Bitcoin Cash outperformed Litecoin and Ethereum Classic in this category

- Bitcoin Cash ranks higher in decentralization than Litecoin and Ethereum Classic.

- BCH whales have been reaccumulating during the recent crash.

Bitcoin Cash [BCH] has been overshadowed by its more popular counterparts for the major part. Nevertheless, it has managed to retain a sizable following, and it is perhaps the most underrated cryptocurrency as far as decentralization is concerned.

Is your portfolio green? Check out the Bitcoin Cash Profit Calculator

Bitcoin Cash happens to be doing quite well on the decentralization front. A higher hash rate is often considered a good measure of decentralization for PoW networks, and it also translates to higher network security.

BCH’s hash rate has been above the 1 EH/s level for the last three months. Its hash rate at press time was as high as 1.78 EH/S.

For context, 1 EH/S is a million times more than 1 TH/S. Litecoin’s latest hash rate figure came in at 716.06 TH/S while ETC’s hash rate was 107.13 TH/s at press time.

This means that Bitcoin Cash outperformed Litecoin and Ethereum Classic in terms of hash rate. Despite these findings, Bitcoin Cash’s hash rate is lower than Bitcoin’s 355.37 EH/S hash rate, hence BTC is still king in that regard.

Even so, Bitcoin Cash does have a higher block size than BTC, and this facilitates a higher TPS. This is why, for some, BCH is a more preferable option as a peer-to-peer payment than Bitcoin.

Bitcoin Cash price action

BCH is still heavily undervalued compared to BTC yet both have a similar circulation and maximum supply.

Bitcoin Cash traded at $114.16 at press time, which represented a 25% discount from February highs. Nevertheless, it still showed a bit of an upside from its current weekly low of $105.05.

BCH’s price action reflects movements in the overall crypto market. But is Bitcoin Cash more likely to achieve a sizable bounce back? So far the recent pivot was underpinned by significant whale accumulation.

How much are 1,10,100 BCHs worth today?

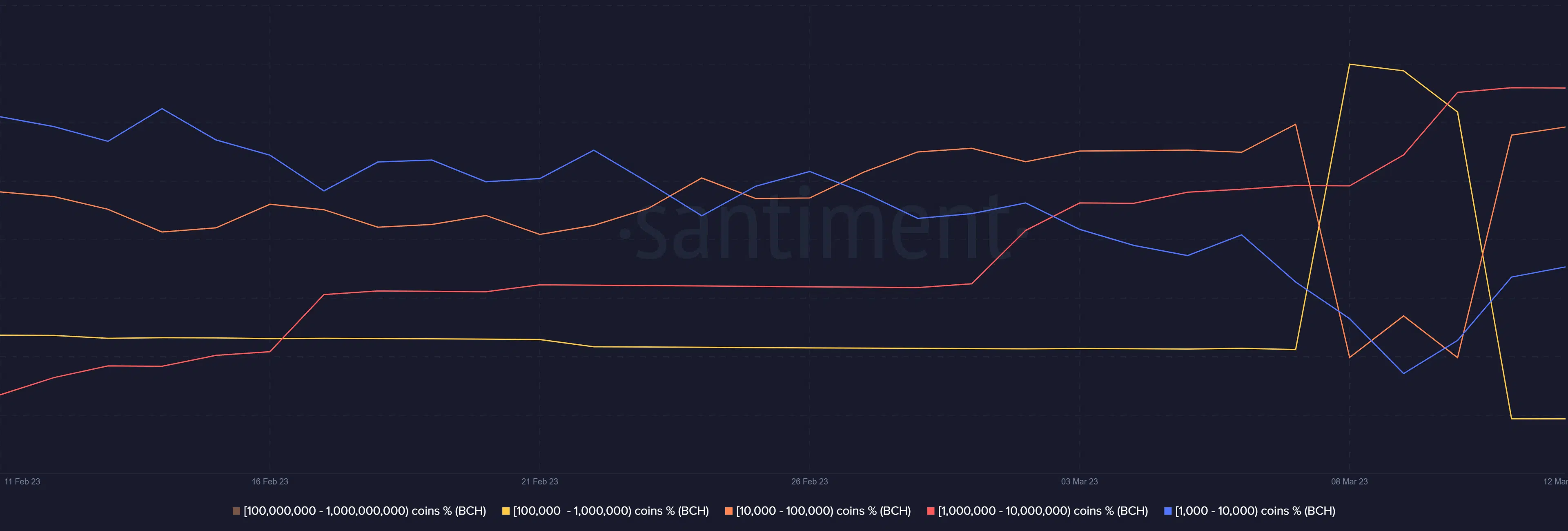

Whales in the highest address category holding over 1 million BCH have been adding to their balances. The same applies to addresses within the 1,000 to 100,000 BCH category. These addresses increased their holdings since 9 March, hence buying the dip.

Despite the accumulation, addresses within the 100,000 to 1 million BCH category have been contributing to some selling pressure.

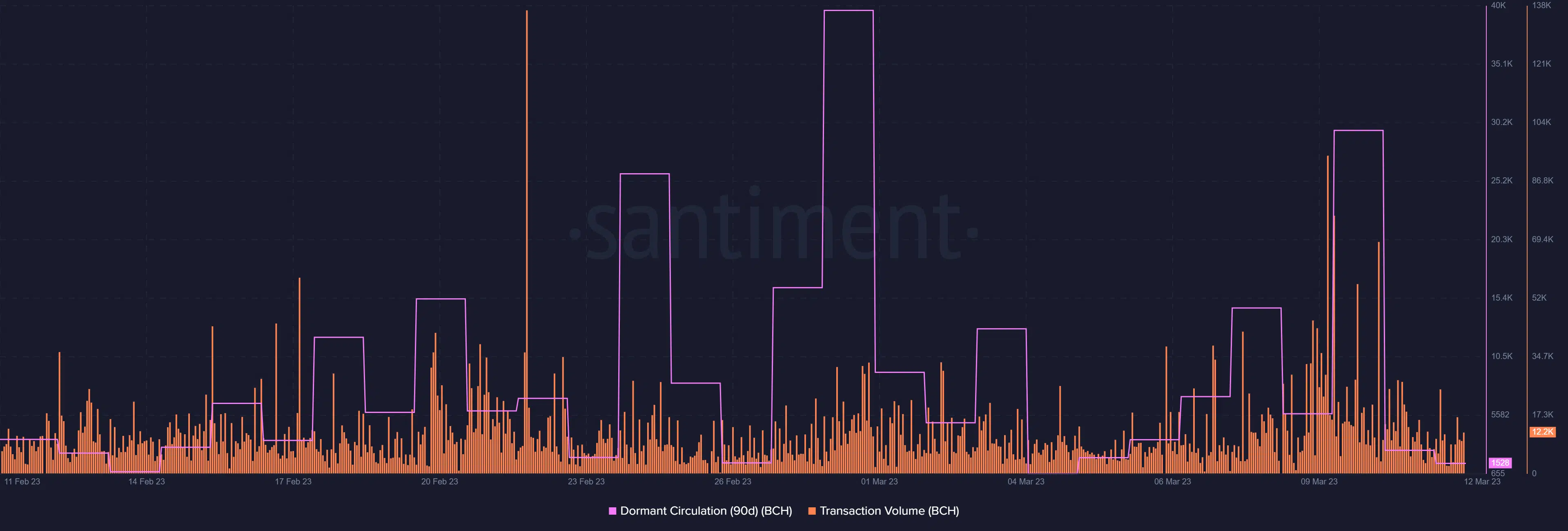

This may explain the limited upside. Bitcoin Cash’s dormant circulation metric indicates that a significant amount of the cryptocurrency exchanged hands during the recent selloff.

On the other hand, the transaction volume indicated a surge in activity on 9 March. This observation confirmed the influx of buying activity observed when the price bottomed out.