Bitcoin [BTC]: Why a hashrate hike will favor the bears

![Bitcoin [BTC]: Why a hashrate hike will favor the bears](https://ambcrypto.com/wp-content/uploads/2023/02/po-2023-02-23T090748.565.png)

- Another ATH of Bitcoin’s hashrate could lead to BTC’s price fall.

- The king coin has recently detached from the S&P 500 trend.

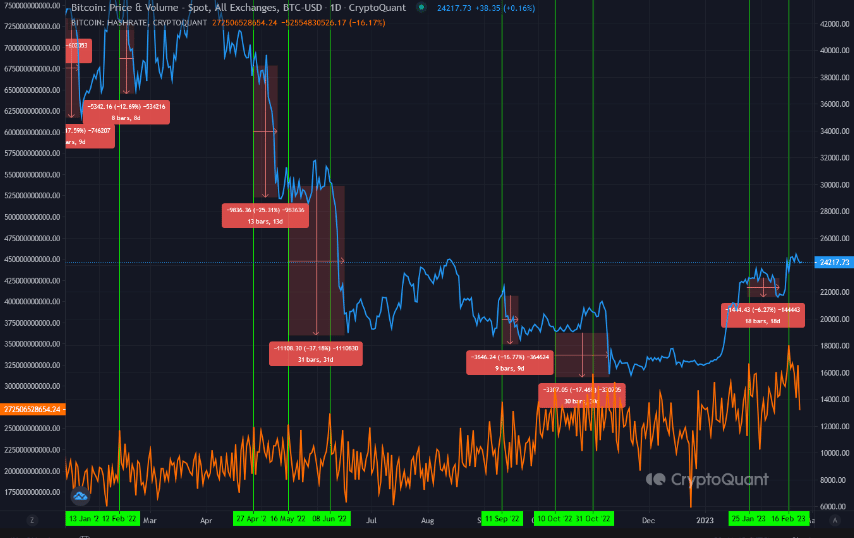

A significant drop in Bitcoin’s [BTC] price could be imminent if the hashrate reaches another All-Time High (ATH), a CryptoQuant analyst revealed on 23 February. Analyst Gigisulivan, who is also a macroeconomic specialist, opined that the 16 February ATH only gave a warning sign. Moreover, a repeat of the occurrence could cause a catastrophic outcome for BTC.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Previous happenings are proof

Bitcoin’s hashrate is the computational power used to mine and process BTC transactions on the Proof-of-Work (PoW) blockchain. On 26 January, Gigisulivan had put out a publication explaining the hashrate’s effect on the coin’s price.

He had initially explained that investor anticipation towards bullishness in the case of an hashrate ATH was a sham. Maintaining his stance, the analyst gave examples of occasions where the metric hike resulted in the king coin’s value decline.

As per the current state, Gigisulivan pointed out that BTC was in a critical state since the ATH recorded seven days ago. The on-chain analyst mentioned the state of the 200-weekly Moving Average (MA), and Bitcoin’s correlation with the stock market as reasons why a price fall could happen. He noted,

“New Hashrate ATH from 16th of Feb, comes at a critical junction for Bitcoin, coming off 200 Weekly MA and its first weekly deathcross, with stock market weakening this all adds up to a bearish sentiment gaining strength.”

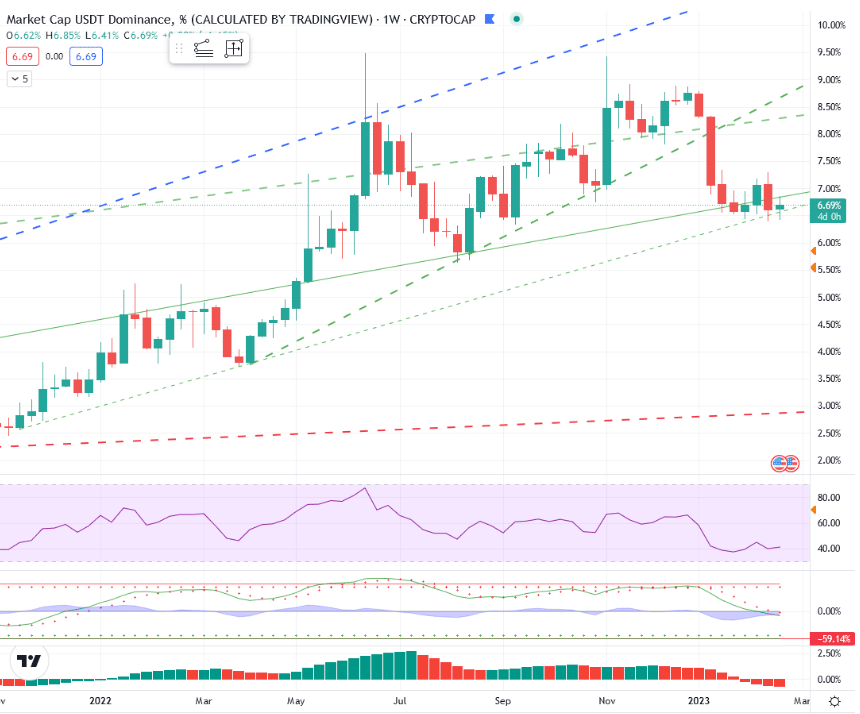

Besides that, Tether’s [USDT] massive dominance over the past few days made an additional case for bears. Recall that the proscription of Binance USD [BUSD] and USDC’s likely probe had propelled many investors to choose USDT as their preferred stablecoin.

For Gigisulivan, this supremacy could drive BTC down to $21,500. This was because the coin seemed overvalued compared to the stock market.

BTC: Sliding away from the tradition

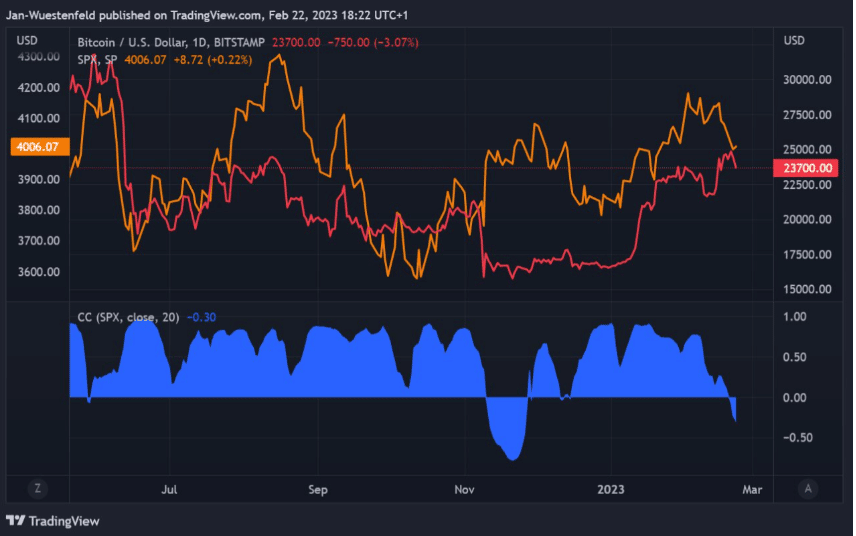

Bitcoin has often correlated with the stock market. But another CryptoQuant publication by Quantum Economics analyst Jan Wüstenfeld opposed Gigisulivan’s perception. According to Wüstenfeld, BTC had detached its correlation from the S&P 500 Index (SPX) over the last 20 days.

Interestingly, the coin had also changed its reaction towards news, like the FOMC outcome. So, could it be that Bitcoin was beginning to only respond to only the crypto market activities?

How much are 1,10,100 BTCs worth today?

Well, Wüstenfeld mentioned that it was not the first time such a thing had happened, as there was a similar occurrence during the FTX collapse. While BTC had lost hold of the $25,000 region, the SPX followed an uptrend.

It was not certain how long the conflicting state would last. However, Wüstenfeld acknowledged that it would be interesting to see, as some parts of the crypto community have even yearned for the disconnect.