Bitcoin Cash could hit the $450 level, key levels reveal

- Bitcoin Cash’s Long/Short ratio was 1.20, indicating strong bullish sentiment.

- BCH’s trading volume skyrocketed by 218%, indicating heightened participation from traders.

Amid a notable price recovery in the cryptocurrency market, Bitcoin Cash [BCH] has been gaining significant attention from traders and investors due to its impressive performance.

The sentiment surrounding BCH has shifted from a downtrend to an uptrend, as the token recently broke a crucial resistance level and is now poised for a massive upside rally.

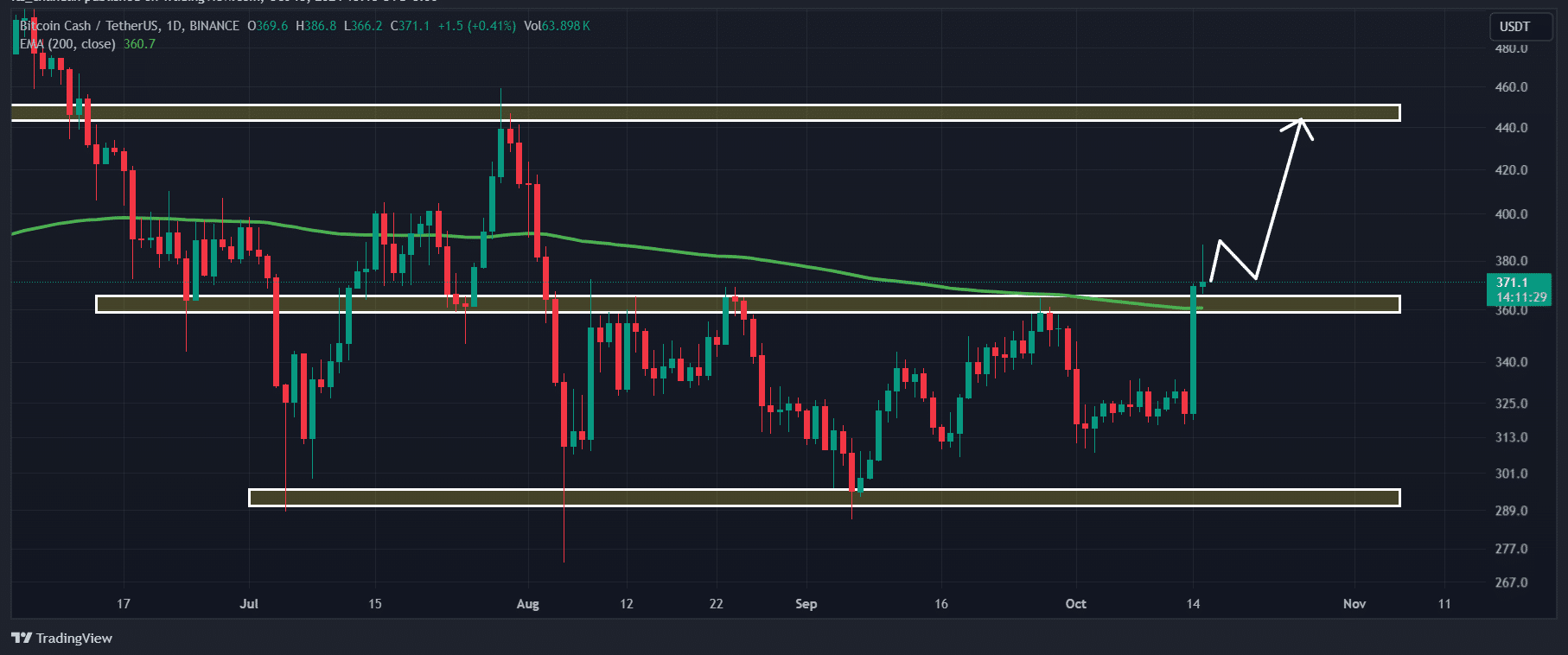

Bitcoin Cash technical analysis

According to AMBCrypto’s technical analysis, BCH appeared bullish following the breakout of its resistance level.

While examining the daily chart, the token seems to have tested this resistance three times, but due to bullish market sentiment ahead of the presidential election, it broke through with a large engulfing candle.

Additionally, this strong bullish candle closed above the 200-day Exponential Moving Average (EMA), suggesting the trend has shifted upward.

Following the breakout, there are currently no hurdles or resistance levels on the daily chart. Based on historical price momentum, BCH has a strong possibility of soaring by 18% to reach the $450 level in the coming days.

Despite this bullish outlook, BCH’s 16% candle may lead to some price consolidation near the breakout area before a significant rally occurs.

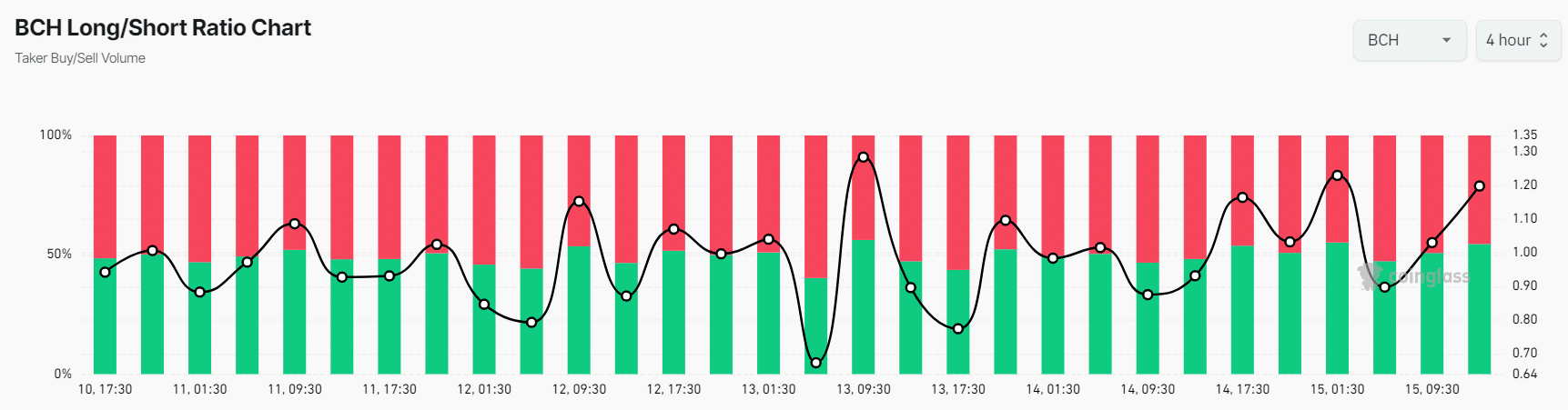

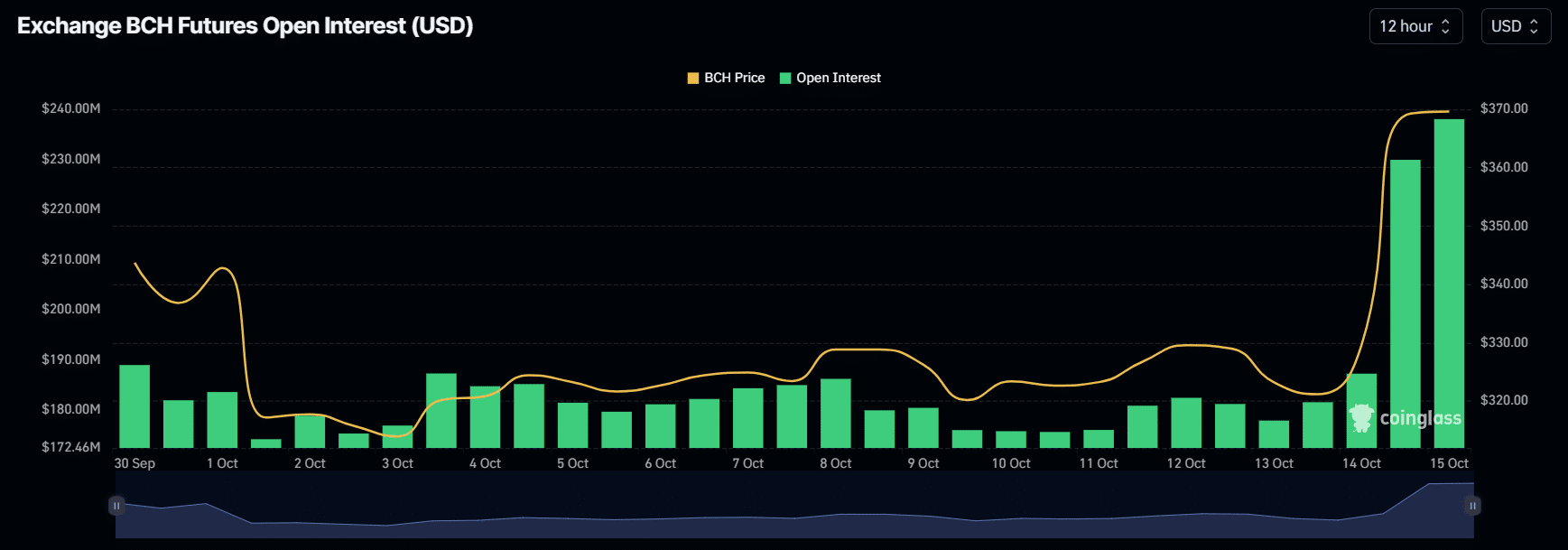

BCH’s bullish on-chain metrics

BCH’s positive outlook is further supported by on-chain metrics. According to the on-chain analytics firm Coinglass, BCH’s Long/Short ratio on a four-hour time frame was 1.20, indicating strong bullish sentiment.

Additionally, its Futures Open Interest has skyrocketed by 30% over the last 24 hours. This surge suggests that traders strongly believe in BCH and may be betting on more long positions.

Traders and investors often use a combination of rising Open Interest and a Long/Short Ratio above 1 when building long positions.

This suggests bulls are dominating the asset and could trigger a significant upside rally. At the time of writing, 54.5% of top traders held long positions, while 45.5% held short positions.

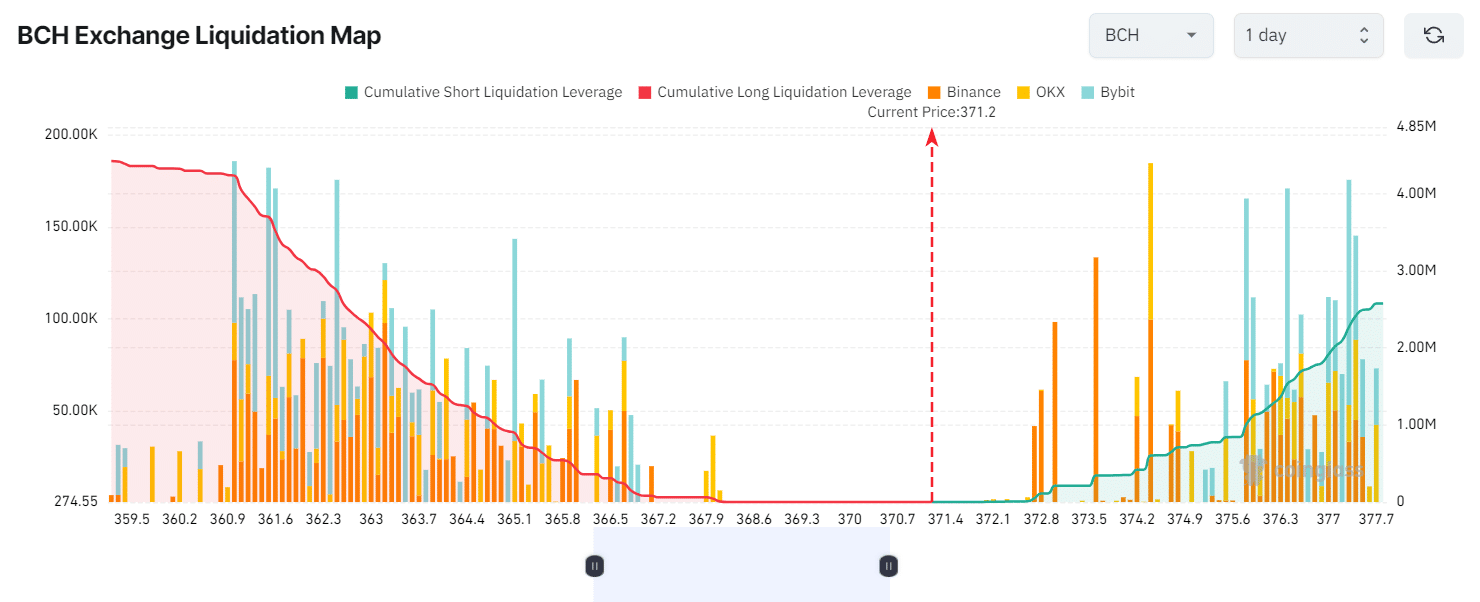

Major liquidation levels

As of now, the major liquidation level on the lower side is at $361, where bulls are over-leveraged. If sentiment shifts and the price drops below this level, $4.23 million worth of long positions will be liquidated.

On the other hand, $374.4 is a key liquidation level on the upper side, where bears are over-leveraged. If sentiment remains unchanged and the price rises above this level, approximately $603,680 worth of short positions will be liquidated.

This liquidation data suggests that bulls’ bets are significantly higher than bears’ short positions.

Read Bitcoin Cash’s [BCH] Price Prediction 2024–2025

Current price momentum

At press time, BCH was trading near $370.5 after a price surge of over 12.75% in the past 24 hours.

During the same period, its trading volume skyrocketed by 218%, indicating heightened participation from traders and investors, likely driven by the recent breakout.