Bitcoin dips 26% in Q1: How low can it go? – Experts predict…

- BTC’s 26% drawdown could be a mid-bull correction or the start of a larger correction.

- Glassnode projected that a likely bottom could be hit above $70K.

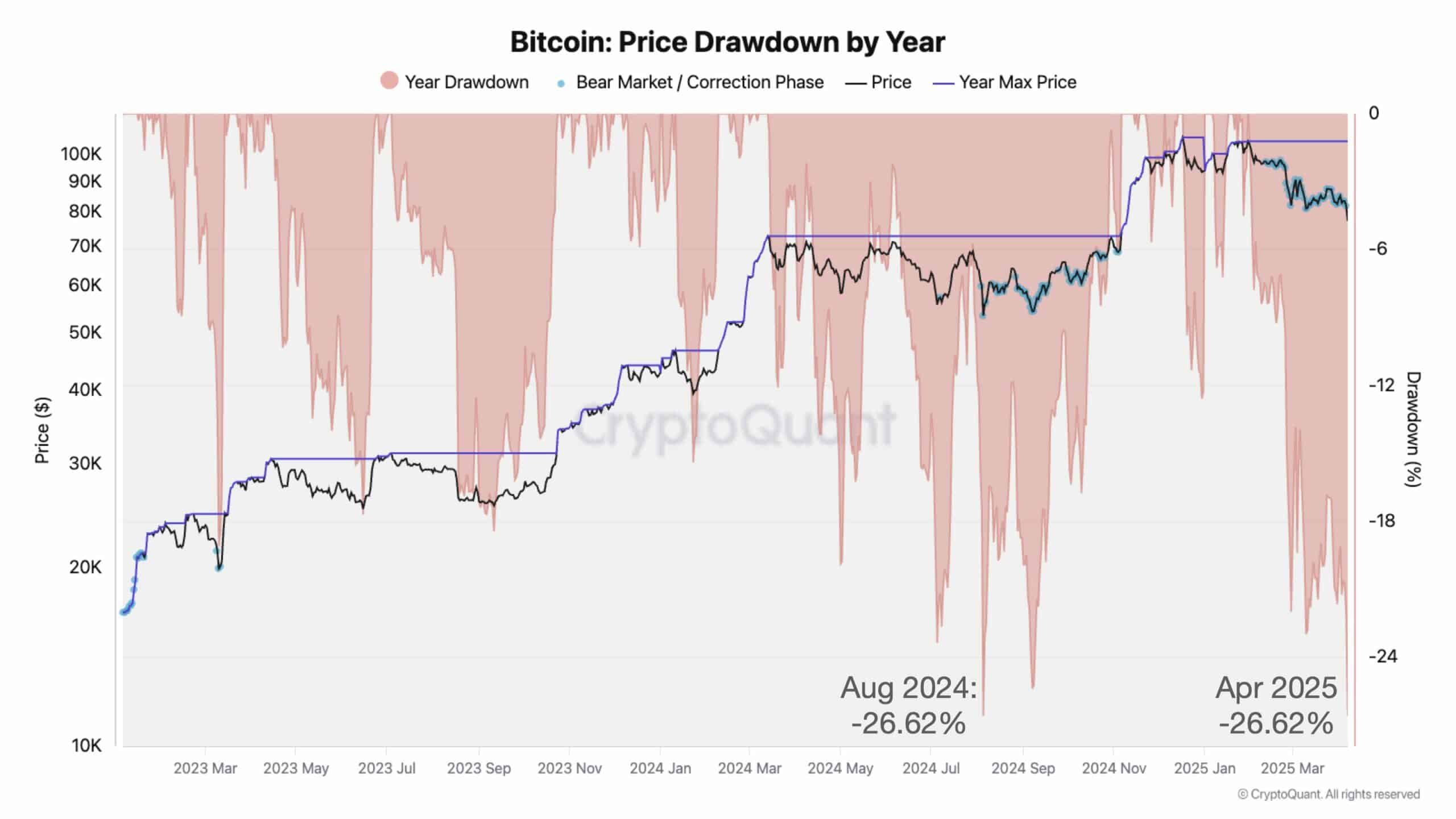

Bitcoin’s [BTC] 26% drawdown in 2025 could become the largest in this current cycle if the decline extends.

According to Julio Moreno, Head of Research at CryptoQuant, the 2025 plunge was currently equal to the August 2024 pullback.

After peaking at $109K in January, BTC retraced to $74K this week amid macro uncertainty — That’s over 30% correction. It has since recovered to $79K. Last year, it dropped from $73K to $49K, marking a 33% decline.

But compared to historical drawdowns, is BTC out of the woods, or is the worst yet to come?

BTC — A rebound or more pain?

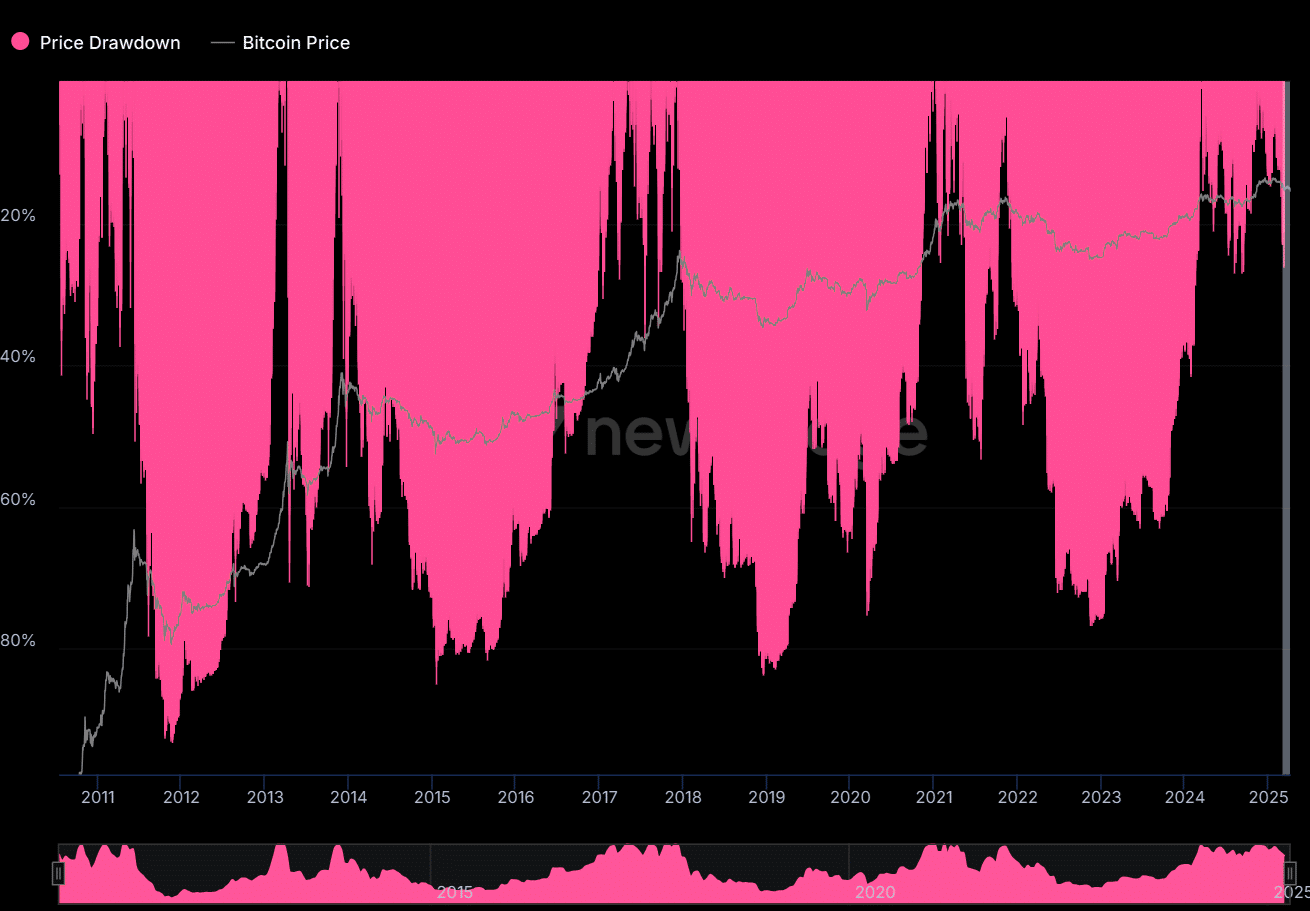

Past BTC drawdowns, especially during the bear market phase, were relatively more severe than the current 36%-30% decline. In 2012, 2025 and 2019, for example, BTC dropped over 80% and lasted 6–12 months after it hit a price peak.

Currently, BTC has declined about 30% over the past 3 months. As such, if past trends play out, this might be just the beginning of a larger correction for the next 3-9 months.

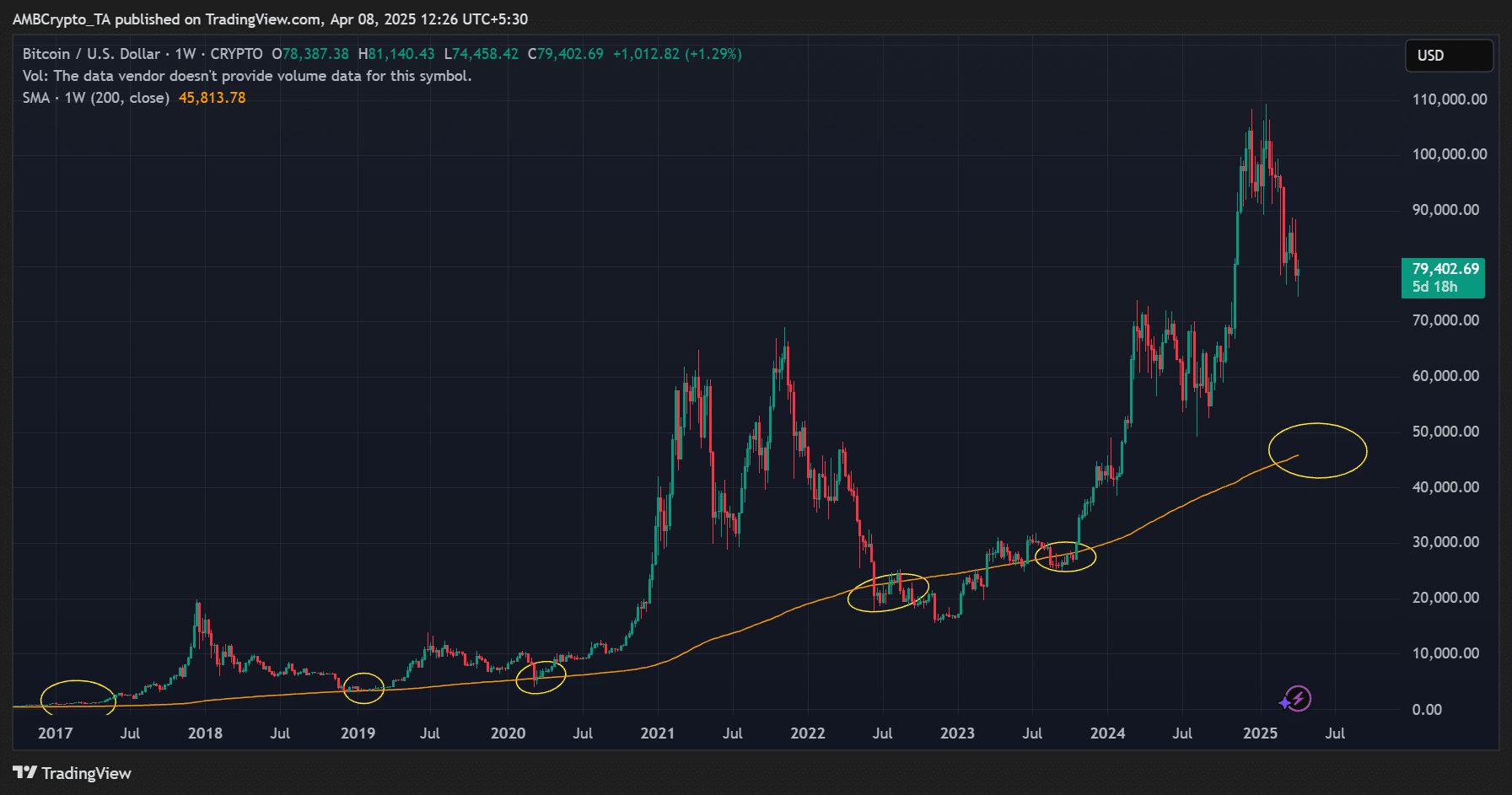

However, an 80% drop (to $21K) might be unlikely given that the key bull market support, the 200-weekly Moving Average, has risen to $45K.

Alternatively, some analysts believe that the current cycle drawdown might be less severe because of market maturation. In fact, Glassnode expected a potential bottom around the $ 74K-$ 70K area.

“The downside may slow down a bit from here – between $74k and $70k, there’s a total of ~175k $BTC in cost basis clusters. The single largest level within this range is $71.6k, holding ~41k $BTC.”

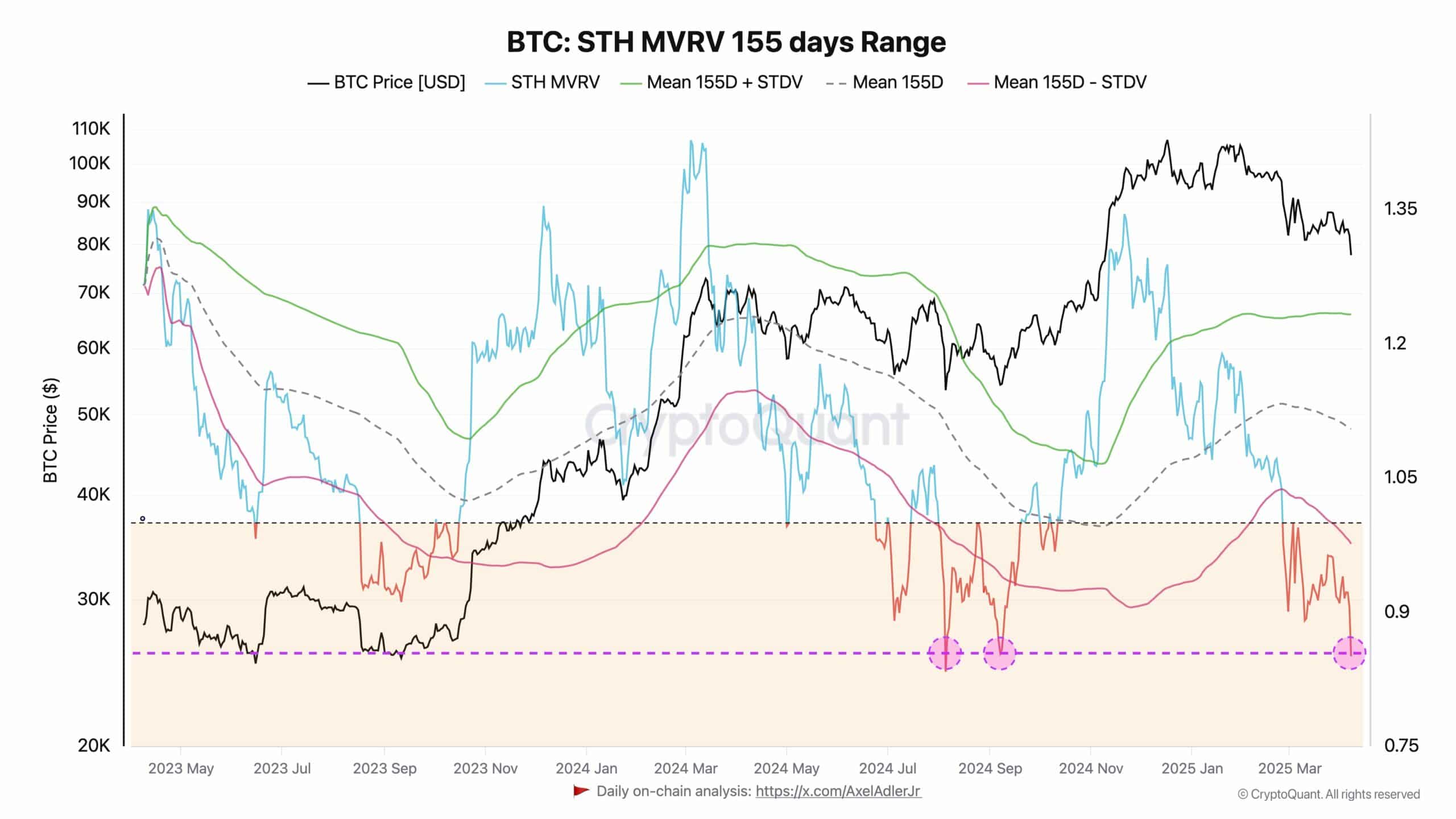

On-chain analyst Axel Adler, echoed a similar stance, noting that BTC had bottomed out and was in an accumulation phase, citing the STH (short-term holder) MVRV indicator, which mirrored the local bottom seen last August.

“In essence, these conditions typically signal the end of a correction phase and the start of accumulation.”

Indeed, other savvy investors, like Philip Swift and Stockmoney Lizards, were confidently bidding at these levels.

However, Moreno warned that the bottom wasn’t fully marked, as several bullish indicators were yet to show improvement for BTC.

In conclusion, the current 30% drawdown was nothing compared to the past cycle’s bear phases, which averaged an 80% price drop. Hence, the current pullback might be a mid-bull correction before another leg up.

Note, however, that it could also be the start of a larger correction if bullish conditions don’t improve.