Bitcoin: Could China’s liquidity injections boost BTC?

- Is China waiting for US FED’s rates decision before pumping the liquidity machine?

- Liquidity to drive market rallies for BTC and altcoins

China is poised to inject significant liquidity into its economy, which could boost Bitcoin [BTC] and other cryptocurrencies as cited by X user and market analyst Quinten.

Historical patterns show that the People’s Bank of China often increases liquidity in August, with previous injections occurring on 11th August in 2020, 31st August in 2021, and 2022, and 28th August in 2023.

Although there was a brief liquidity boost in June, there has been little activity since.

China might be waiting for the Federal Reserve to cut rates, possibly on 18th September, before ramping up its liquidity efforts. This move could elevate global liquidity.

Historic post-halving BTC consolidation in play

The crypto market remains bullish despite recent dips, proving wrong those who predicted a bear market.

Bitcoin is currently in its typical post-halving consolidation phase, which often precedes a significant bull run. Combined with China’s expected liquidity injection, the market is poised for a potential explosion.

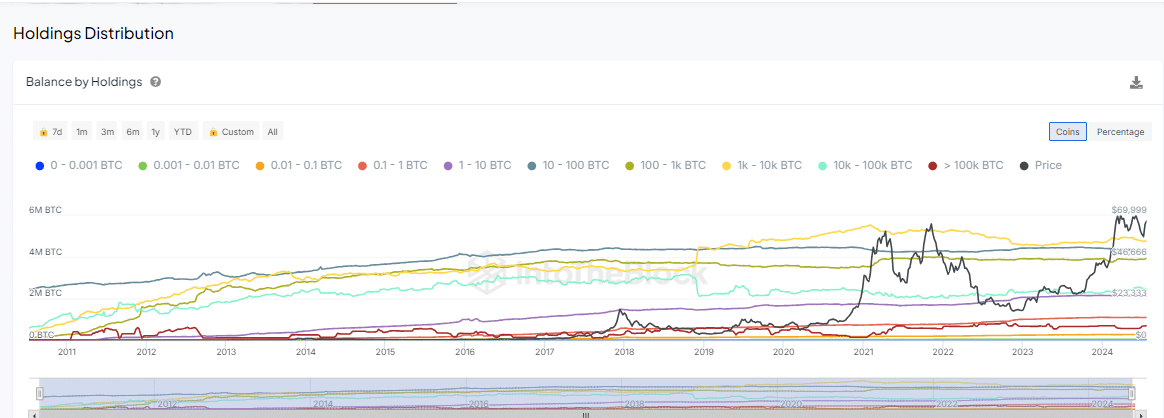

Examining BTC address holdings on IntoTheBlock shows little movement, suggesting accumulation.

This phase typically comes before significant market surges, as it reflects a period where traders and investors are placing orders.

The current accumulation hints at a potential rise in BTC and other cryptocurrency prices, driven by anticipated increase in liquidity.

BTC’s double bottom forms below the daily 200 EMA

The BTC price chart shows a double bottom below the daily 200 EMA, a pattern often signaling a market rally.

This is reinforced by a retest of the lower Gaussian channel band, coinciding with the daily 200 EMA.

These strong indicators suggest BTC is poised to rise soon, especially with the added boost from China’s liquidity injections.

Massive weekly candle for the entire market

Additionally, anticipated liquidity boost has created a strong bullish signal with a large weekly candle and a significant rejection wick.

This suggests a potential surge in Bitcoin, Ethereum and altcoins in the coming weeks. Support levels on higher time-frames are also showing strong buying interest, reinforcing the expectation of a market rise.