Bitcoin

Bitcoin: FUD to the rescue? Data for BTC suggests…

The earlier decline caused panic among investors but data shows a possible rise to $83,000.

- About 311,000 wallets exited the network in the last 10 days.

- The 30-day MVRV ratio indicated that the coin could produce more gains.

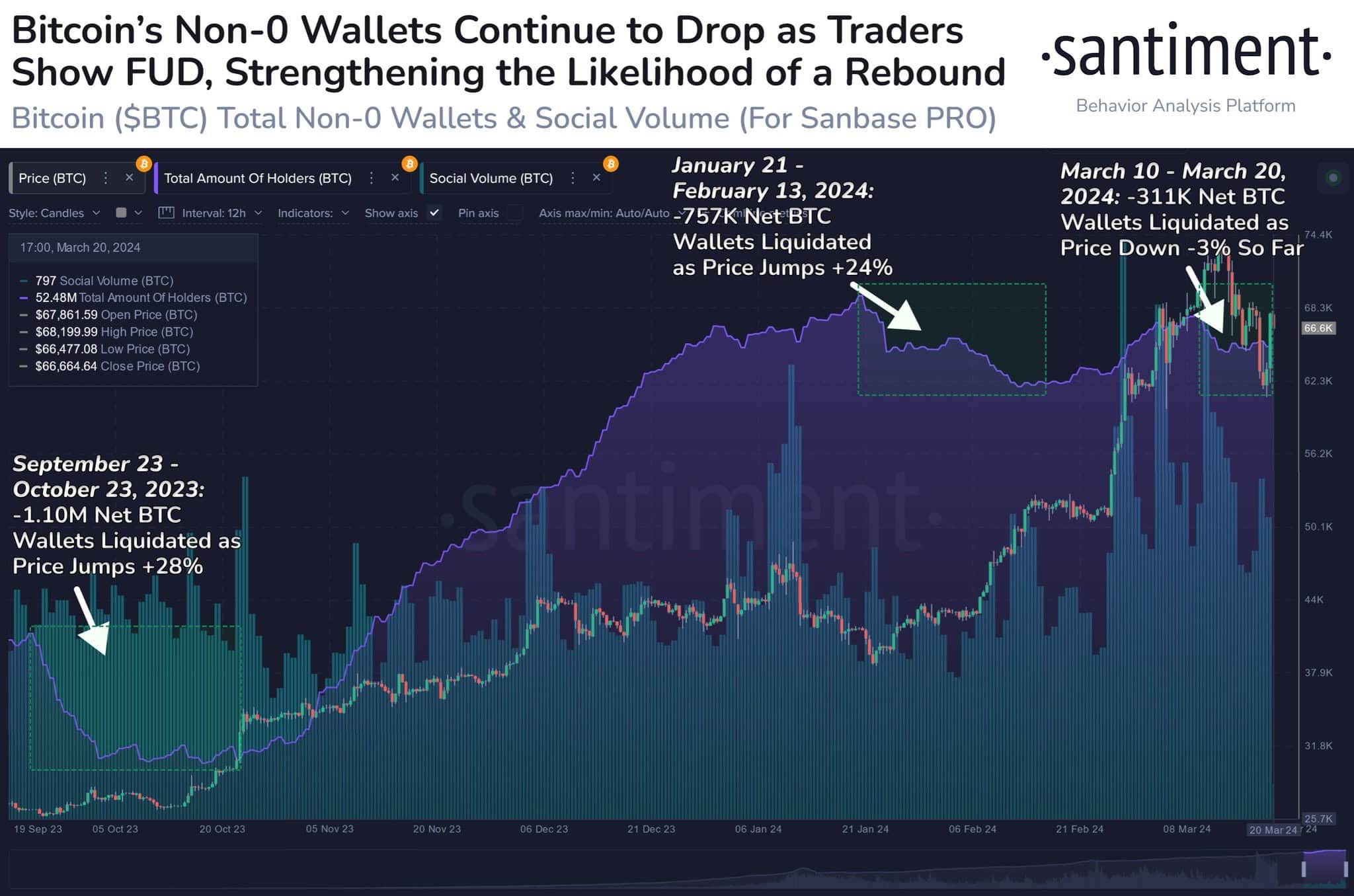

Though Bitcoin’s [BTC] price almost hit $68,000 again, on-chain data showed that the earlier correction led to significant exits. According to AMBCrypto’s analysis, 311,00 non-zero addresses left the Bitcoin network in the last 10 days.

Our investigation showed that the exodus was a result of Fear, Uncertainty, and Doubt (FUD) as prices collapsed. However, those who are familiar with the market terrain can confirm that this departure should trigger panic.

The coin’s showtime isn’t over

Instead, it gave whales, the opportunity to buy cheap BTC at the expense of those “paper hands.” Beyond that, Santiment data showed

Bitcoin typically gains from a scenario like this.For instance, between September and October 2023, 1.10 million non-zero addresses left the network. But the resulting outcome was a 28% price increase.

Likewise, between 21st January and 13th February, some addresses departed. But the price of BTC rose by 24% later on. At press time, Bitcoin was at a 3% negative 10-day performance.

If history repeats itself, Bitcoin could head toward $83,000 in a few weeks. However, it is also important to look at BTC from another angle.

As such, AMBCrypto checked its Market Value to Realized Value (MVRV) ratio. Typically, the MVRV ratio reflects the average profit or loss of all cryptocurrencies currently in circulation. It also indicates whether an asset is at fair value or not.

Will optimism return?

As of this writing, the 30-day MVRV ratio was 2.487%, indicating that BTC holders were hit hard by the recent correction. But the condition of the metric seems like good news for the price. At such a low ratio, the value of Bitcoin has the potential to climb higher.

On a seven-day basis, on-chain data showed that Bitcoin circulation had decreased. At press time, the circulation was 427,000. This was almost 50% down from what it was on the 11th of March.

Concerning the price action, the decrease in circulation means that BTC might experience less selling pressure. As a result, the value of the coin can appreciate.

Furthermore, AMBCrypto observed that there has been a change in the short-term sentiment around Bitcoin. We got this inference after analyzing the Short Term Holder- Net Unrealized Profit/Loss (STH-NUPL).

The STH-NUPL serves as an indicator of the behavior of short-term investors. When March began, the metric moved from hope (orange) to optimism (yellow).

Read Bitcoin’s [BTC] Price Prediction 2024-2025

However, the switch to the brighter color did not last long. As of this writing, the STH-NUPL was back in the hope-fear territory, indicating that investors were skeptical about betting on a price increase.

But at the same time, this indicates a slight decrease in greed, suggesting that the market was not overheated. Should this remain the case, the coin price might rise higher than $67,631.