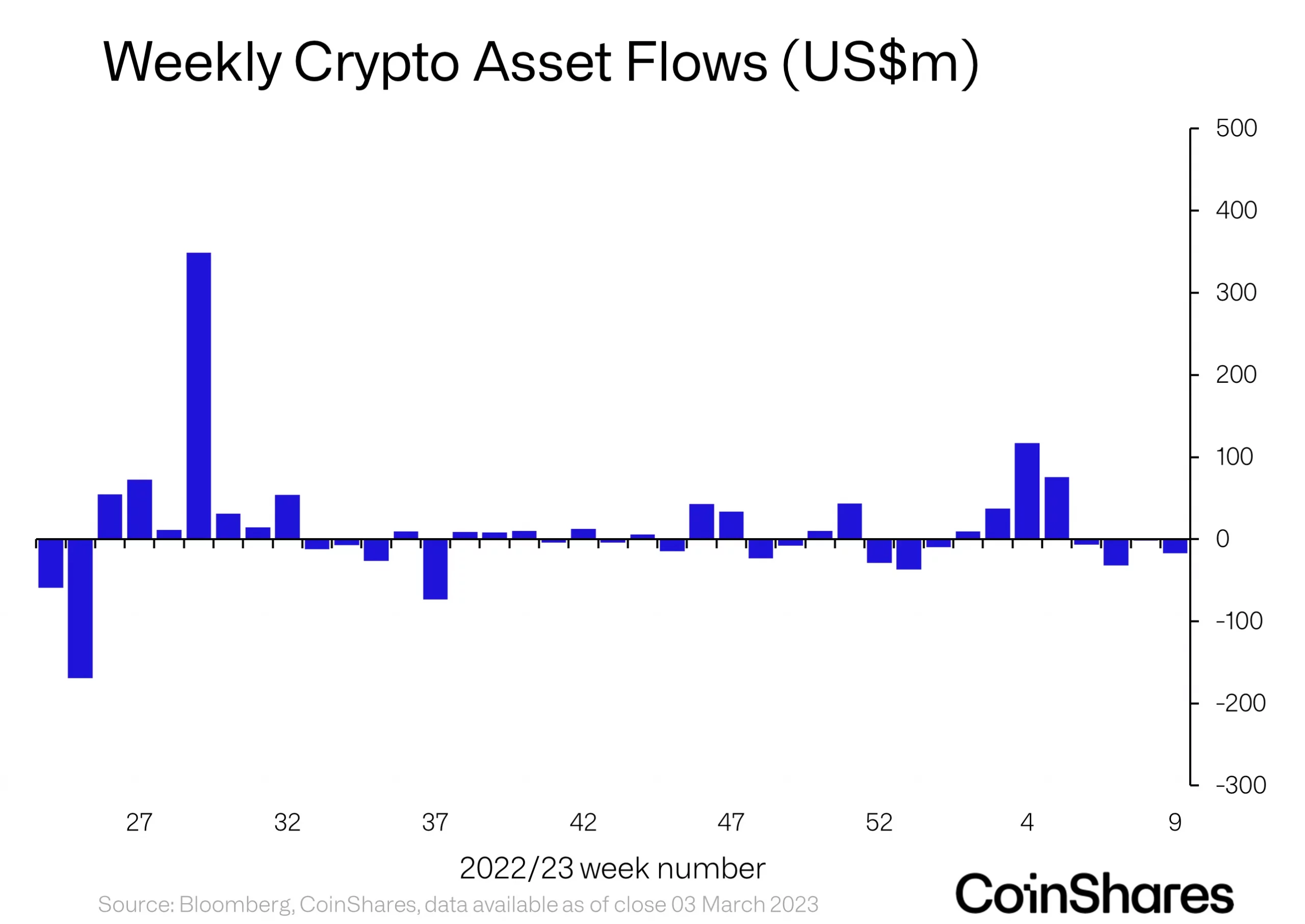

In a new report, digital asset investment firm CoinShares found that ongoing apprehension among investors regarding the uncertain regulatory landscape of crypto-assets led to a fourth consecutive week of outflows for Bitcoin [BTC]. This, as investors rallied around short investment products instead.

The value of BTC sharply declined in the early trading hours of 3 March, causing investor confidence in the coin’s short-term price rally to drop even further due to the uncertainty around Silvergate Capital. This event contributed to long liquidations soaring to a seven-month high, data from Coinglass revealed. According to CoinShares,

“The poor sentiment likely represents continued investor concerns over regulatory uncertainty for the asset class.”

To short or not to short?

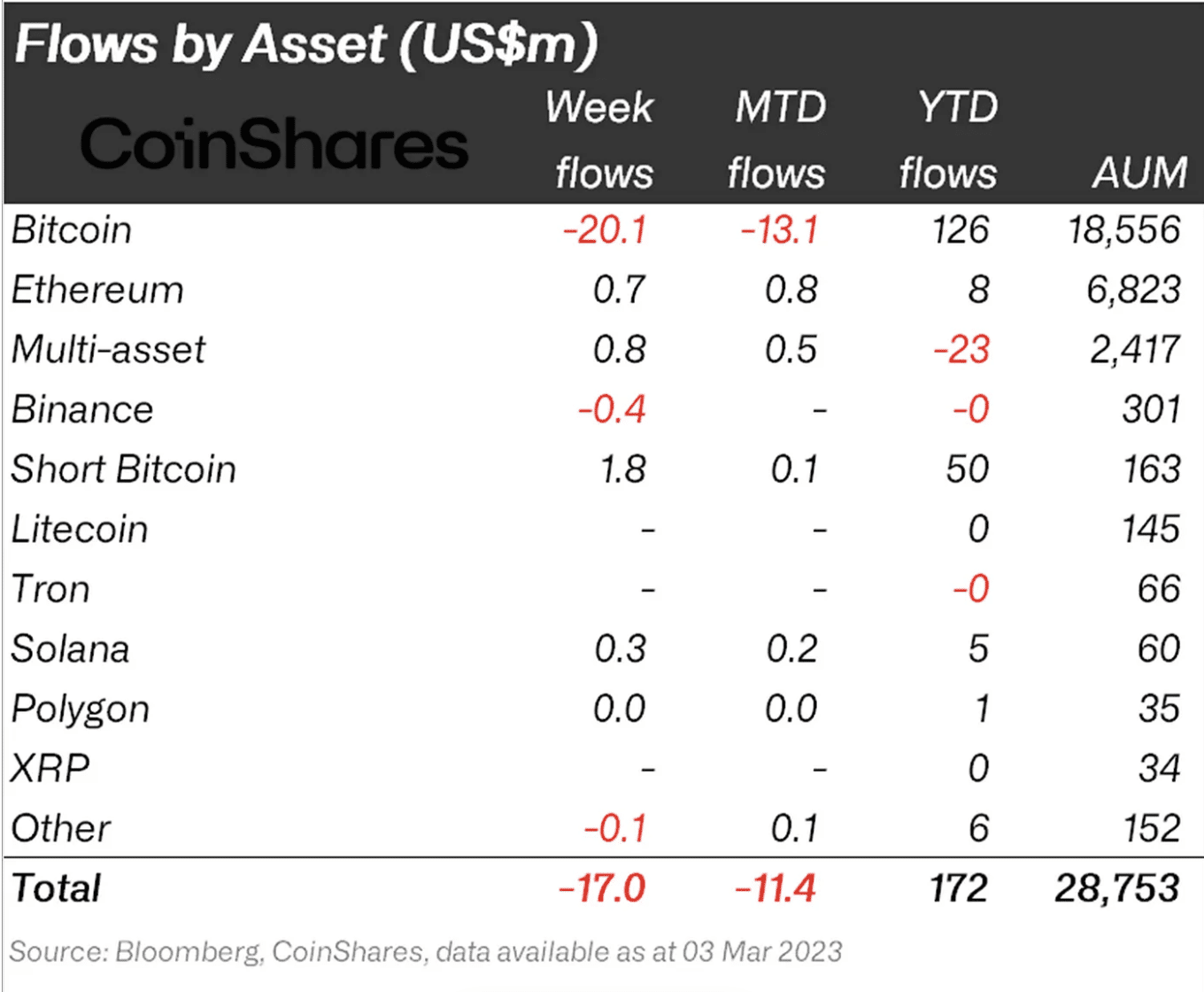

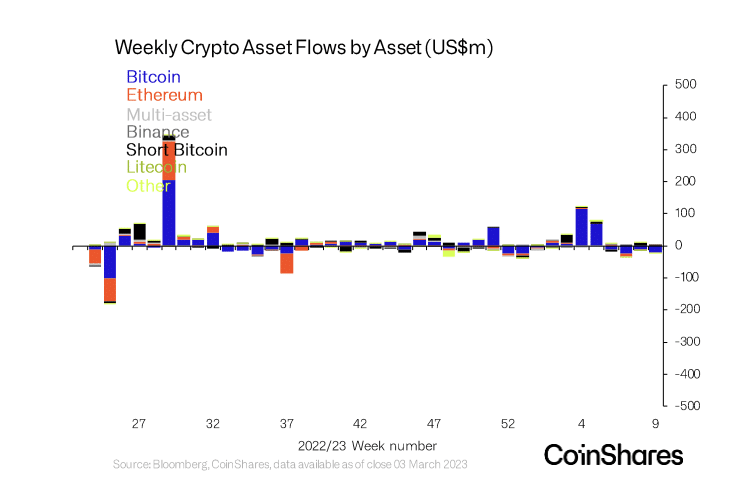

According to CoinShares, last week, investors funnelled funds into Short-Bitcoin products. As a result, Short-Bitcoin saw inflows of $1.8 million. On a year-to-date basis, Short-Bitcoin products have logged inflows of $50 million.

Interestingly, despite the recent inflows into Short-Bitcoin, the value of its total assets under management (AuM) has only risen by 4.2% TYD. This starkly contrasted with Long-Bitcoin AuM, which has hiked by 36%.

Citing concerns over regulatory uncertainty for the asset class, CoinShares added that the discrepancy in performance suggested that short positions are yet to deliver the returns that some investors are expecting.

For its part, Bitcoin logged its fourth consecutive week of outflows totaling $20 million. Due to the coin’s impressive performance towards the beginning of the year, its YTD inflows stood at $126 million.

While the entire investment products market suffered low volumes due to outflows last week, BTC experienced a lower-than-usual market volume, CoinShares found. According to the report,

“Volumes across investment products were low at US$844m for the week, but a similar situation was seen for the entire Bitcoin market volumes, averaging US$57bn, 15% lower than usual.”

Overall, the low investment product volumes and lower-than-usual BTC market volumes suggested that investors have been exercising caution and might adopt a wait-and-see approach.

Minor inflows into Ether ahead of the Shanghai Upgrade

There were minor inflows into altcoins last week, with Ethereum [ETH] and Solana [SOL] receiving $700,000 and $340,000, respectively. On the other hand, Binance’s BNB and Cosmos’ ATOM logged outflows of $380,000 and $210,000, respectively.

Investors have exercised caution as the date for Ethereum’s Shanghai Upgrade is approaching. There is a general sense of uncertainty regarding the direction of ETH’s price after previously locked ETH coins become available.

![Polygon's [POL] short-term momentum faces strong resistance HERE](https://ambcrypto.com/wp-content/uploads/2025/03/Polygon-Featured-400x240.webp)