Bitcoin [BTC]: To sink or swim, investors unsure of market’s next direction

![Bitcoin [BTC]: To sink or swim, investors unsure of market's next direction](https://ambcrypto.com/wp-content/uploads/2023/05/AMBCrypto_A_group_of_bitcoin_traders_standing_at_a_train_statio_825a43b4-c564-4d6c-9fe3-6fe2ac58741d.jpg)

- BTC’s price and SOPR moved sideways as investors remain unsure of the market’s direction.

- Long-held BTC coins remain idle in wallet addresses.

As Bitcoin’s [BTC] price continued to oscillate within a narrow range in the last month, pseudonymous CryptoQuant analyst Joao Wedson found that the coin’s Spent Output Profit Ratio (SOPR) indicator on an 80-day moving average also remained sideways.

Read Bitcoin’s [BTC] Price Prediction 2023-24

The SOPR metric tracks the profit or loss made by coin holders by analyzing the difference between the price at which they acquired their coins and the price at which they are being spent or moved on the blockchain.

When an asset’s SOPR metric moves sideways, it means that the proportion of outputs spent at a profit within a certain time frame is not significantly increasing or decreasing.

According to Wedson, in the current BTC market, this suggests a possible distribution scenario, where short-term holders may be selling their coins while the market remains vulnerable to a price drop.

Little buying, little selling. What then?

BTC’s price trading within a tight range and a sideways movement of its SOPR indicator indicate a period of consolidation or indecision among its investors.

This is common when market participants are waiting for more clarity or a new catalyst before taking significant positions in the market.

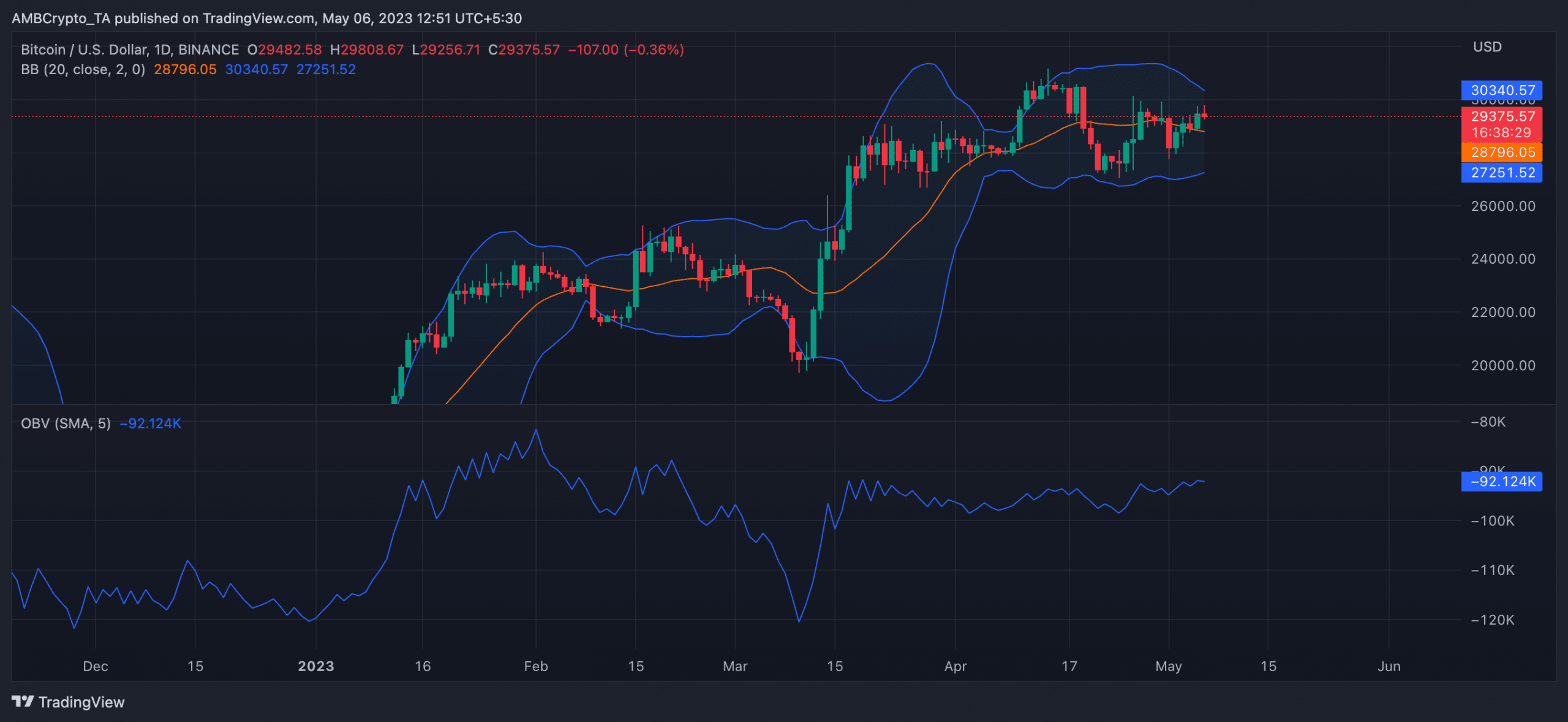

Assessing BTC’s Bollinger Bands indicator on a 24-hour chart lent credence to this position. At press time, its price traded in the middle of the upper band and lower band of the Bollinger Bands.

When an asset’s price trades in such a manner, it suggests that there is no strong buying or selling pressure in the market, and the price is moving within a relatively tight range.

Also, at -92.12k at press time, BTC’s On-balance volume has remained sideways since the end of April. The indicator uses volume data to track the flow of money into and out of an asset.

When it moves within a tight range, the buying and selling pressures are roughly equal, and traders and investors alike remain unsure of the next direction in which the market is likely to move.

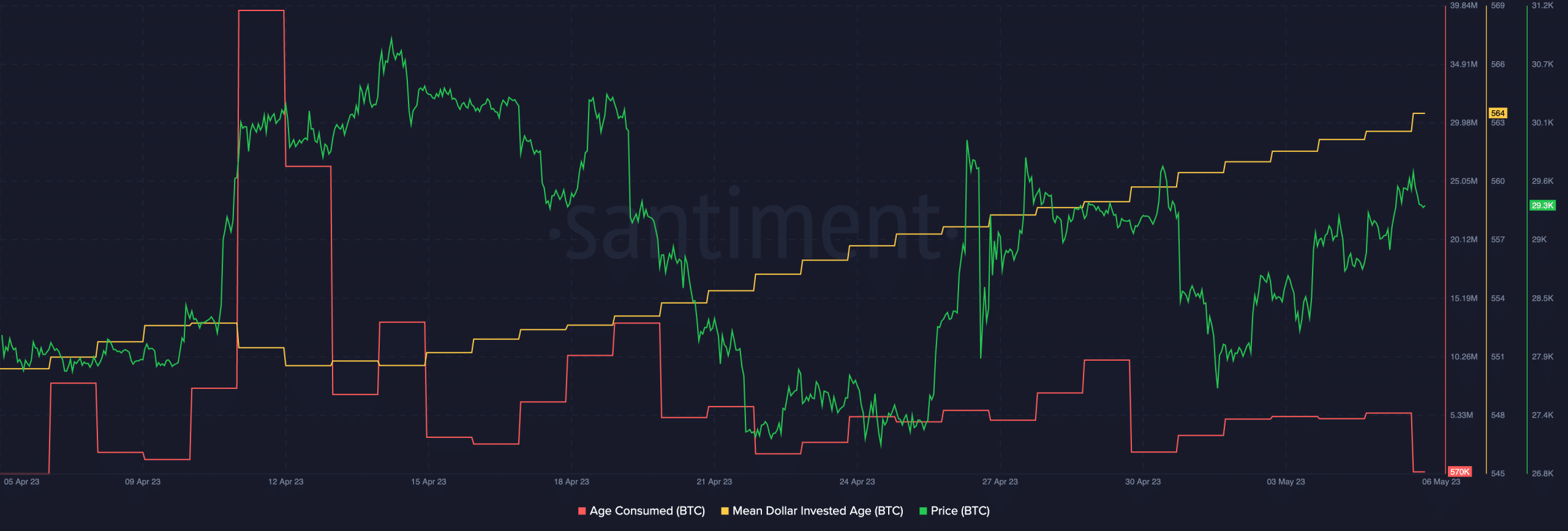

Further, on the chain, long-held BTC coins have remained inactive, contributing to the sideways movement of the asset’s price. For example, following the spike on 17 April, BTC’s Age Consumed metric has since trended downwards.

This metric tracks the number of tokens changing addresses on a certain date, multiplied by the time since they last moved. When it spikes, it means that a large number of tokens changed addresses after being idle for an extended period. This can drive up the value of the asset concerned.

Conversely, when the Age Consumed metric dips, long-held coins remain in wallet addresses without being traded.

How much are 1,10,100 BTCs worth today

Lastly, after a slight dip on 17 April, BTC’s Mean Dollar Invested Age (MDIA) metric began to rise. According to Santiment, when an asset moves in such a manner:

“It means that the location of where the investments lie is becoming more and more dormant over time. If there is a long stretch (months at a time) where this metric continues to rise, this generally implies that there is some concerning stagnancy on that coin’s network. And stagnancy makes it hard for prices to continue rising.”

For BTC’s price to re-claim the $30,000 price mark, sentiments have to improve, and long-held coins need to exchange hands.