Bitcoin DeFi TVL hits record highs, flips BNB – Good news for BTC?

- Bitcoin’s DeFi activity has surged after the TVL hit an ATH and flipped that of BNB Chain.

- This rise co mes amid demand for restaking on the Babylon Bitcoin staking protocol.

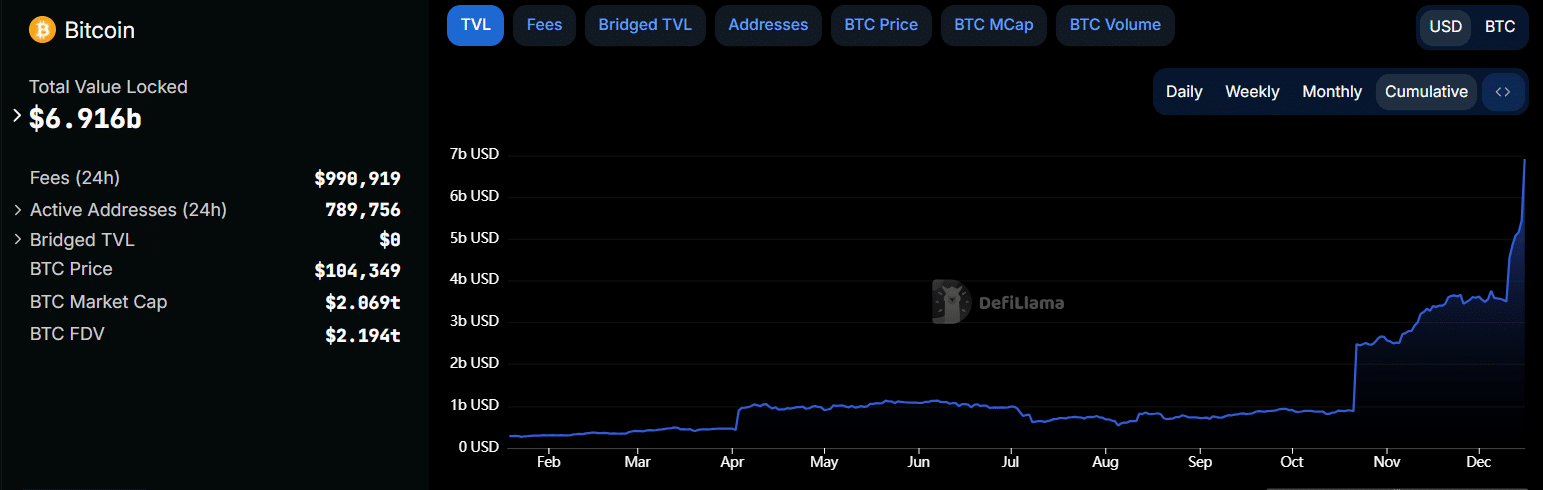

Bitcoin [BTC] has recorded a surge in decentralized finance (DeFi) activity, with its Total Value Locked (TVL) surging to an all-time high of $6.9 billion per DeFiLlama. This growth has seen Bitcoin surpass BNB Chain to become the fourth-largest blockchain by this metric.

Bitcoin’s DeFi activity started to rise in late October as demand for BTC yield grew. DeFiLlama showed that on 21st October, the TVL was below $1 billion, indicating that it has surged by more than six times in under two months.

The rising TVL is not only because of BTC’s price appreciation but also an increase in the coins locked on the network. These assets have increased from 34,980 BTC to 66,040 BTC at press time.

So, what is driving the boom in DeFi activity on the blockchain?

Rising demand for restaking

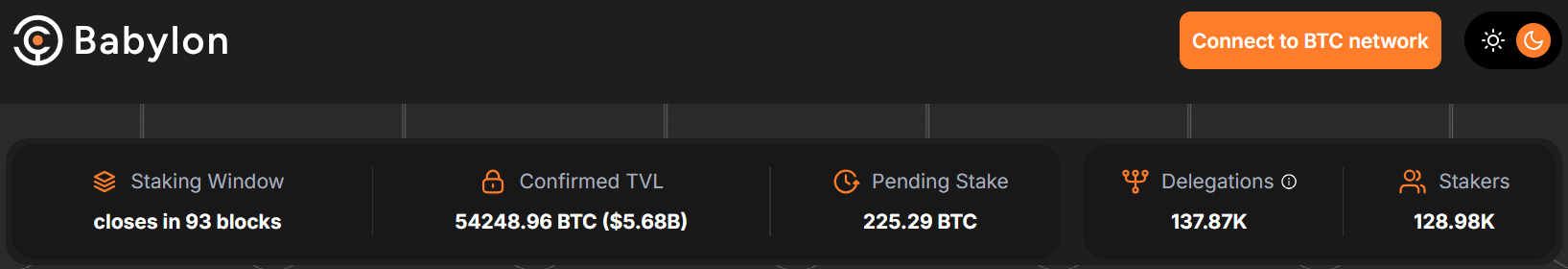

The main factor behind the rising metric is the Babylon staking platform. This platform accounts for $5.6 billion of the total TVL on Bitcoin.

According to the Babylon staking dashboard, 128,000 stakers have locked more than 54,000 BTC on the platform, showing rising demand for Bitcoin yield.

Per DeFiLlama, the amount of BTC staked on this platform has also increased by 151% in seven days.

This surge has pushed Babylon to the top of the leaderboard as the largest Bitcoin DeFi project. Its growth has also outpaced the Lightning Network, which ranks a distant fifth with a $530 million TVL, highlighting a shift in BTC’s use case from payments to DeFi.

Despite this growth, Bitcoin’s TVL still pales in comparison to Ethereum’s $88 billion. The largest staking protocol on Ethereum [ETH], Lido, also has $38 billion in TVL.

However, after flipping BNB Chain, Bitcoin is now close to flipping Tron [TRX], whose TVL stood at $8.08 billion.

Impact on Bitcoin price?

Bitcoin, at press time, traded at $104,240 after a 1.67% gain in 24 hours. The king coin hit a fresh all-time high of $106,488 on 16th December. This was amid rising demand from institutions after US-listed spot Bitcoin exchange-traded funds (ETFs) posted $2.17 billion inflows last week.

The rising DeFi activity could drive fresh demand for BTC, which could in turn push prices higher. Moreover, staking could reduce selling activity on the coin as traders seek to generate yield.

DeFi activity soars to 2022 highs

Bitcoin is not the only blockchain whose DeFi activity is rising. The TVL across all protocols has surged to $154 billion, its highest level since May 2022.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Ethereum has added more than $24 billion to its TVL in just one month, while Solana’s TVL has grown by over $1 billion. At the same time, DeFi tokens such as AAVE [AAVE)] have outperformed most altcoins.

This rise could drive more gains to Bitcoin’s TVL and deliver a significant rally for the king coin.