Bitcoin capital outflows – Reset for $60k or a launchpad to higher levels?

- Bitcoin capital outflows prompt market reassessment, signaling potential price shifts

- Bitcoin’s key support zones could determine future bullish or bearish momentum

Bitcoin’s [BTC] recent capital outflows have raised concerns about future price movements. Historically, such movements have served as precursors to market shifts, prompting investors to reassess their strategies. With market makers potentially looking for new entry points, the question remains – Where is Bitcoin heading?

Bitcoin capital outflows

Capital outflows in Bitcoin signify a redistribution of funds, often reflecting changes in market sentiment. When investors pull their assets from BTC, it can indicate profit-taking, fear-driven selling, or shifts to other asset classes. Market makers – who act as liquidity providers – respond by exploring lower or higher price levels to determine optimal re-entry zones.

Such outflows are not inherently bearish; they frequently serve as a recalibration phase. For market participants, tracking these movements is critical.

Bullish trend continuation?

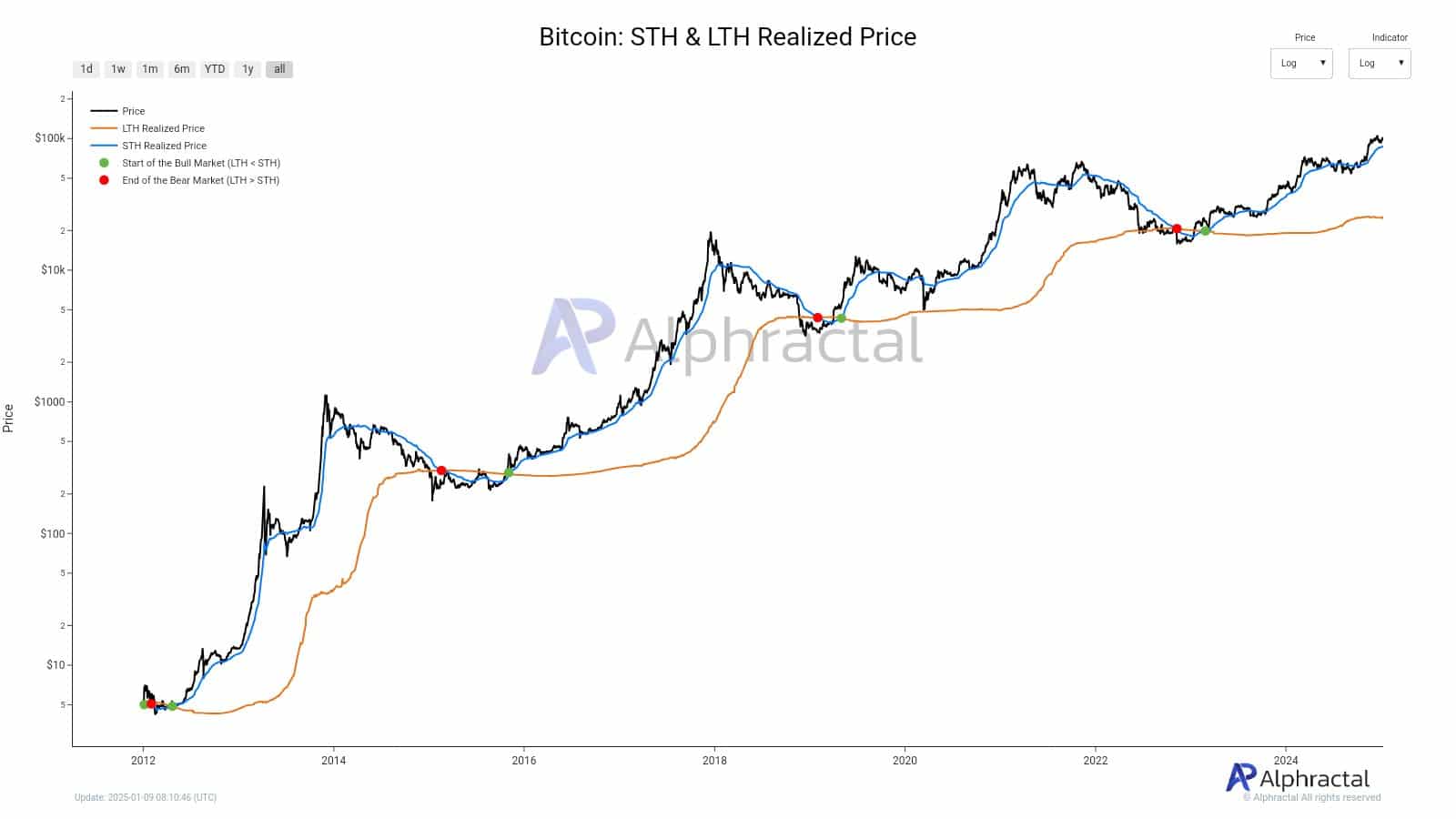

One bullish scenario hinges on Bitcoin reclaiming its STH Realized Price, currently pegged at $86.2k. This metric, representing the average price of coins held by short-term holders, often serves as a psychological and technical support during bull markets. Its recovery has historically coincided with renewed investor confidence and bullish momentum.

The data highlighted how previous bull runs respected the STH Realized Price as a springboard for further gains. If Bitcoin surpasses this level, it could indicate a resurgence in buying pressure, signaling that market makers and retail investors alike are ready to propel the price higher.

This scenario suggests a potential upward continuation, with $86.2k acting as the first checkpoint in Bitcoin’s rally.

Sentiment-based price action

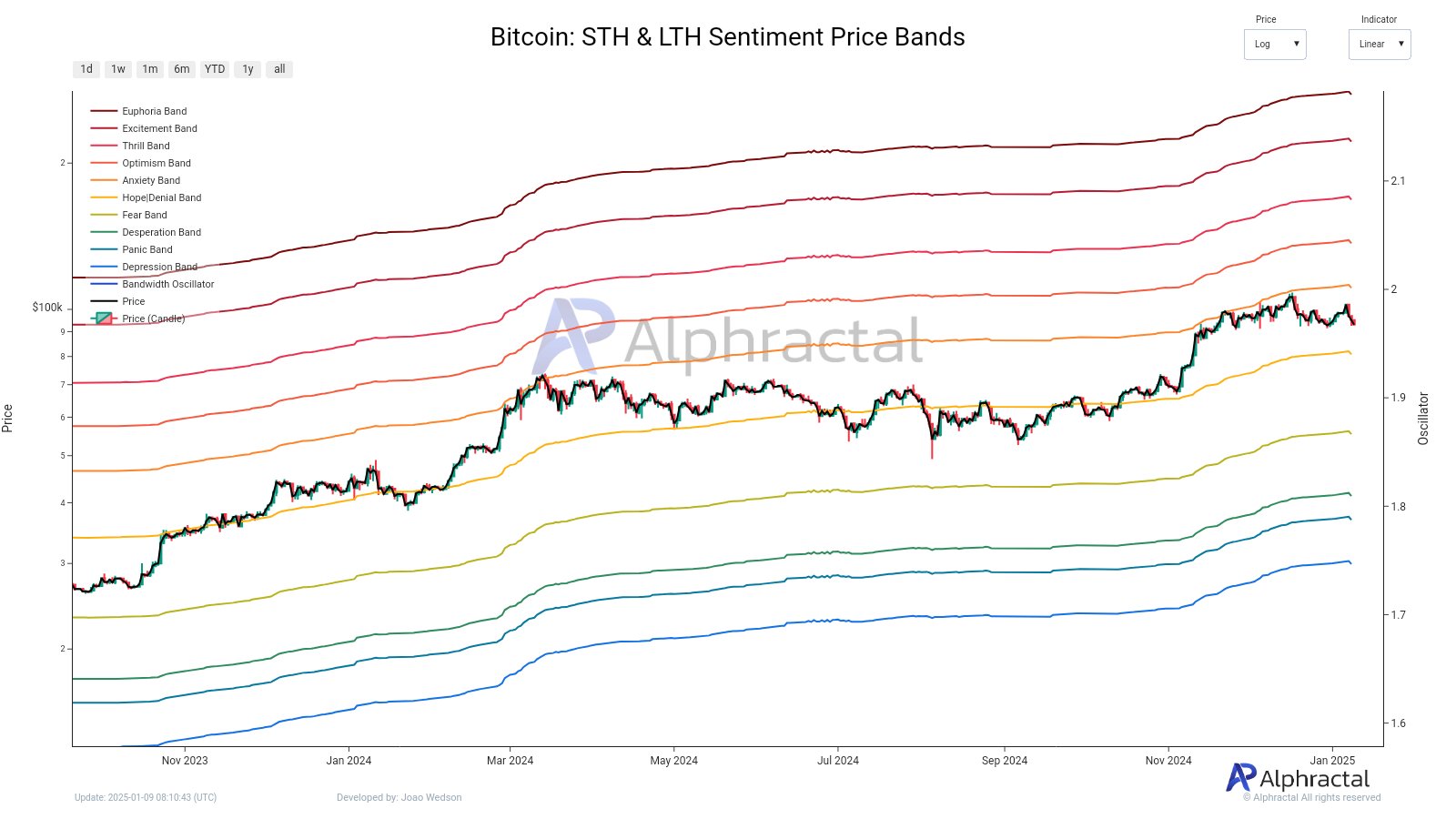

The Hope/Denial Band, currently positioned at $80.7k, serves as a vital metric reflecting the sentiment balance between short-term holders and long-term holders. This band captures emotional shifts in the market, oscillating between optimism and caution, and often acts as a stabilizing force during bullish phases.

Historically, Bitcoin’s price has respected this range, with sustained trends frequently emerging from these levels. For STHs, this zone symbolizes confidence, while LTHs view it as a potential validation of long-term investment strategies.

As shown in the chart, prior interactions with the Hope/Denial Band coincided with upward price movements, reinforcing its role as a key reference point. A strong defense of $80.7k could signal resilience and bolster bullish momentum.

Read Bitcoin’s [BTC] Price Prediction 2025-26

A potential downturn

The risk of the latest Bitcoin price drop seemed to mirror events from May 2021, when the market faced a sharp correction following overheated sentiment and profit-taking. In that instance, significant capital outflows drove Bitcoin to lower support levels, resetting market expectations.

Currently, similar dynamics are in play. If bearish pressures prevail, Bitcoin could decline to the $66k–$60k range. These levels align with key metrics such as the Active Realized Price and True Market Mean Price, which account for the network’s fair value excluding newly mined coins.

Such a downturn would test investor confidence and challenge both short- and long-term holders. While this scenario signals caution, it also provides an opportunity for market makers to explore sustainable re-entry points.