Bitcoin could witness a rough start to 2023; are these BTC holders responsible?

- The count of BTC whale transactions above $1 million clinched a two-year low

- Negative sentiment around BTC still lingers in the market

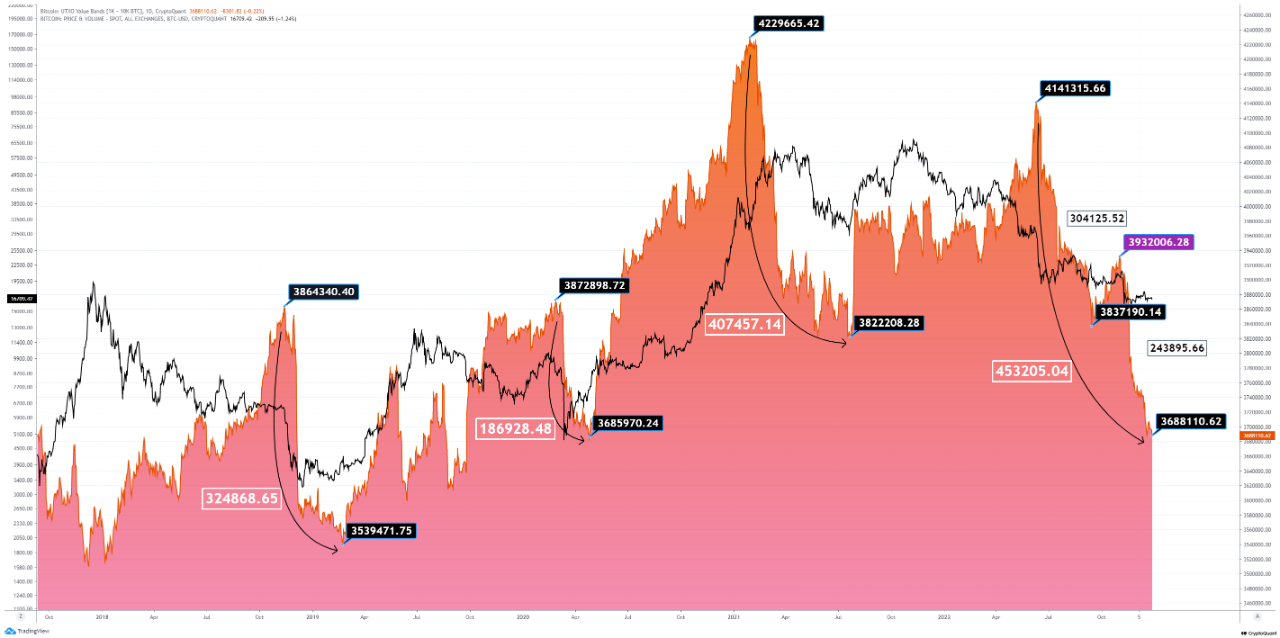

Pegged at 4331 at press time, the count of Bitcoin [BTC] whale transactions that exceed $1 million marked its lowest spot since December 2020, data from Santiment revealed.

There is a strong correlation between BTC’s price and whale transactions that exceed $1 million. This is because the unwillingness of whales to accumulate or distribute can lead to a consistent decline in BTC’s price.

? #Bitcoin's ranging prices have a lot to do with declining whale interest. This chart illustrates how closely $BTC and $1M+ valued whale transactions correlate. If prices continue sliding and a spike occurs, this would be a historically #bullish signal. https://t.co/nDZj3eicRD pic.twitter.com/t7GFIKNpax

— Santiment (@santimentfeed) December 28, 2022

Similarly, for BTC transactions that exceed $100,000, at 31,300 transactions as of this writing, the lowest spot since 2019 was recorded.

A 0.45X decrease if BTC falls to Ethereum’s market cap?

Furthermore, CryptoQuant analyst BinhDang found a significant drop in the BTC from Unspent Transaction Outputs (UTxOs) held by the cohort of BTC investors that hold between 1000 to 10,000 coins.

BinhDang assessed BTC’s historical performance and found that in comparison with previous bear cycles. The current bear cycle has been remarkably plagued by a decline in UTXOs held by investors with wallet balances of 1000 to 10,000 coins.

With FUD lingering in the market, BinhDang concluded,

“Generally, the market can only recover when this cohort has enough confidence to accumulate again. And at the moment, we still not get any positive signals from this cohort.”

In addition to reduced whale activity on the BTC network, short-term holders continue to sell despite facing losses, CryptoQuant analyst Phi Deltalytics found.

According to Phi, an assessment of BTC’s Short-Term Output Profit Ratio showed that these participants have prioritized liquidity over holding onto their assets, even if it means incurring losses.

Source: CryptoQuant

In the interim…

On a daily chart, BTC’s On-balance volume (OBV) was spotted at – 2.127 million. A negative OBV indicated that the volume of an asset sold is greater than the volume bought, furthering the price decline.

This position was confirmed by the fact that BTC’s Relative Strength Index (RSI) and Money Flow Index (MFI) rested below their neutral zones at press time. Both in downtrends, the RSI was 43.75, while the MFI was 40.17.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

A persistent decline in an asset’s RSI and MFI indicates a severe downturn in buying momentum, which might cause such an asset to be oversold. For a reversal to take place, a change in investors’ conviction is necessary.