Bitcoin: Did Germany’s million-dollar BTC sell-off impact its prices?

- Germany sold a large amount of their seized BTC holdings, causing a dip in price.

- The profitability of holders declined while number of long-term holders decreased.

Bitcoin [BTC] slipped below the $65,000 level over the last few days causing a dip in sentiment around the king coin.

What is Germany up to?

Germany’s crypto holdings are in the spotlight after a recent fire sale. Over the past two days, the German government has shed nearly 1,700 Bitcoins, worth a cool $110 million, across major exchanges like Kraken, Coinbase, and Bitstamp.

While this might seem like a significant move, it’s a mere drop in the bucket compared to their massive $43 billion Bitcoin stash.

This on-chain activity suggests a deliberate strategy of offloading a small portion of their Bitcoin holdings.

It’s worth noting that Germany has been accumulating Bitcoin through seizures, with a total of 50,000 confiscated over the past few years.

According to CryptoQuant CEO Ki Young Ju, despite this recent sale of 3,000 BTC, Germany is still sitting on a hefty pile of unrealized profits.

The recent surge in BTC’s price has significantly inflated the value of Germany’s holdings. Their current stash is estimated to be worth a staggering $3.24 billion, with a whopping $1.1 billion of that being unrealized profit.

This puts them firmly in the position of the world’s fourth-largest Bitcoin holder, trailing behind the US, China, and the UK.

Interestingly, the US holds a significantly larger amount at 213,246 Bitcoins, valued at $13.7 billion. China, despite a ban on Bitcoin transactions and a large sell-off in 2019, still surprisingly holds onto a sizable stash of 190,000 Bitcoins.

This recent German sell-off, coupled with outflows from spot Bitcoin ETFs, is being blamed for the current selling pressure on Bitcoin.

Bitcoin begins to suffer

At press time, BTC was trading at $64,562.51 and its price had declined by 1.29% in the last 24 hours.

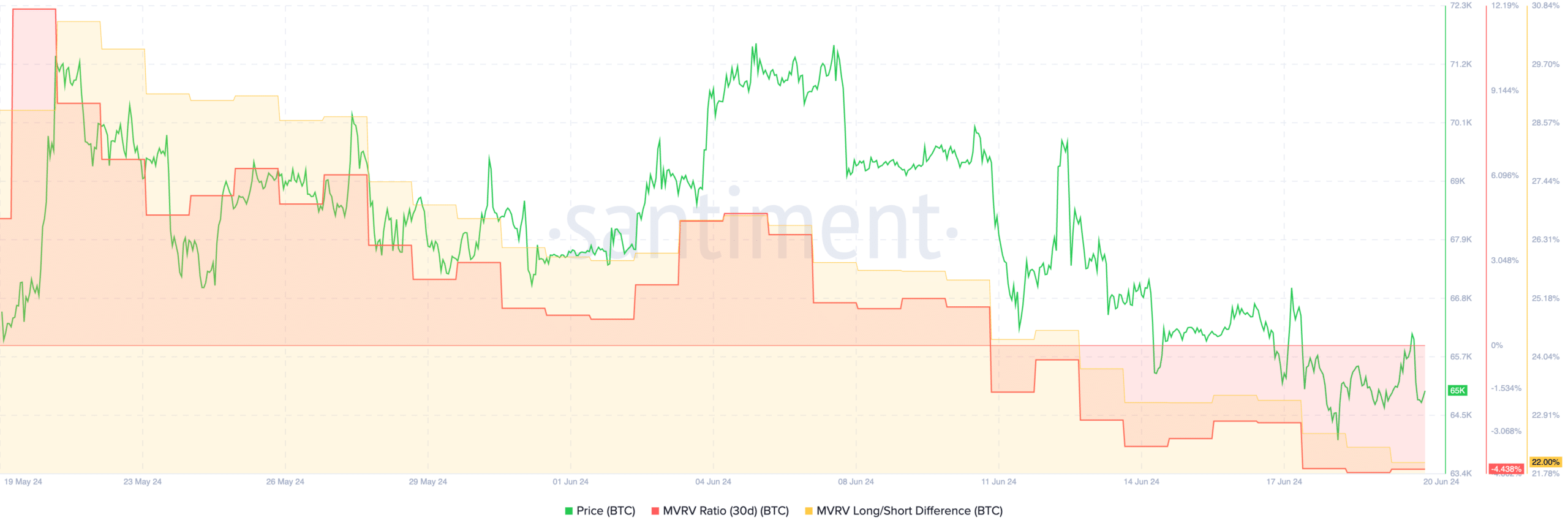

The MVRV ratio for BTC had also declined indicating that most holders at the time of writing were not profitable. This could further impact sentiment around BTC negatively.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, low profitability also means that most hold will have to wait before selling to make a profit.

Coupled with that, the long/short difference around BTC had also decreased indicating that the number of long term addresses holding BTC had declined.