Bitcoin: Coinbase sees 2,500 BTC inflow in one block—Are whales looking to exit?

- Over 18,000 Bitcoin from short-term holders sold amid macro volatility.

- Trump’s tariff shock highlighted Bitcoin’s sensitivity to macroeconomic headlines.

Bitcoin [BTC] markets faced major turbulence between the 3rd and the 4th of April as long-dormant coins moved, exchange inflows surged, and prices dropped sharply.

The catalyst behind this market unrest was U.S. President Donald Trump’s sweeping tariff announcement, which rattled global risk assets.

What’s behind Bitcoin’s quick response?

Not to mention, Bitcoin responded swiftly—falling from $88,500 to $81,000 before recovering near $83,000, at the time of writing. Interestingly enough, a notable trend was observed.

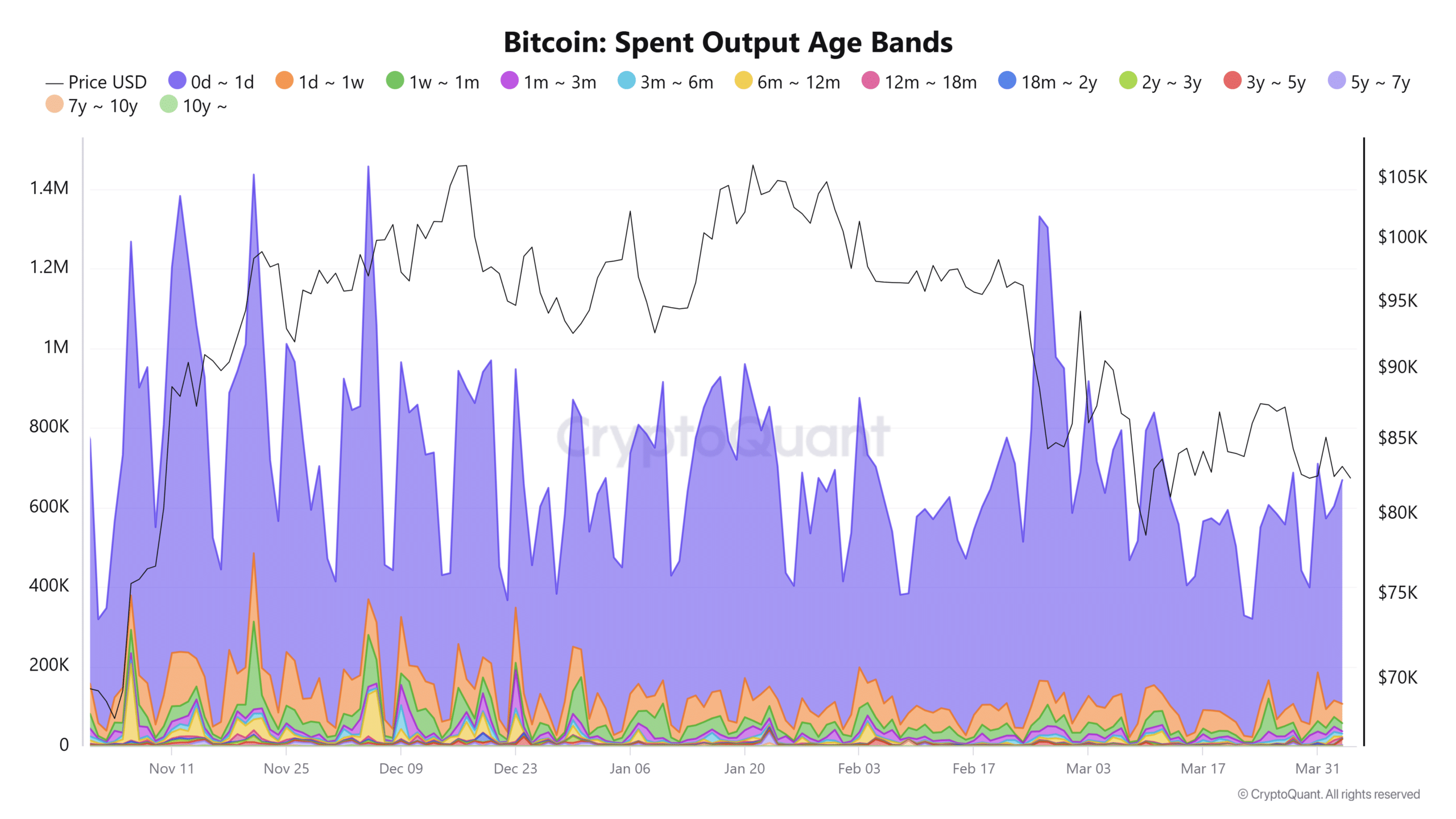

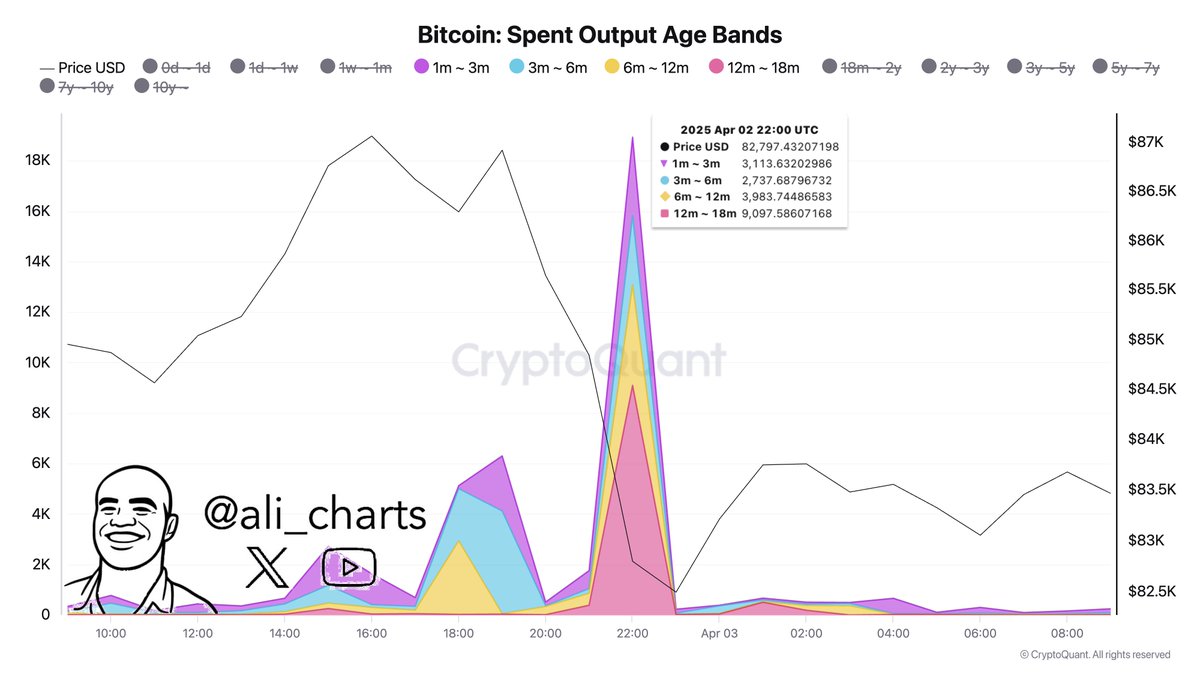

Long-term holders began to move dormant coins, while short-term holders contributed to a flurry of sell-side activity.

In fact, over 1,057 BTC aged between 7 and 10 years were spent for the first time in years.

The calm before the storm? Bitcoin price settles amid chaos

This activity pushed the Spent Output Age Bands above the 50 threshold.

Meanwhile, Bitcoin’s price hovered between $82.6K and $83.8K, suggesting long-term holders were either taking profits or reacting to macro uncertainty. But the activity wasn’t limited to old hands.

It was confirmed that over 18,930 BTC from holders aged 1 month to 18 months were moved on-chain. These coordinated movements reflected not just panic selling but a broader market response to external news.

Are big players preparing to exit?

Of course, in conjunction to this, multiple exchange showed that a single block recorded an inflow of 2,500 BTC into exchanges, primarily Coinbase. This suggests large holders were preparing to sell.

Following the tariff news, Coinbase registered unusually high deposit volumes from whale wallets, some transferring between 10–100 BTC in a single move.

These inflows directly aligned with Bitcoin’s sharp drop from $88.5K to $81K, confirming that capital was moving to exchanges, not cold storage—typically a bearish indicator.

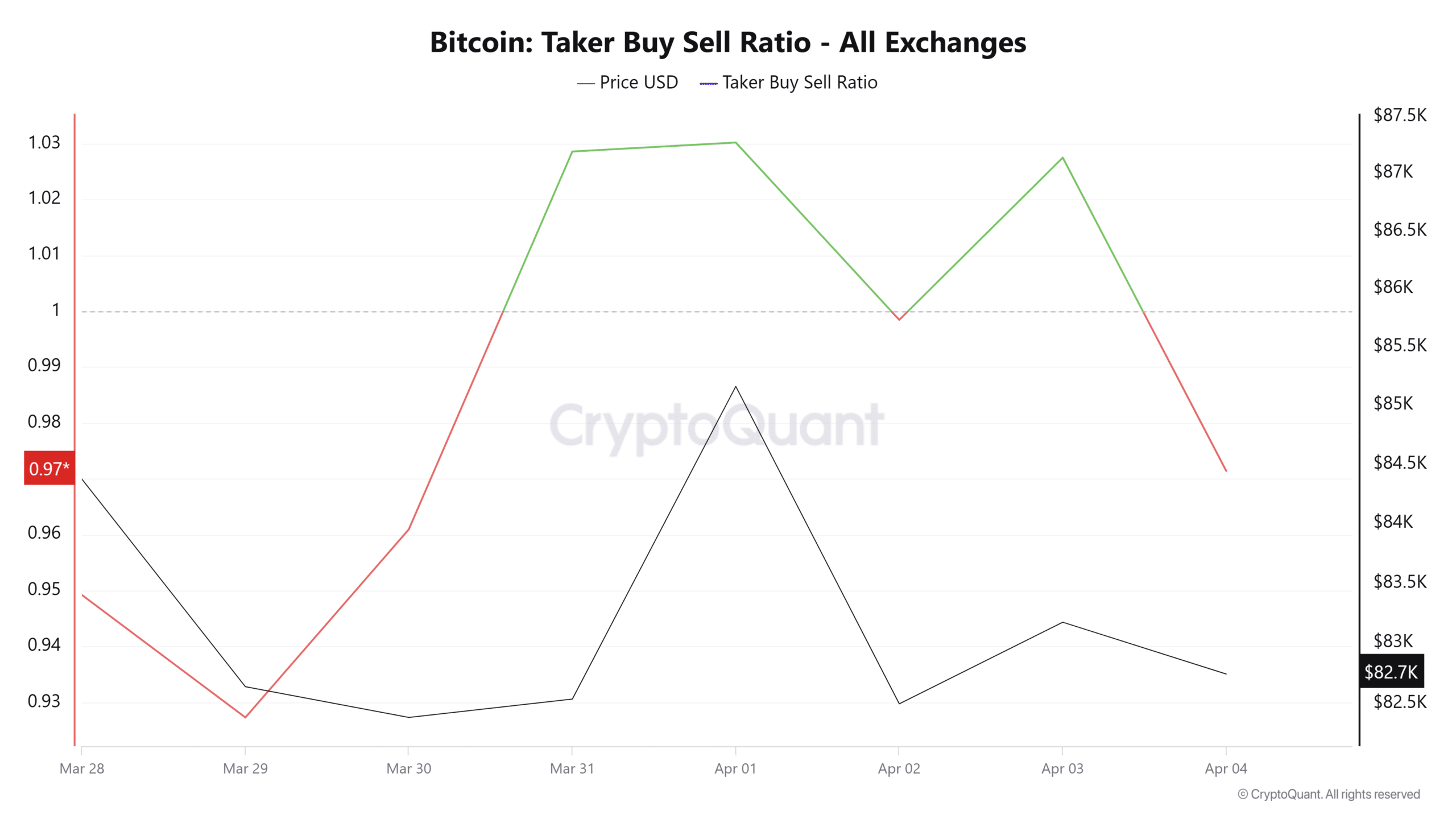

Amid the sell-off, an anomaly surfaced on derivatives exchange Bybit.

The Taker Buy/Sell Ratio spiked to 5.3. Seemingly, it is a surge in aggressive buyers placing market buys, heavily outpacing sellers.

Putting it all together, the market moved in unison.

Bitcoin markets saw synchronized action across all holder cohorts, triggered by Trump’s tariff announcement.

The rare presence of dormant coins, paired with ongoing high-frequency selling from newer entrants, created a perfect storm that pushed prices lower before stabilizing.

How Trump’s tariff test highlights crypto’s sensitivity

Zooming out, Trump’s tariff shock laid bare Bitcoin’s reflex to macro stress—rapid outflows, dormant coins moving, and speculative swings.

Yet not all signals were bearish. Analysts at Reuters noted that such geopolitical instability could lead to dollar weakening, possibly driving future demand for Bitcoin as a non-sovereign hedge.

Still, for now, the charts point to short-term fear and positioning adjustments, not systemic adoption.

![Bitcoin [BTC]](https://ambcrypto.com/wp-content/uploads/2025/08/Bitcoin-BTC-400x240.webp)