Bitcoin crosses $70K for new ATH – Is $100K next to fall?

- The historic hike caused a 3.87% spike in Open Interest (OI)

- BTC’s demand was approximately five times greater than supply at press time

The world’s largest cryptocurrency, Bitcoin [BTC] shattered the $70K-level in style, days after bettering its previous all-time high (ATH). In fact, at the time of writing, it had climbed to a new ATH, with BTC trading at $70,973.

Bitcoin hit its latest ATH on the back of a 2% hike over 24 hours and an appreciation of 12% over a 7-day period.

Source: BTC/USD, TradingView

The ascent continues

The king coin rose by 1.40% in the last 24 hours of trading, according to CoinMarketCap. The sought-after digital asset has risen 65% since the beginning of 2024 and looked primed to make further gains to the north.

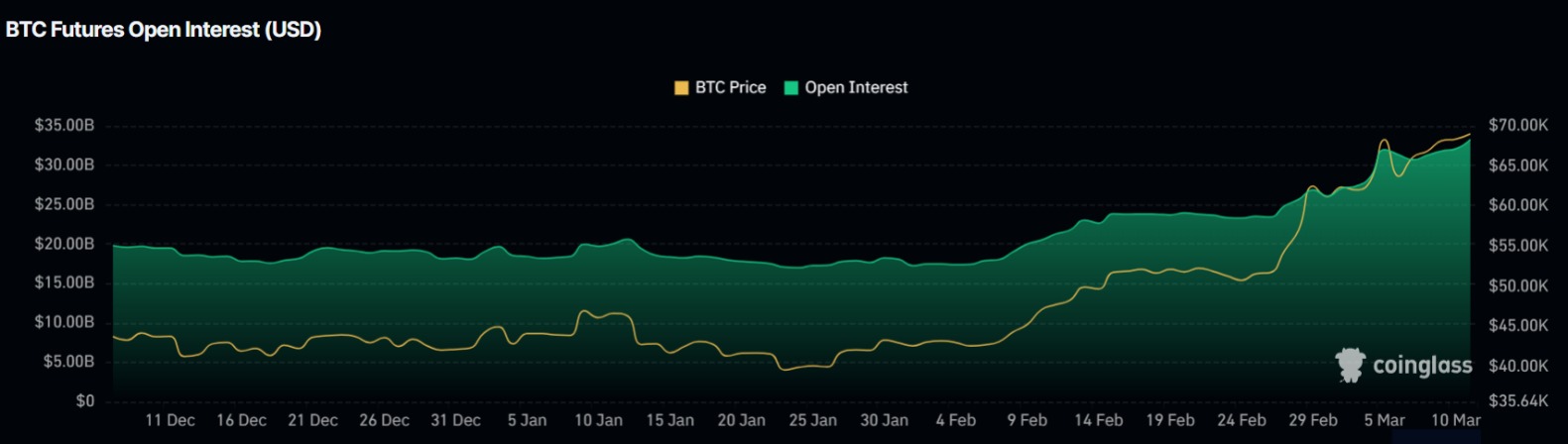

The historic climb spurred a 3.87% increase in Open Interest (OI) in Bitcoin futures, causing it to rise above $34 billion at press time.

Demand>>>Supply

Bitcoin’s ascent comes on the back of soaring demand from the recently launched spot ETFs in the U.S.

Nearly $223 million worth of Bitcoins was purchased by issuers on the 8th of March.

With this, the cumulative net inflows since the listing day rose to a whopping $9.59 billion, according to data sourced by AMBCrypto from SoSo Value.

As of this writing, Bitcoins worth $55.5 billion were backing these spot ETFs, accounting for more than 4% of Bitcoin’s total supply.

On the other hand, the network on average was producing Bitcoins at the rate of just $45 million per day, AMBCrypto noticed using Santiment’s data.

This meant that demand was approximately five times greater than the supply.

Emissions from blocks are expected to fall further during next month’s halving. With demand being strong, one could expect Bitcoin’s northward surge to continue.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Seasoned investors holding on

Meanwhile, Bitcoin’s exchange supply continued to plummet. Just over 4% of its total supply was available for trading at press time, as per AMBCrypto’s analysis of Santiment data.

This was happening despite a 100% network profitability. The underlying takeaway was that long-term holders (LTH) were not looking for profits just yet, but rather using Bitcoin as a store of value.