Bitcoin

Bitcoin: Can whales’ exchange activity cause BTC to decline?

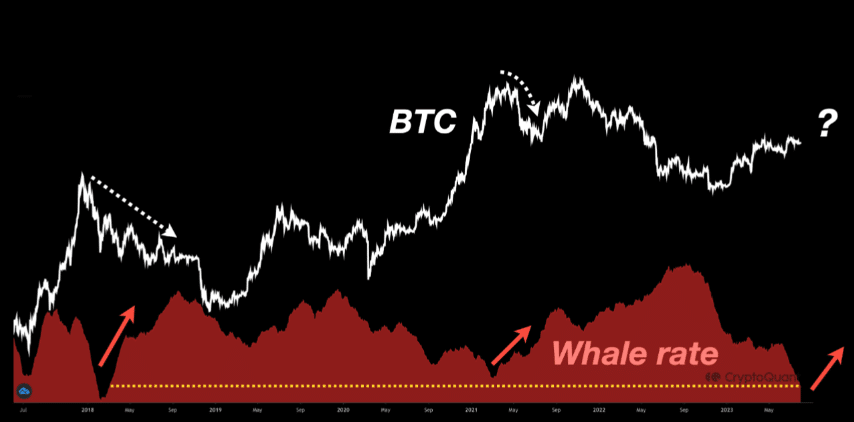

Large transactions decreased, prompting a repeat of the incidents of 2018 and 2021.

- The Bitcoin exchange whale ratio reached its ATL, indicating a possible BTC decrease.

- Price-DAA suggested a possible exit position amid low volatility.

Bitcoin [BTC] lost hold of the $29,000 region following a slight decrease in price in the last 24 hours. For a coin that began the year on a strong note, its rollercoaster ride down the chart amid significant volatility has been worthy of note.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

Whales take it back in time

However, it seems that BTC might not exit this state of consolation and falling value soon. According to SignalQuant, the condition of the exchange whale ratio could ensure the aforementioned projection becomes a reality.

The exchange whale ratio is an indicator that measures the ratio between the sum of the top 10 transactions to exchanges and the total amount of Bitcoin moving into exchanges.

High values of this metric suggest that whales

are using exchanges in large amounts. But when the metric is low, it implies how whales are evading the use of exchanges for transactions.SignalQuant, who published his analysis on CryptoQuant, noted that the exchange whale ratio was at an All-Time Low (ATL).

Historically, when the ratio drops to a low and rebound, the BTC price severely decreases. The analyst referred to similar happenings in February 2018 and May 2021 saying,

“In Feb ’18, and again in May ’21, when it rebounded from an all-time low ratio, its price peaked and started to decline. Since Q4 ’22, the ratio has been in a downward spiral, so there hasn’t been a significant drop so far. But it’s worth keeping an eye on because it could rebound at any time, and when it does, the price could follow historical patterns.”

BTC tilts towards low volatility

Meanwhile, Santiment showed that overall transactions by whales

(not just on exchanges) have been decreasing. According to the on-chain analytic platform, $1 million BTC transactions, which were around 373 on 29 July, had dropped to 142 at press time.The decrease in large movement means BTC volatility could decrease and the price could continually compress.

So, will BTC fall below $28,000? For this potential projection, the Daily Active Addresses (DAA) might come in handy. In most cases, Bitcoin’s price has a strong correlation with the DAA.

How much are 1,10,100 BTCs today?

At press time, the price-DAA had fallen severely to -73.37%. So far, when the DAA increases and the price decreases, it’s a potential exit indicator. But if it’s the opposite, it could be a buy signal.

Since the price fell, and the DAA subsequently increased, then it’s a sign that BTC could decrease.