Bitcoin drop below $8,500 may be tied down to USDCoin

If one were to look at the unrelated rise and fall of Bitcoin vis-a-vis internal factors within the digital assets space, the relevance of stablecoins increases. Seen as a balancing tool for the volatile world of decentralized currency, the printing, volume and change in stablecoins is often tied to the rapid price movements of Bitcoin.

The recent drop below $8,500 was no different, however, it had a different stablecoin playing a tethering agent, and according to Santiment, a crypto-analytics service it wasn’t Tether [USDT]. Rather the stablecoin USDCoin should be given more weightage.

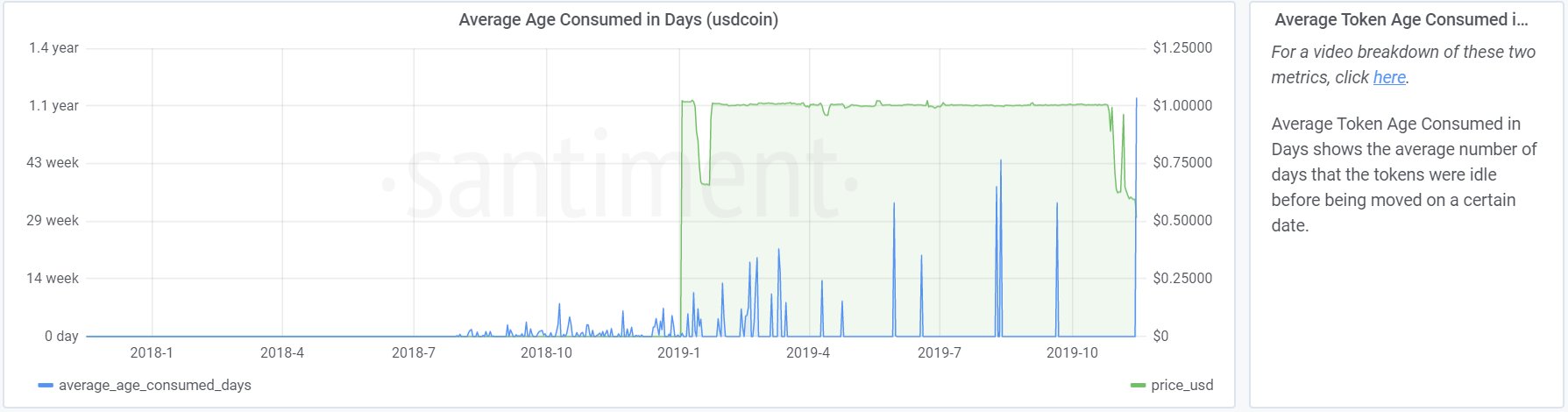

According to Santiment, the over $600 fall of Bitcoin observed on November 15 can be tied down the USDCoin’s “average age consumed in days metric, which spiked to its all-time high during the same period. They stated,

“#Bitcoin has fallen back below $8,500 for the first time in three weeks, and one likely foreshadow was $USDC‘s [USDCoin] largest “average age consumed in days” spike of all time.”

The metric, although not used frequently in charting is used to determine the number of days, on average, that digital assets are not used before being transacted on a said date, as per the Santiment website. This metric looks at the “idleness,” of the blocks within cryptocurrency’s network and hence the days since the “last time said token moved.”

Source: Santiment via Twitter

Santiment stated the three elements in this price move was Bitcoin, stablecoins and large whales. As Bitcoin is being moved between two exchanges, stablecoin movement can indicate future drops in price when “previewing,” activities of large -whales. They opined that this is most often on the sell-side, with a large number of organic buyers within the market. Santiment stated,

“This spike likely occurred from the result of a large amount of $BTC being transferred between exchanges, and stablecoins often indicate future drops in price with these types of spikes by previewing a whales’ plan to make a large (most often sell-related) move.”

At press time, Bitcoin is trading below $8,500 for the first time since it marked its biggest daily gain of over 40 percent on October 23, owing to Xi Jinping’s comments about China making headway in blockchain technology to ramp up its plan of issuing a digital currency tied to the Chinese yuan.