Bitcoin [BTC]: Why $25,000 might be the next target support level

![Bitcoin [BTC]: Why $25,000 might be the next target support level](https://ambcrypto.com/wp-content/uploads/2023/05/AMBCrypto_a_group_of_whales_hovering_above_a_treasure_chest_in__09652f99-3160-4594-9c01-0e9797d65e8f_1200x900.png)

- Bitcoin had a bearish performance last week after being unable to push past $30k.

- BTC whales contributed to the ongoing sell pressure.

Bitcoin [BTC] attempted to push above $30,000 not so long ago. However, it has since shown significant weakness after multiple retests of the same level, and last week’s bearish performance is a testament to it.

Is your portfolio green? Check out the Bitcoin Profit Calculator

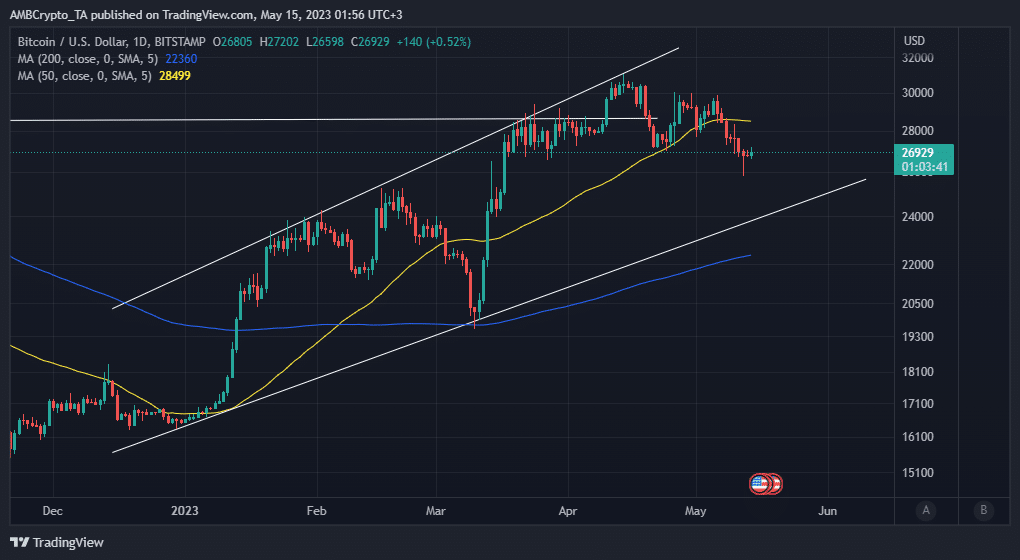

The failure to stay above $30,000 was an important observation because it underpinned an ascending resistance line. The latter is part of Bitcoin’s ascending price pattern since the start of the year.

We previously contemplated the probability of Bitcoin descending as low as the $24,000 price range where it would retest its YTD support line. Fast forward to the present and the probability of that support retest is now higher.

Bitcoin has so far delivered a bearish performance by as much as 13% in the first half of May. It exchanged hands at $26,929 at the time of writing.

If Bitcoin maintains this pace for the next two weeks, the chances of a retest of the ascending support line will be quite high. The $25,000 price level is of particular interest because it has already demonstrated resistance in multiple instances. In other words, the same price level represents a significant support range.

Assessing the prevailing Bitcoin demand

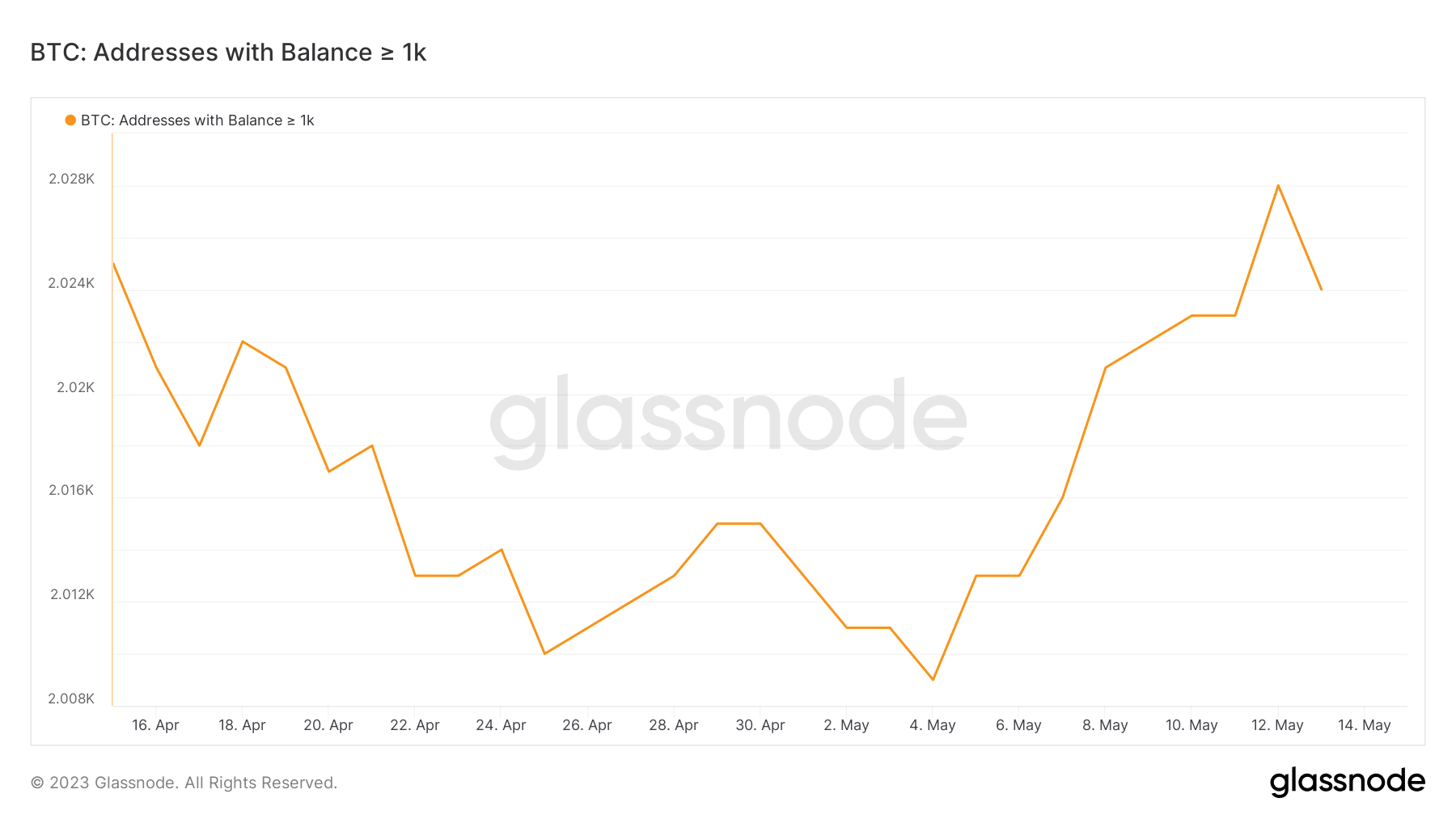

Whales have the most significant impact on price, hence, a look at their activity offers some insights into what to expect. On-chain data revealed that addresses holding a balance equal to or greater than 1000 BTC shrunk in the last three days.

The above observation suggested that whales were contributing to sell pressure at press time. This further validated bearish expectations. Bitcoin’s on-chain volume also pulled back substantially in the last five days. As such, more BTC holders were at a loss in the last four weeks.

? #Bitcoin $BTC Percent Addresses in Profit (7d MA) just reached a 1-month low of 66.432%

View metric:https://t.co/ik5IkrcQZM pic.twitter.com/B9lpXe7vq0

— glassnode alerts (@glassnodealerts) May 14, 2023

It is now clear that the market is experiencing less confidence, hence the liquidity outflows. If the market maintained the same trend, then more sell pressure, especially from the retail segment if whales continue to sell.

Read Bitcoin’s [BTC] Price Prediction 2023-24

Unpredictability is one of the main characteristics of the market. Current expectations are leaning predominantly in favor of the bears. However, a bullish surprise might still emerge, but it would have to be backed by healthy whale accumulation.

But, that remains to be seen, hence the press time market conditions continued to indicate that the bulls were sidelined.

![Over the past two days, large Cardano [ADA] holders made their presence felt](https://ambcrypto.com/wp-content/uploads/2025/05/Lennox-2-1-400x240.png)

![Solana [SOL] is back in the spotlight, showing signs of strength across several key metrics.](https://ambcrypto.com/wp-content/uploads/2025/05/Samyukhtha-6-1-400x240.webp)