Bitcoin

Bitcoin dominance weakens as BTC holds $63K: Will altcoins surge?

Bitcoin dominance has weakened amid uncertainty, yet select altcoins are thriving, signaling an emerging altcoin season.

- Bitcoin dominance weakens as altcoin performance rises.

- A potential price correction may be tempered if this trend holds.

Bitcoin [BTC] bears have thwarted another breakout attempt, maintaining pressure as bulls hold above $62K. At $63,390 at press time, a reversal toward $70K may not be imminent.

While some analysts predict a rebound, others suggest BTC dominance might be topping out, hinting at a potential dip. Could this set the stage for an altcoin season?

Bitcoin dominance might be at risk

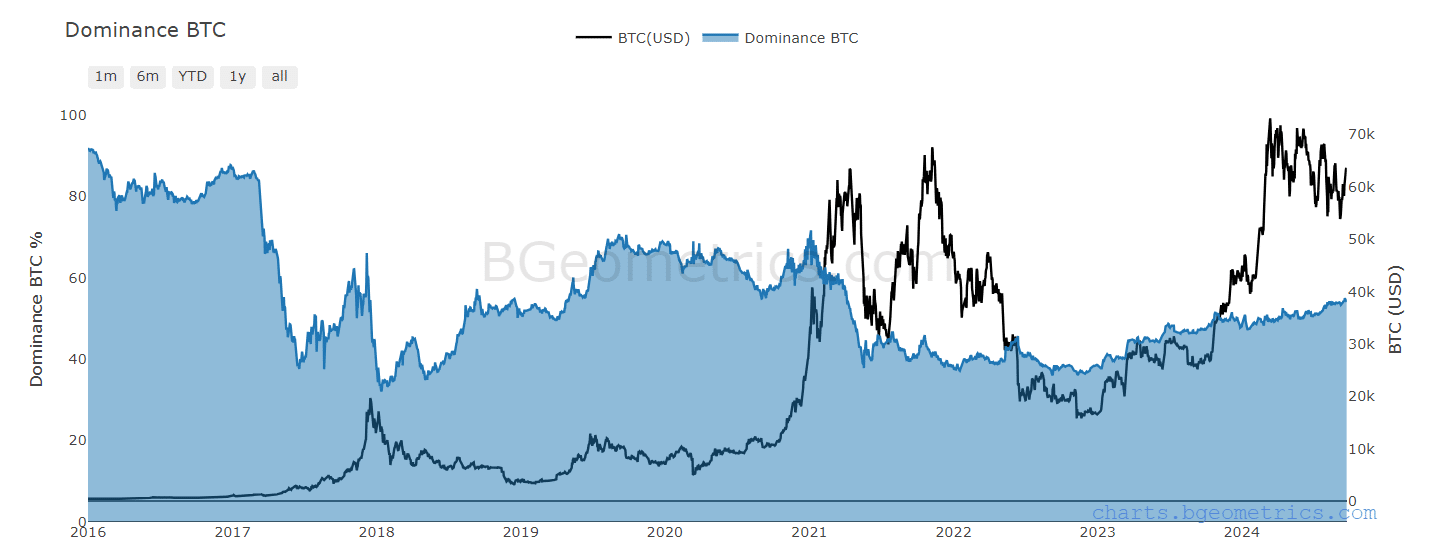

Historically, Bitcoin dominance has played a crucial role in forecasting market tops, reflecting Bitcoin’s massive share in the crypto market.

Typically, when BTC approaches a key resistance level, a corresponding peak in its dominance is often observed.

However, the chart below revealed a divergence during BTC’s ATH of $73K in March. Despite the price surge, BTC dominance stayed flat, suggesting a decoupling between price action and market dominance.

Per AMBCrypto, this hinted at growing altcoin interest, with investors viewing them as less risky alternatives to Bitcoin amid its value surge.

Interestingly, Ethereum’s [ETH] recent price action supported this hypothesis, as ETH has outpaced BTC with a double growth rate over the past week, surging more than 15% to $2,656 at press time.

In summary, should altcoin investors monitor BTC’s crucial resistance level for a potential surge? This could be key to predicting the next market moves.

Diversification signals potential market top

According to this data, 15 altcoins have outperformed Bitcoin in the last 90 days, with TAO leading the group, boasting an impressive 80% gain over BTC.

While this number is half of what’s needed for an altcoin season, the significant difference certainly challenges Bitcoin dominance.

Additionally, TAO has recorded a staggering 18% surge in the last 24 hours, far exceeding BTC’s 2%, which reinforces AMBCrypto’s earlier hypothesis.

Notably, TAO’s surge coincided with Bitcoin breaching the key $63K range.

Currently, a spike in TAO outflows has reached a two-month high of $3M, indicating that investors are moving into altcoins as BTC prices rise, signaling a direct correlation between the two.

Put simply, this correlation indicates a potential market top, as many investors are losing faith in a trend reversal and shifting their capital toward less risky alternatives.

If this trend holds, a price correction to $68K – the next resistance – could be tempered, especially as Bitcoin dominance weakens with more altcoins entering the top 50, setting the stage for a potential altcoin season – What are the odds?

The market is at a crucial juncture

Interestingly, on the day Bitcoin retested the $63K range, a significant portion of investors were in profit, as highlighted by the green wig nearing 14.

However, as bulls failed to trigger a breakout and bear dominance reasserted itself, a significant portion of stakeholders began realizing losses.

If these investors lose confidence in a price correction, it could lead to panic selling, further weakening Bitcoin dominance.

Additionally, this may trigger a shift in asset allocation toward altcoins, which investors might view as a safer option.

In summary, the market is at a crucial juncture. If Bitcoin dominance holds and bulls support a breakout, the altcoin season could falter unless BTC reaches its next resistance at $68K.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, if bulls fail to maintain the $64K range and a retracement below $60K occurs – which seems likely – many altcoins might see a temporary surge.

Yet, for a sustained altcoin season, trust in future gains is essential, which is directly or indirectly tied to Bitcoin dominance. Thus, monitoring it is essential.