Bitcoin ETF inflows dominate as BlackRock leads: ‘No place for ETH’

- Bitcoin ETFs saw strong inflows, with $298M net inflow on the 31st of July.

- On the other hand, Ethereum ETFs experienced outflows of $77.2M on the 31st of July.

On the first day of August, Bitcoin [BTC] ETFs experienced significant inflows, with $50.6 million pouring into spot Bitcoin ETFs.

Notably, BlackRock’s IBIT ETF led the charge, capturing $25.9 million in inflows as per Farside Investors.

Bitcoin ETF flow analysis

This trend reflected a broader pattern of Bitcoin ETFs steadily accumulating BTC, despite a brief decline in early June. Since the 1st of July, inflows have surged, outpacing the averages of the previous two months.

Infact, on the 31st of July, spot Bitcoin ETFs saw a net inflow of $298 million, including $17.99 million into the Grayscale mini ETF BTC and $20.99 million into BlackRock’s IBIT, per SoSo Value.

Expressing optimism about the development, X (formerly Twitter) account Crypto Empire, a prominent crypto content hub, shared,

“That’s quite the financial rollercoaster! Interesting to see the different movements in the ETFs for Bitcoin.”

Impact on BTC

However, BTC experienced a bearish movement on the price front, dropping to the $62K level on 1st August.

By press time, it had recovered to $64K, though the daily charts remained in the red, reflecting a modest 0.30% decline over the past 24 hours.

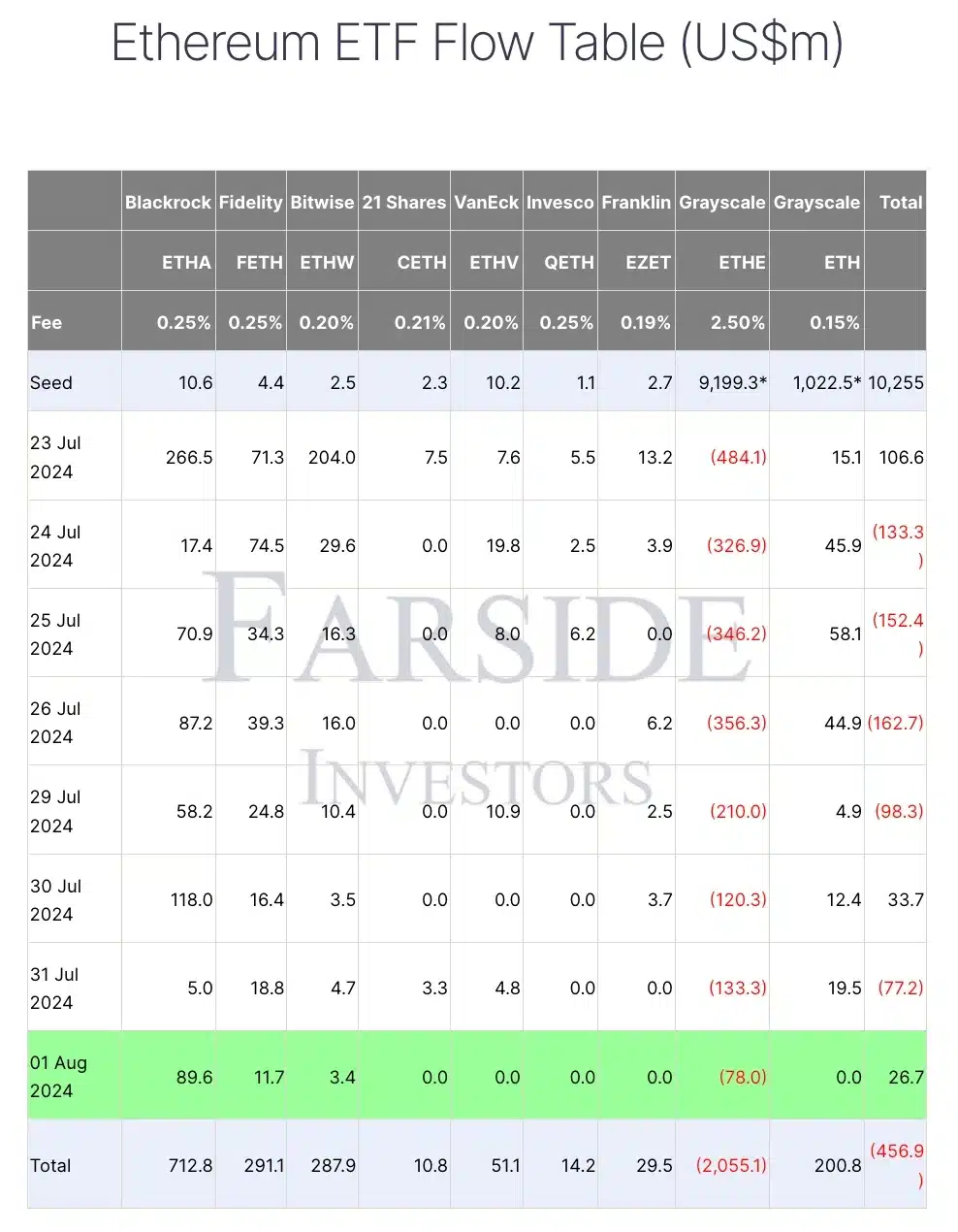

Ethereum ETF analysis

Interestingly, the performance of BTC ETFs contrasted sharply with that of Ethereum [ETH] ETFs.

While the ETH ETF recorded inflows of $26.7 million on the 1st of August, it had seen significant outflows of $77.2 million just a day earlier, on the 31st of July.

As a result, ETH’s daily price chart showed red candlesticks, indicating a decline. At the latest update, ETH was down by approximately 1% over the past 24 hours, trading at $3,142.

Remarking on the same, George from StepFinance noted,

“If you want a store of value narrative sound money etc. theres btc. If you want some decentralised world computer for building apps there is solana. Theres no place for eth in that world.”

Here, George is underlining that Ethereum doesn’t have a unique or necessary function in a market dominated by Bitcoin and Solana [SOL].

Thus, with continuous inflows into Bitcoin ETFs, it will be intriguing to watch whether ETH ETFs can surpass BTC or if BTC will continue to lead in the ETF race.

![Shiba Inu [SHIB] price prediction - Mapping short-term targets as selling pressure climbs](https://ambcrypto.com/wp-content/uploads/2025/03/SHIB-1-2-400x240.webp)