Bitcoin dives below $60K, $56K support levels: Till where will BTC fall?

- Bitcoin plummeted past the $60k and $56k levels, which had been faithful support zones in recent months

- Sentiment was extremely bearish, and long-term investors can wait for a few days before looking to “buy the blood.”

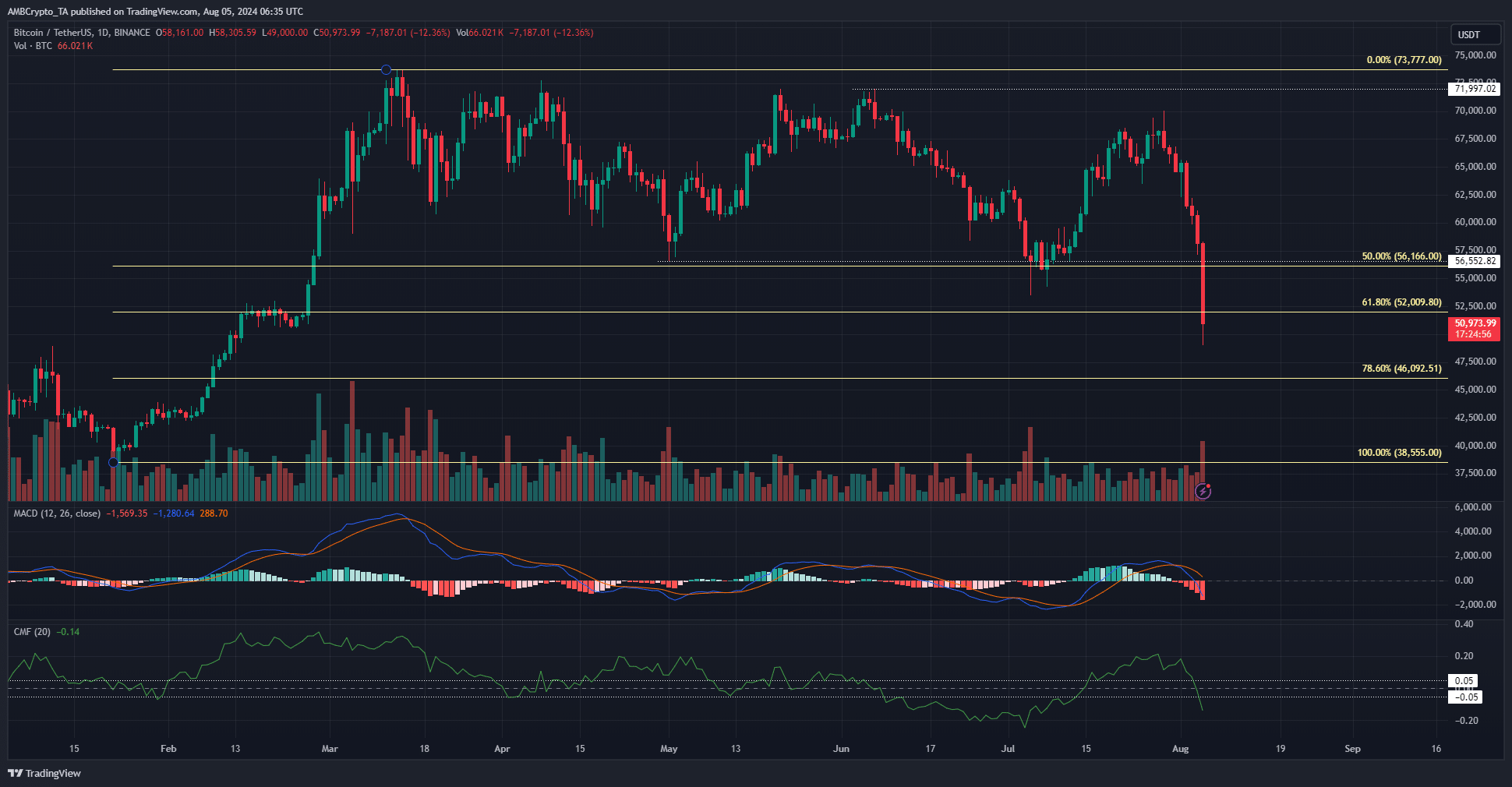

Bitcoin [BTC] was down 24% in a week, falling from $70k to $53.1k since the 29th of July, as the bulls were unable to defend the Fibonacci retracement level at $56k.

The past 24 hours saw $880 million in crypto liquidations.

The largest of them was a $27 million BTC/USD long position on Huobi. Panic well and truly gripped the market, and investors might want to wait for the muddy waters to settle a bit before buying.

Sub $50k Bitcoin prices are here

News of Japan’s rate hike raised fears of a repeat of the 2008 market crash. This news likely catalyzed, but isn’t wholly responsible, for the recent losses.

At press time, the Monday New York open in traditional markets was not yet in.

The New York trading session could reinforce the selling pressure and drive prices lower. The CMF was at -0.14 to signal significant capital outflow.

The MACD formed a bearish crossover on the daily chart and dived below zero.

The 78.6% Fibonacci retracement level at $46.1k is the next target for Bitcoin. Trading volume was high, and lower timeframe volatility was heavy. Traders might want to stay sidelined.

Exploring the next liquidation cluster

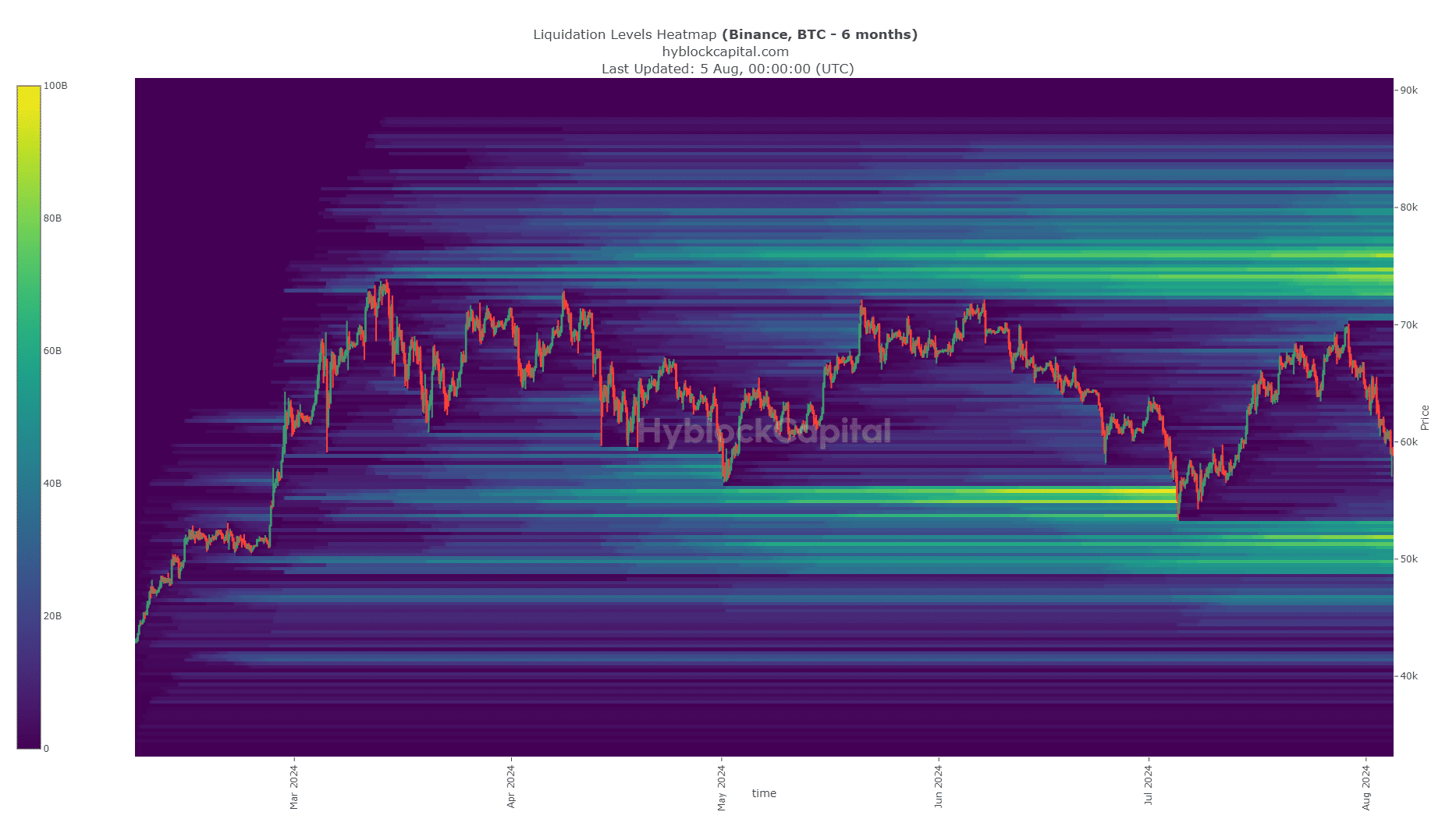

Source: Hyblock

The 6-month lookback period showed that the $50k area had a concentration of liquidation levels. They have been building up since June and strengthened in July.

In early July, the $54k liquidity pocket saw Bitcoin sweep the zone and then embark on a bullish reversal. Investors would be hoping that a similar scenario occurs at $50k.

To the north, the notable liquidation target was at $73k, near the all-time high.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Market sentiment is nuked, and evidence for that is the Intel CEO posting Scripture on social media. ATHs seem to be an eternity away.

Bitcoin has been through worse in the past and still found a way to recover, investors would be praying.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.