Bitcoin closes above $100K – Bullish surge or volatile retest ahead?

- Bitcoin’s $100K breakthrough triggers record volumes and volatility in crypto trading markets.

- Massive liquidations and leveraged positions drive Bitcoin’s uncertain retest of $100K resistance.

Bitcoin [BTC] has achieved a historic milestone, marking its first-ever daily close above $100,000, according to crypto analyst Rekt Capital.

Meanwhile, the price breakthrough reflects growing bullish momentum in the crypto market and has sparked discussions about Bitcoin’s next potential moves as it retests this key level.

Volatile retest at $100K resistance

Rekt Capital’s analysis points to ongoing volatility as Bitcoin undergoes its third consecutive retest of the $100,000 level.

While the symmetrical triangle breakout earlier in December signaled bullish continuation, the current price action remains uncertain.

The critical zone of $99,757.85, identified as a key resistance-turned-support area, is being closely monitored.

If BTC fails to hold above this level, analysts suggest it may retrace to deeper support areas such as $91,070.40 or even $87,325.43, levels seen during prior consolidation phases.

However, if the $100K retest holds, Bitcoin could establish this level as new support, paving the way for further upward movement.

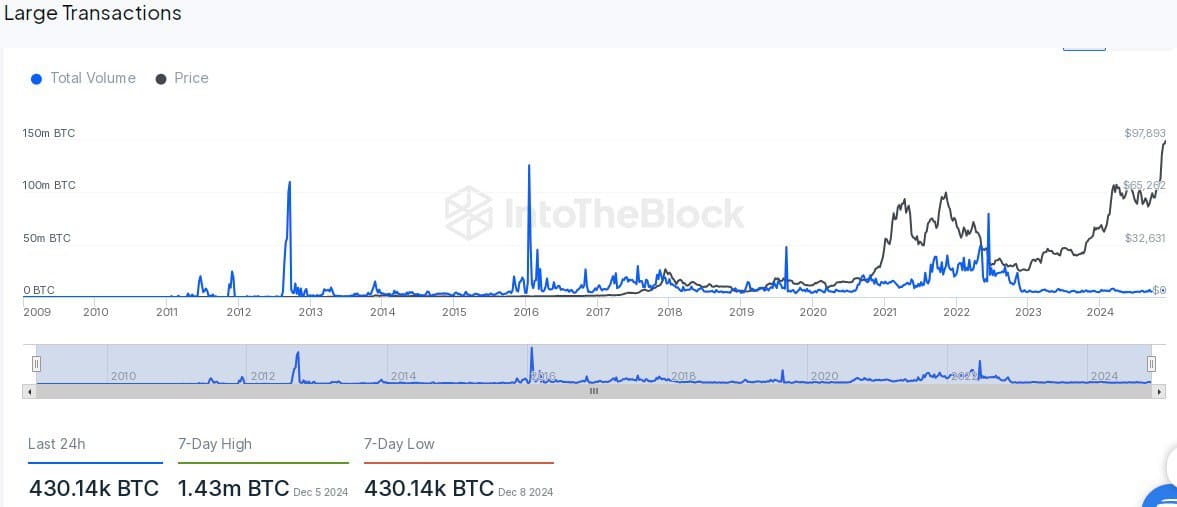

Large transactions and market activity trends

Data from IntoTheBlock reveals trends in Bitcoin’s large transaction volumes, which often spike during bullish cycles.

Historical data shows that transaction peaks have aligned with major bull markets in 2013, 2017, 2021, and early 2024.

Over the past seven days, Bitcoin saw a notable 1.43 million BTC in transaction volume on 5th December, 2024, which has since dropped to a 7-day low of 430,140 BTC on 8th December.

This reduction suggests cooling activity following the historic price milestone, as institutional players and whales may be waiting for price stabilization before increasing activity again.

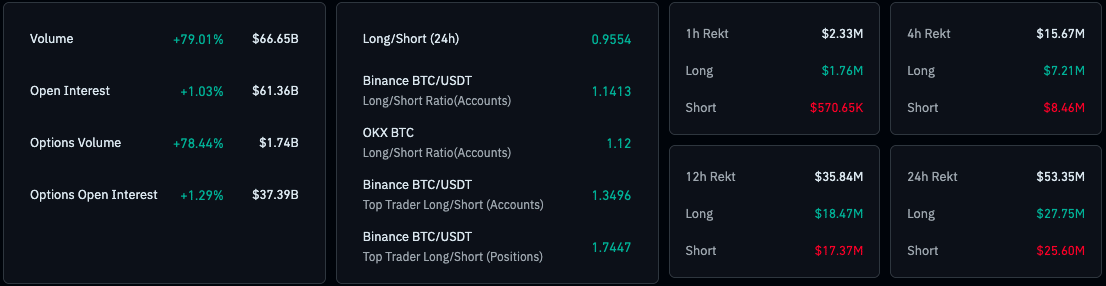

Liquidations and leverage data suggest active volatility

CoinGlass data shows significant activity in leveraged positions as traders navigate Bitcoin’s price movements.

The 24-hour liquidation total reached $53.35 million, split between $27.75 million in longs and $25.60 million in shorts, indicating balanced pressure on both sides of the market.

The largest liquidations occurred in the past 12 hours, where long positions dominated with $18.47 million liquidated.

Short positions, however, saw heavy liquidations over shorter timeframes, including $8.46 million in a 4-hour period, reflecting increased volatility around the $100K mark.

Derivatives and trading metrics

Trading metrics also suggest elevated market activity. Bitcoin’s 24-hour trading volume rose by 79.01% to $66.65 billion, while open interest grew by 1.03% to $61.36 billion.

Read Bitcoin’s [BTC] Price Prediction 2024-25

In options markets, volume increased by 78.44% to $1.74 billion, with options open interest rising by 1.29% to $37.39 billion.

These figures indicate heightened interest from traders and investors, particularly in derivatives markets, as Bitcoin’s price movements attract speculative and hedging activity.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)