Bitcoin [BTC] weekly inflows grow despite Shapella completion as ETH…

![Bitcoin [BTC] weekly inflows grow despite Shapella completion as ETH…](https://ambcrypto.com/wp-content/uploads/2023/04/btc-eth-AMBCrypto_An_image_of_a_smooth_road_with_two_separate_lanes_one_8faf7ed2-901c-4252-b428-4de254768357.png)

- For the umpteenth time, investors overlooked ETH over BTC.

- Bitcoin inflows went up to $104 million, but other altcoins were also starved.

As two of the most dominant cryptocurrencies, Bitcoin [BTC] and Ethereum [ETH] have gained interest from investors across several regions. This fascination is the reason why investment products linked to the top two largest cryptocurrencies in market value have registered noteworthy inflows over the years.

Realistic or not, here’s ETH’s market cap in BTC’s terms

BTC stays, but is Shapella really the worry?

Recently, Bitcoin’s digital asset investment products’ weekly inflows have been growing steadily, indicating renewed investor attraction to the asset.

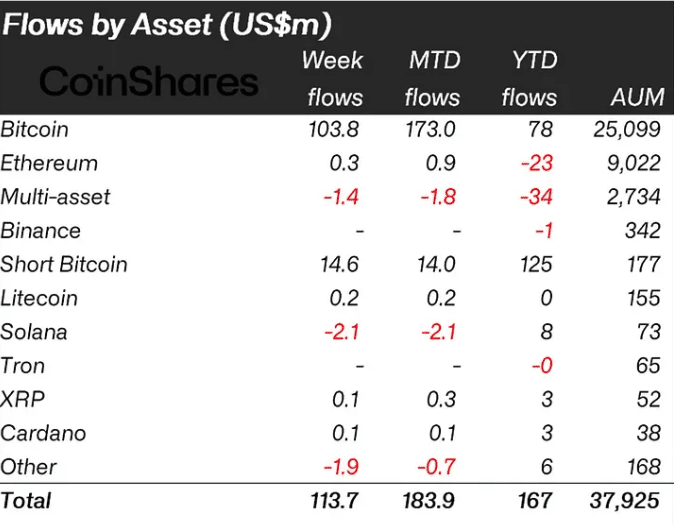

And, according to CoinShares’ report of the 14 April weekly close, it was the same case for the king coin. During this period, inflows related to BTC’s products reached $104 million.

Like the previous volumes before volume 127, the digital asset investment group noted that the interest in BTC was because of the challenges faced by traditional institutions. The report read:

Bitcoin has again been almost the sole focus for investors, with inflows of US$104m last week, bringing its total 4-week run to US$310m. We believe this is a flight to safety by investors fearful of the ongoing traditional finance challenges.

On the other hand, Ethereum’s weekly inflow has remained flat for several weeks. For prospective investors, the decision to abstain from ETH products was because of the Shapella upgrade, which many expected to trigger a sharp dip in the ETH value.

Surprisingly, the projection was not the case, as ETH could break past $2,000. However, the successful completion of the upgrade did not change investors’ perception as last week’s inflows remained low at $300,000.

The report continued:

Despite the successful launch of Ethereum’s yield features (Shapella), only US$0.3m of inflows were seen last week.

ETH’s impression looks…

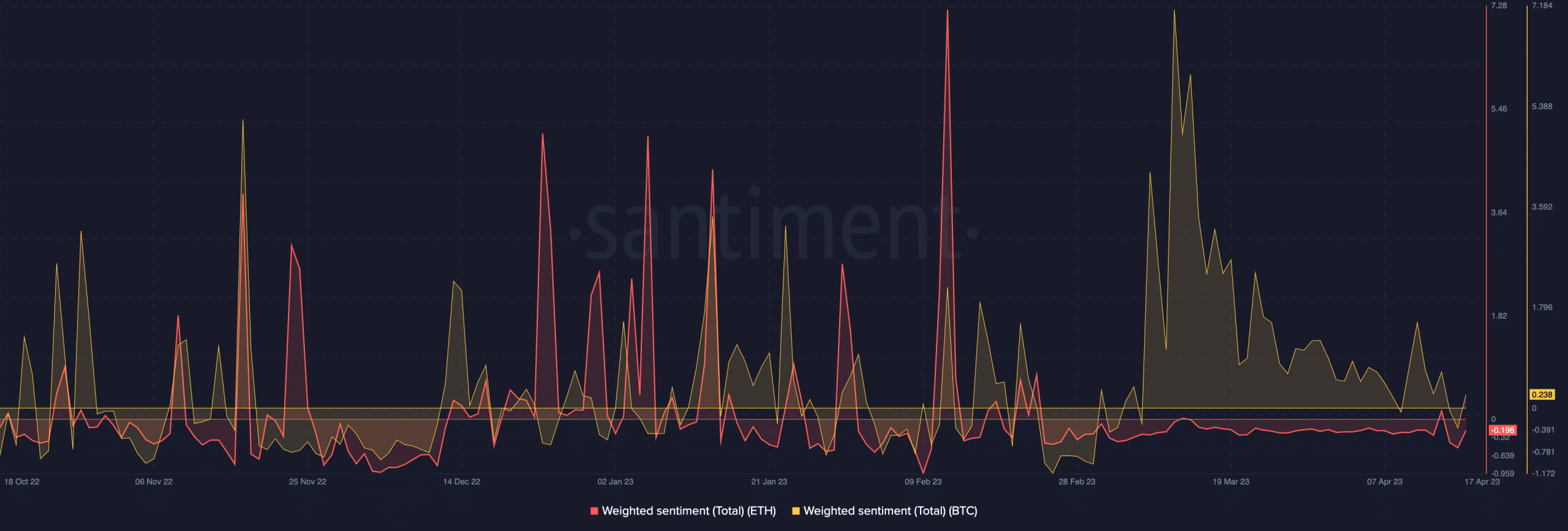

Yet, ETH’s rise could not change the acumen of the broader market. According to Santiment, the altcoin’s weighted sentiment attempted to exit the negative axis. However, it could not accomplish the task as the metric was -0.198.

The weighted sentiment spikes when the vast majority of messages around an asset are positive. It decreases when the social conversation depicts doubt.

For Bitcoin, the metric had also fallen from the highs in March. However, its own attempt to leave the red zone has not been met with resistance. At press time, Bitcoin’s weighted sentiment was 0.238.

Read Ethereum’s [ETH] Price Prediction 2023-2024

Overall, there was minimal inflow into altcoins, even though Ripple [XRP] recorded giant strides two weeks back.

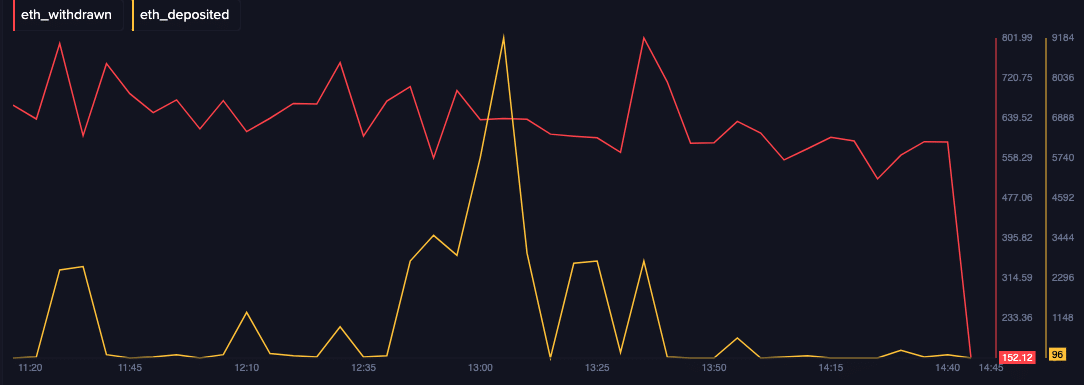

With respect to ETH withdrawals on the Beacon Chain, Santiment revealed that the total fees claimed were 7719. Moreso, deposits and withdrawals on the new coordination mechanism have notably decreased.