Bitcoin Cash: After a strong mid-October, BCH faces sluggish demand – Why?

- Bitcoin Cash bulls have been a no show after a promising mid-month performance.

- Assessing BCH ownership and address stats.

Should you still buy into Bitcoin Cash [BCH] after its mid-October bounce? A large bullish price move in a day is often translated as accumulation by whales. BCH demonstrated such an outcome about a week ago but has since then struggled to sustain the bullish momentum.

Bitcoin Cash has been gradually moving further from its latest local lows in August. A sign of recovery from its previous downturn. The mid-month price surge on 14th October was expected to bring back excitement into the cryptocurrency.

BCH has since then struggled to sustain more upside, indicating weak demand since then. Sell pressure was also limited, therefore allowing Bitcoin Cash to retain most of its mid-Month gains. The cryptocurrency exchanged hands at $258.6 at press time.

The weak sell pressure may indicate that the whales behind the mid-month purchase have not taken profits off the table. While this signals that bullish expectations remain intact, it may not necessarily signal that BCH will continue rallying.

But what does on-chain data say about this?

No signs of strong Bitcoin Cash accumulation?

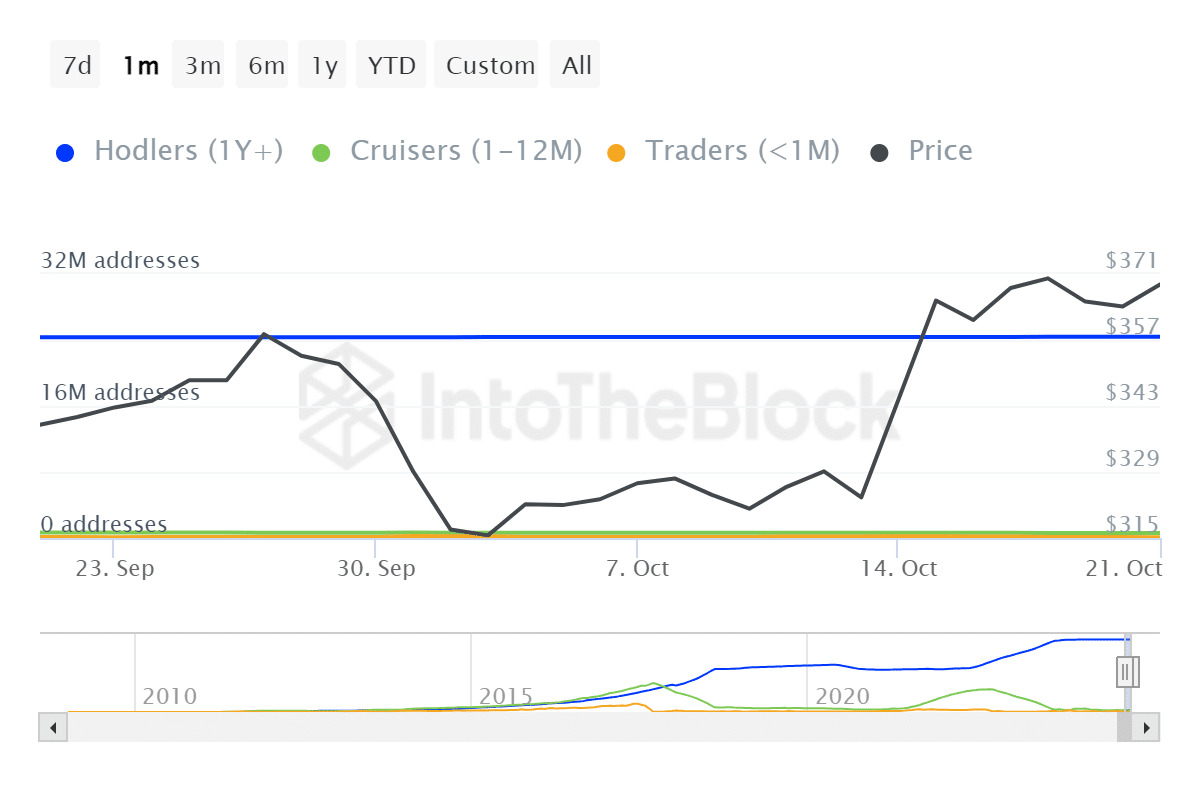

Ownership data confirms that HODLer addresses did gain slightly since mid-October. There were 24.34 million holder addresses as of 24th September and have since grown to 24.39 million addresses.

Cruisers dropped considerably from over 653,710 addresses as of 22 September to 618,460 addresses. Traders dropped from 107,640 addresses to 94,820 addresses during the same period.

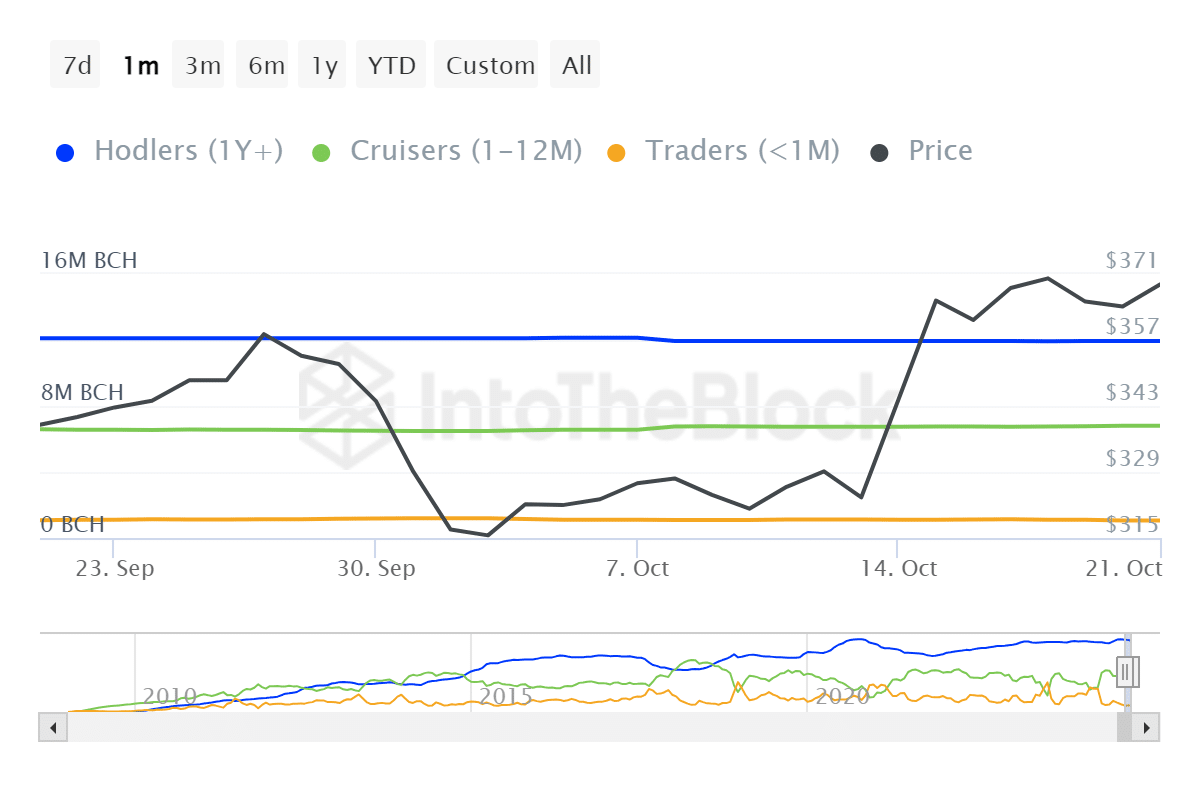

Address data confirms a shift from short term to a long term focus as addresses reduced. But has far as address activity since the mid-week rally, hodler balances dipped from 11.94 million BCH to 11.93 BCH. This may suggest that some took profits.

Cruisers added to their balances during the same period. Their balances were up from 6.75 million BCH to 6.8 million BCH. Trader balances dropped from 1.11 million BCH to 1.07 million BCH according to the latest data.

These findings did not offer conclusive evidence to indicate that strong accumulation has been taking place.

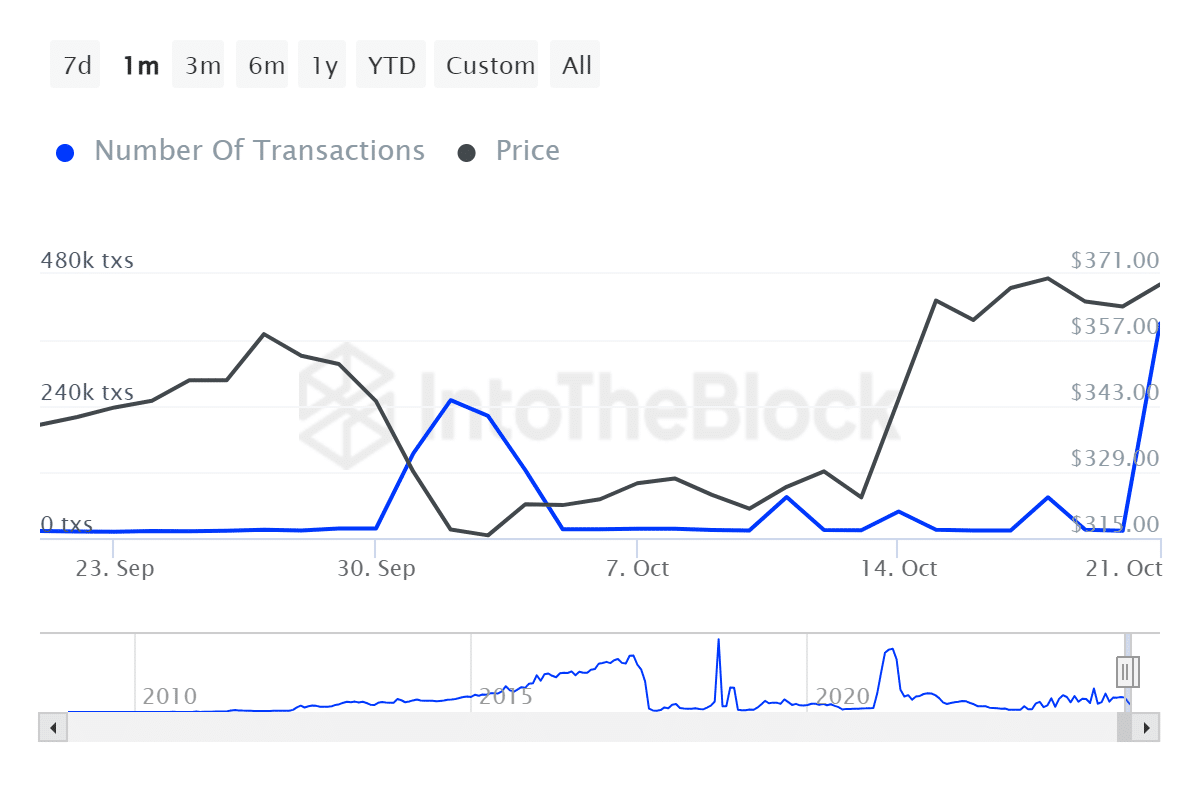

The recent bullish activity in the middle of the month may have been an attempt at inducing activity. Speaking off, Bitcoin Cash just registered its highest transaction spike since mid-August.

Read Bitcoin Cash’s [BCH] Price Prediction 2024–2025

The number of transactions grew from around 13,000 TXs on 20th October to over 368,000 transactions on 21st October. It was unclear whether the transaction spike and the mid-month surge are related.

Nevertheless, this renewed surge in transaction activity may offer more confidence to investors.