Bitcoin

Bitcoin: Bullish signs emerge, but is it time to be cautious?

Despite Bitcoin’s recent rally past $64,000 following the U.S. Fed rate cut, potential reversal signals have emerged.

- Bitcoin surged to over $64K after the Fed’s rate cut, showing a 2.8% increase in 24 hours.

- Analysts caution that despite bullish signs, certain indicators suggest a possible price reversal ahead.

Bitcoin [BTC] has shifted its trajectory from a period of accumulation and decline to a noticeable recovery phase.

Over the past 24 hours, the asset surged to as high as $64,000 before retracing slightly to trade at $63,786 at the time of writing, marking a 2.8% increase.

This rally comes in the wake of the U.S. Federal Reserve’s announcement of a rate cut, which has triggered positive market sentiment across risk assets, including Bitcoin.

Is a reversal ahead?

While this price increase has sparked optimism, analysts are cautiously examining Bitcoin’s fundamentals to determine the sustainability of this rally.

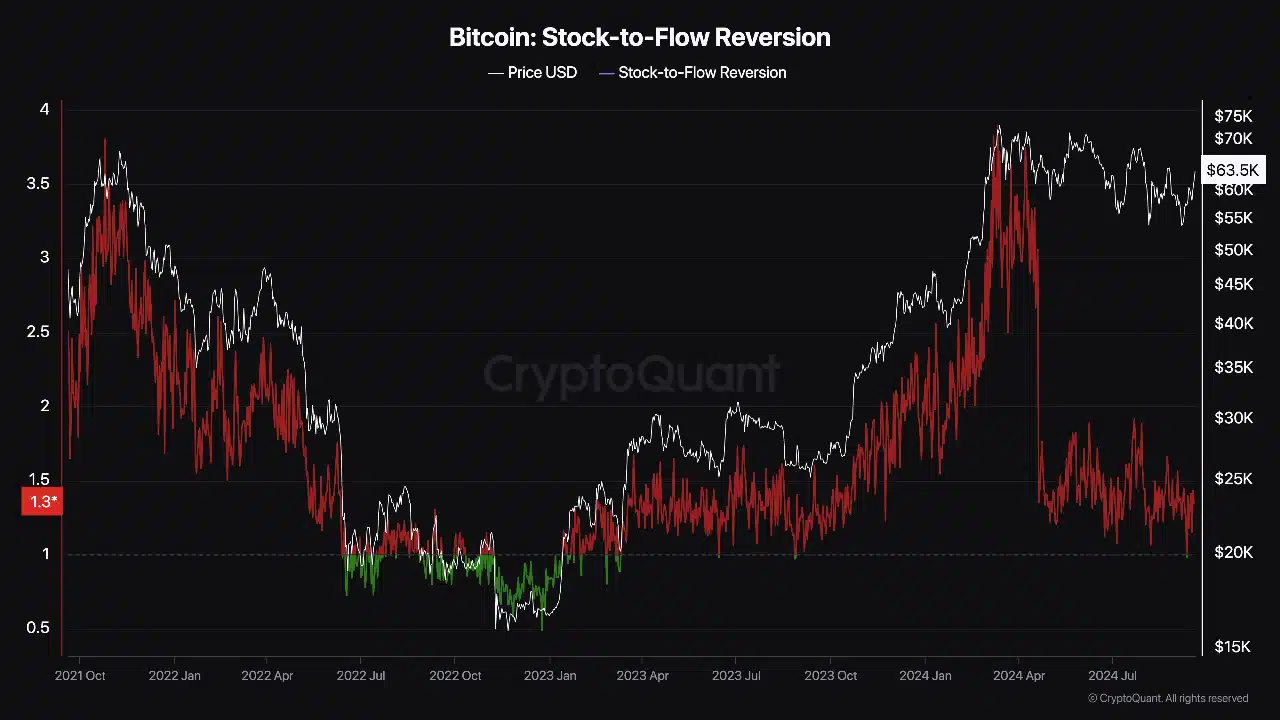

A CryptoQuant analyst, using the pseudonym ‘Darkfost,’ highlighted a potential red flag. Darkfost pointed to the Stock-to-Flow (S2F) reversion chart, signaling a possible reversal.

The S2F model is often used to forecast Bitcoin’s price movements by comparing the supply of new BTC entering the market (flow) with the total existing supply (stock).

According to Darkfost, the S2F ratio is currently in a green zone, signaling a buying opportunity as Bitcoin touched this threshold and began its recovery.

However, the analyst warned that the last time this occurred, in September and June 2023, the asset experienced a significant pullback.

This raises whether the current rally has enough momentum to sustain itself, or if another retracement is on the horizon.

Bitcoin fundamentals show strength

Despite concerns of a potential reversal, Bitcoin’s fundamentals are showing signs of strength that may support further upward movement.

One key metric is the recovery of Bitcoin’s active addresses, which serves as an indicator of retail interest in the asset.

Earlier this month, the number of active Bitcoin addresses dipped to around 600,000,

data from Glassnode shows.However, this figure has since climbed to more than 700,000 as of today. The increase in active addresses suggests that more users are engaging with the network, a positive sign for demand.

Typically, when retail interest increases, it reflects growing confidence in Bitcoin, which can bolster price momentum.

Another important metric to consider is Bitcoin’s Spent Output Profit Ratio (SOPR), which measures whether investors are selling their Bitcoin at a profit or a loss.

A SOPR value above 1 indicates that holders are selling at a profit, while a value below 1 suggests they are selling at a loss. As of today, Bitcoin’s SOPR sits at 1.01, up from 0.994 in late August.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This slight increase indicates that more investors are realizing profits on their Bitcoin holdings, signaling a healthier market sentiment.

A rising SOPR often aligns with periods of upward price movement, as investors gain confidence in the market and feel more inclined to take profits without fear of a sharp downturn.