Bitcoin Cash [BCH] crosses 6-month high; why then, should investors be wary?

![Bitcoin Cash [BCH] crosses 6-month high; why then, should investors be wary?](https://ambcrypto.com/wp-content/uploads/2023/02/po-2023-02-21T113921.190.png)

- Bitcoin Cash’s price hit its highest since August 2022.

- Volume surged as BCH could reach overvalued levels soon.

Bitcoin Cash [BCH] surged to its highest value since August 2022, after it broke the $150 region on 20 February. According to CoinMarketCap, the cryptocurrency recorded one of the most gains on the said date as it raced to the height. But at press time, the momentum seems to have decreased as BCH traded at $147. 53.

Is your portfolio green? Check out the Bitcoin Cash Profit Calculator

BCH greens at risk of…

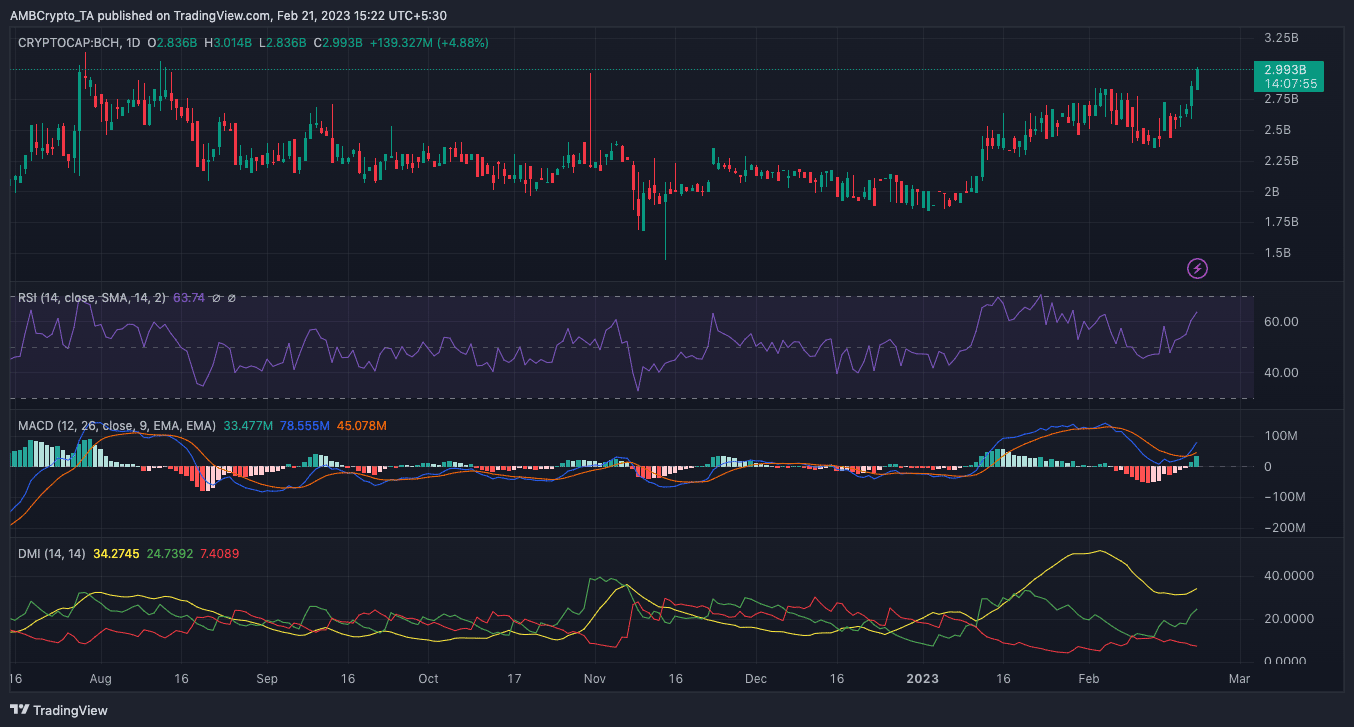

There have been cases where a slide like this was only a short-term drawback. So, is this one of such times? Based on the daily chart, the Relative Strength Index (RSI) was higher than normal at 63.74. The indicator is a momentum oscillator that gauges changes of price movements and speed.

Now, the BCH RSI value indicated that the cryptocurrency had a high buying power. But in the case where the value hits 70, then it means that it has hit an overbought zone. Hence, there could be a significant price reversal in that area.

As per the Moving Average Convergence Divergence (MACD), the Bitcoin Cash momentum was not necessarily bullish. This was because the blue dynamic line was only positioned above the orange slightly. This condition meant that buyers and sellers were in a heated contest for control. But the greens had an edge, nevertheless.

Furthermore, the Directional Movement Index (DMI) suggested consolidation in the short term, as there was no support for a continuous uptick.

As of this writing, the -DMI (red) was 8.93. The opposite number, the +DMI (green), was notably higher at 24.73. But the Average Directional Index (ADX), which signals weak or strong asset direction, had trended lower. This means the greens may be interrupted before it could BCH $150 again.

The driving forces behind the rally could…

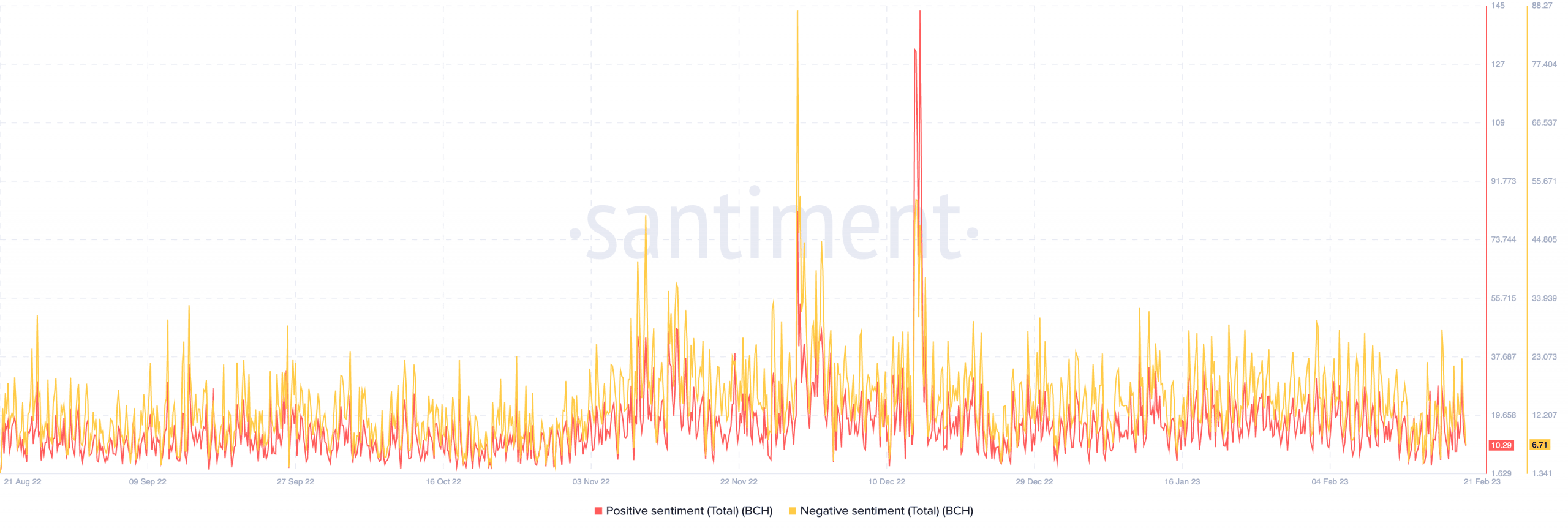

Concerning the on-chain status, Bitcoin Cash’s sentiment has been one of the driving forces behind the recent rally, according to Santiment. At the time of writing, the positive sentiment was 10.29. On the other hand, negative sentiment was 6.71.

Nonetheless, the minimal difference between both metrics might mean that the positive perception towards the cryptocurrency had declined.

Realistic or not, here’s BCH’s market cap in BTC’s terms

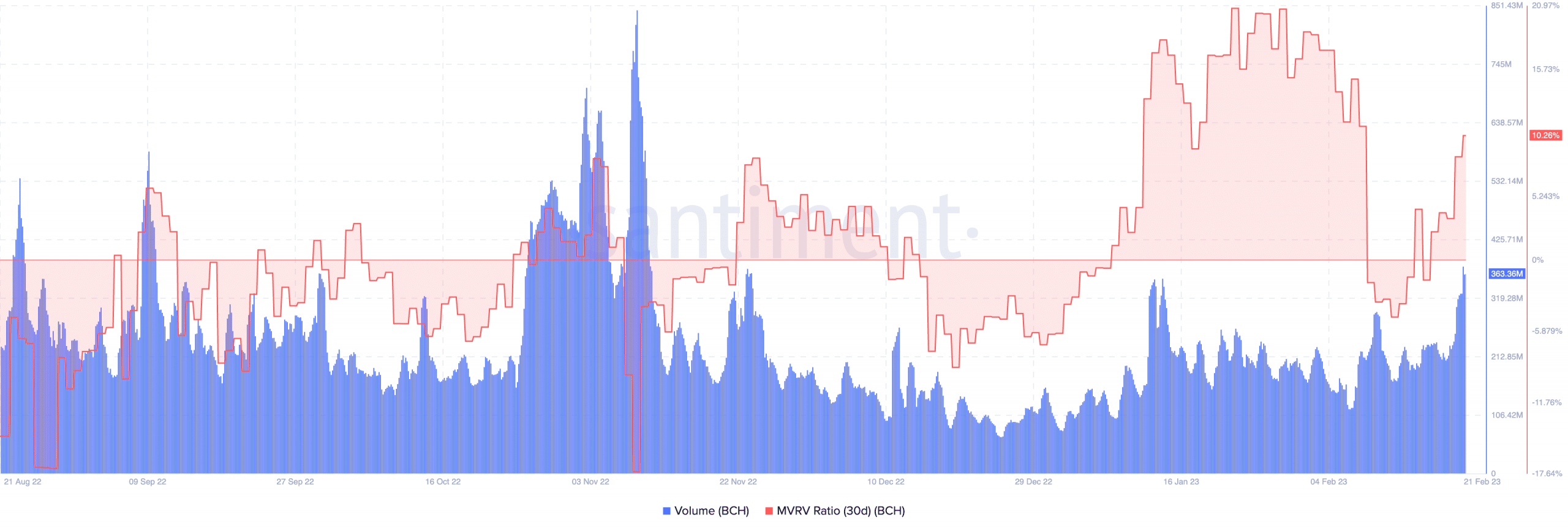

Also, there have been many transactions that passed through the Bitcoin Cash network lately, as displayed by the volume. At press time, BCH’s volume was 346.09 million.

The Market Value to Realized Value (MVRV) ratio was 10.26%. The metric describes the rate at which holders have made profits and how valuable an asset is. Such a high ratio implied that the rally had produced good gains for holders, but it could also infer an overvalued state in the short term.