Bitcoin [BTC]: What the king coin’s FOMO and FUD indicators suggest

![Bitcoin [BTC]: What the king coin's FOMO and FUD indicators suggest](https://ambcrypto.com/wp-content/uploads/2023/04/po-2023-04-07T072817.100.png.webp)

- Bitcoin’s volume in profit and loss ratio dropped to the negative zone.

- Investors doubted a further price increase even though the fear and greed index rose.

Bitcoin [BTC] may have disappointed a ton of doubting Thomases after an impressive Year-To-Date (YTD) performance. But as things stand at press time, the arm of defeat has been extended to investors who came late to the party.

Realistic or not, here’s BTC’s market cap in ETH’s terms

According to Santiment, the coin’s daily on-chain transaction volume in profit-to-loss ratio fell into the negative region for the first time in five weeks. This metric reveals if transactions in profit are outpacing those in losses or otherwise. At press time, the value was -0.145.

Cravings of the covetous

This condition implies a significant number of investors have bought BTC above the press time price. A simplification here means that the Fear of Missing Out has been triggered (FOMO) since the king coin attempted to hit $30,000 several times.

Although BTC, as a speculative asset, has always had traders and investors torn between fear and greed, the condition tends to be in favor of the latter. After breaking the neutral zone last month, the emotional behavior of the average investors has entirely left the fear region, which probably offers a buying opportunity.

Instead, the Bitcoin fear and greed index rose to 64. The metric takes into account volatile price movements, dominance, and market momentum, At this point, it meant that investors were tending towards being too greedy.

But in the last seven days, the index had remained around the same region. This breeds Fear, Uncertainty, and Doubt (FUD) since the BTC consolidation has lasted for a while. Also, the status at the time of writing aligns with a further correction that BTC has experienced in the last few days.

Sideways trend leads to skepticism

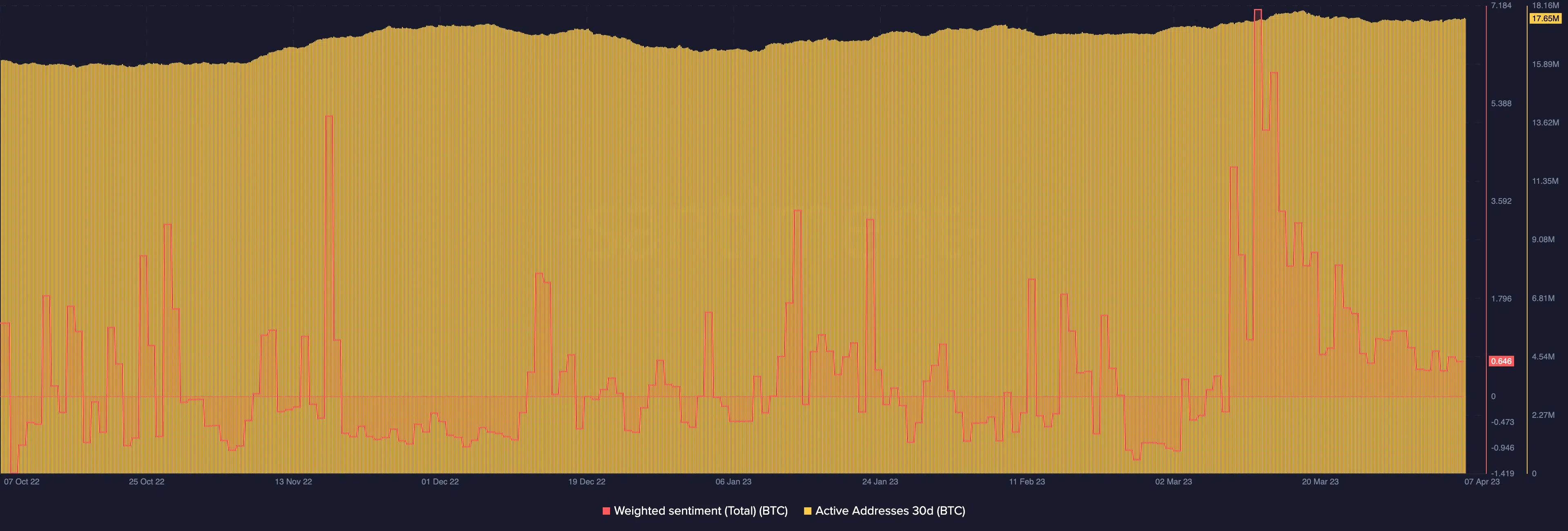

Meanwhile, the repeated rejection at $29,000 and subsequent correction seemed to have dampened the belief of a further uptick. This was excerpted from the weighted sentiment decrease to 0.646.

When this metric falls, it suggests that public opinion of the asset was rarely positive. But historically, prices are likely to increase when the sentiment falls. However, this only happened when the weighted sentiment which combines the positive and negative perceptions reaches extremely low levels.

How much are 1,10,100 BTCs worth today?

In addition, Bitcoin active addresses have reneged on the momentum they had earlier in the year. The metric measures user interaction and growth by considering the transaction on the network.

At press time, the 30-day active addresses were 17.65 million. But generally, there hasn’t been any major influx. Oftentimes, this situation is associated with low demand, which could lead to bearish market momentum.