Bitcoin dominance nears 60%: Will BTC help altcoins boost as well?

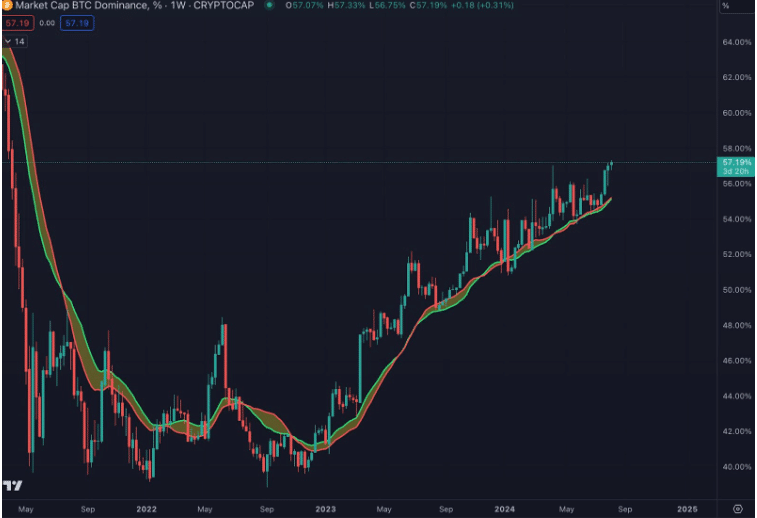

- Bitcoin’s dominance was set to surpass 60% at the time of writing.

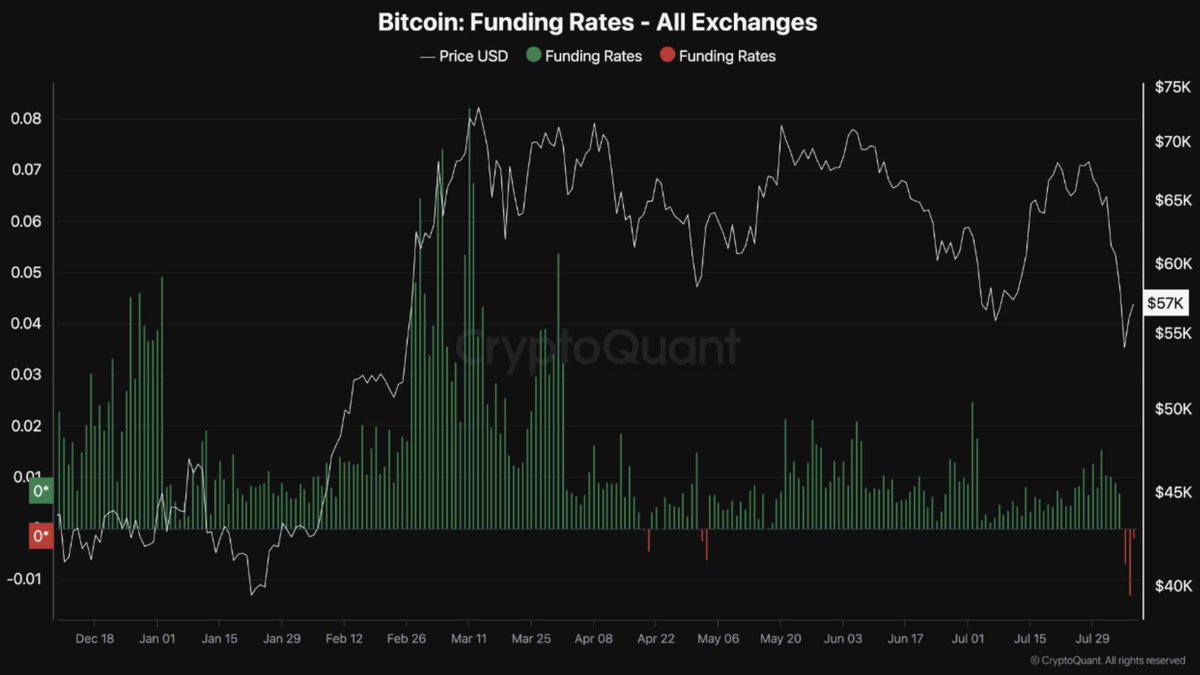

- Bitcoin wallet activities saw a resurgence despite negative Funding Rates.

Bitcoin’s [BTC] dominance has steadily been increasing, with 60% at reach during press time.

The death cross, where the short-term average falls below the long-term average, has crossed over on the daily chart, but remains on the weekly chart.

In 2023, Bitcoin began to rise right after this event, moving above its 50-day moving average and maintaining it as support.

However, in 2022, Bitcoin had a small rally before the death cross, but it faded afterward, similar to 2021.

In 2020, Bitcoin also rose into the death cross, had a brief pullback, and continued upward, similar to 2023.

The strength of the current move depends on Bitcoin staying above $60K and holding that level as support. If it fails, a slow decline might follow until the Fed makes a move.

What does the negative BTC Funding Rate mean?

Bitcoin has recently experienced its first major, 33% decline in this bull market. The Funding Rate for BTC has gone negative again, signaling a potential buying opportunity for long-term investors.

Major buyers such as Blackrock and MicroStrategy are increasing their Bitcoin holdings.

As the business cycle reaches a low point with the ISM index below 50, Bitcoin’s dominance in the market is expected to rise.

Bitcoin addresses holding more than 0.1 BTC hits ATH

The number of Bitcoin addresses holding more than 0.1 BTC is growing steadily, signaling dominance is increasing as well as whales’ buying activities.

Over the past month, they have accumulated $23 billion worth of Bitcoin. Long-term holders, those who plan to keep their BTC for the foreseeable future also moved 404,448 BTC, valued at $22.8 billion, to their addresses.

This significant accumulation indicates a strong belief in Bitcoin’s future potential.

Is your portfolio green? Check out the BTC Profit Calculator

ETH/BTC rotates back up

Ethereum initially rebounded strongly after this week’s market crash, but quickly lost those gains as Jump Trading continued to sell.

The declining ETH/BTC chart indicates that Bitcoin’s dominance will likely continue to grow, especially considering Ethereum is the largest cryptocurrency after Bitcoin.