‘Bitcoin can go to $20k’ – Exec says after BTC falls to $49K

- Bitcoin plunges below $53K, sparking a broad crypto market downturn.

- Crypto market turmoil extends to stocks, with notable reactions from former President Trump.

After approaching the $70K mark, Bitcoin [BTC] has recently plunged below $53K. According to CoinMarketCap, BTC was trading at $52,591, reflecting a drastic 13.42% drop in just 24 hours.

This sharp decline triggered a widespread crypto bloodbath, with many altcoins experiencing significant losses.

Crypto bloodbath

Ethereum [ETH] fell by over 20%, and Solana [SOL] dropped more than 16%, among other substantial declines across the market.

Despite the recent dip in Bitcoin’s value, the crypto community has remained resilient. Jameson Lopp, Co-founder and Chief Security Officer at CasaHODL, highlighted this sentiment by stating,

“If you’re sad from looking at charts, just switch to the Bitcoin dominance chart.”

Echoing this perspective, Samson Mow, CEO of JAN3, a company focused on Bitcoin adoption, underscored the positive outlook for the leading cryptocurrency, and stated,

“If you’re worried about the collapse of the financial system, you want #Bitcoin. If you’re worried about war, you want #Bitcoin. If you’re worried about the future in any way, you want #Bitcoin.”

He further emphasized the opportunity for investors not currently buying BTC, and added,

“If you don’t want #Bitcoin, then you either don’t understand Bitcoin or what is about to happen.”

Bitcoin falls further

Despite the positive sentiment surrounding Bitcoin, the cryptocurrency at the time of writing fell further below $49K. Commenting on this, Jason A. Williams, co-founder of Morgan Creek Digital, said,

“If you get more excited to buy Bitcoin the further it goes down, like and retweet this post.”

Further fueling criticism, Frank Chaparro, Host of The Scoop podcast and Director of Special Projects, added,

“Bitcoin can go to $20k before I feel anything.”

Notably, the turbulence didn’t just impact the crypto market; it also extended to the stock market, which faced a significant downturn.

But, what shocked the community was former President Donald Trump‘s recent statement on Truth Social, where he commented,

On-chain metrics paint a different picture

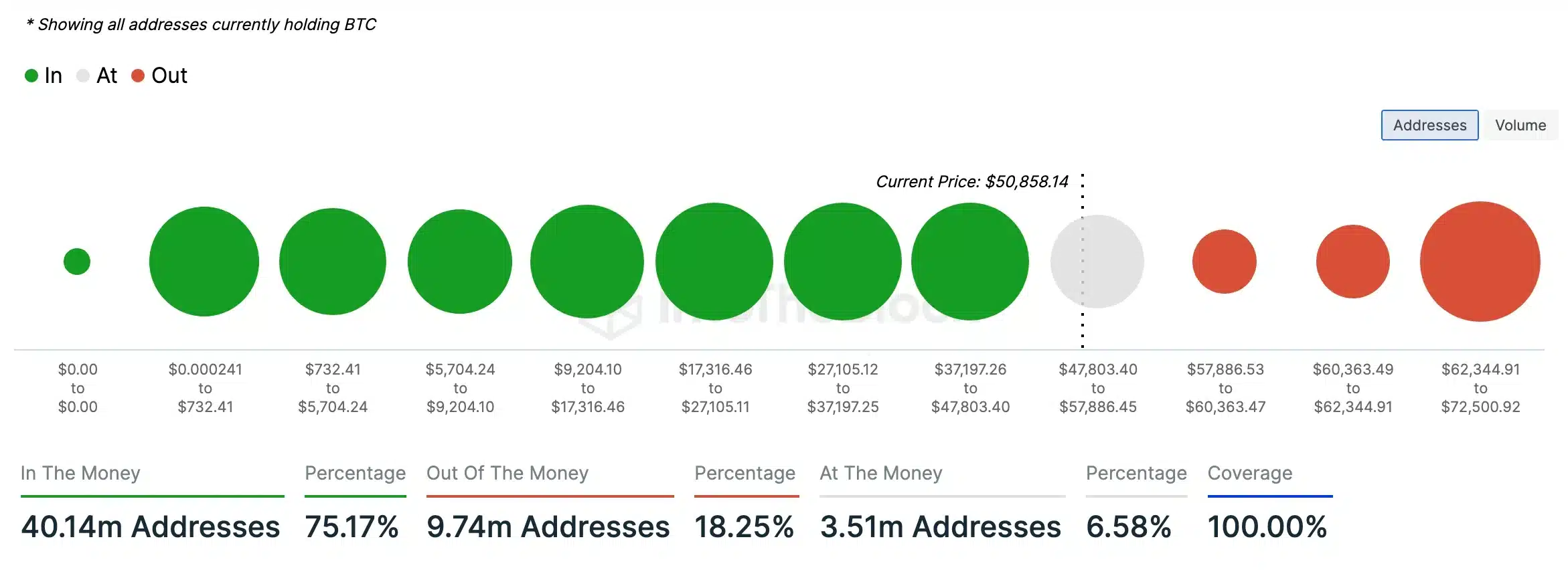

To understand the true essence of market dynamic, AMBCrypto analyzed the IntoTheBlock data and revealed that a significant majority (75.17%) of BTC holders held tokens valued higher than their purchase price at press time, indicating that they were “in the money.”

In contrast, a smaller segment (18.25%) held BTC tokens that were worth less than their purchase price, placing them “out of the money.” This suggested a bullish sentiment or potential upcoming price surge for Bitcoin.

That being said, eToro market analyst Josh Gilbert speaking with a publication put it best when he said,

“When you invest in crypto assets, you’re stepping into the ring of volatility. This is a small jab for crypto, not even a black eye. We’ve got more rounds left of this bull market before the bell rings.”