Bitcoin ETF investors are ‘20% worse off’: Peter Schiff – Is this true?

- Bitcoin ETFs showed signs of recovery, with net inflows of $73 million as of the 28th of June.

- Despite recent bearish signals for BTC, ETH, and SOL, declining price volatility suggested a stabilizing market.

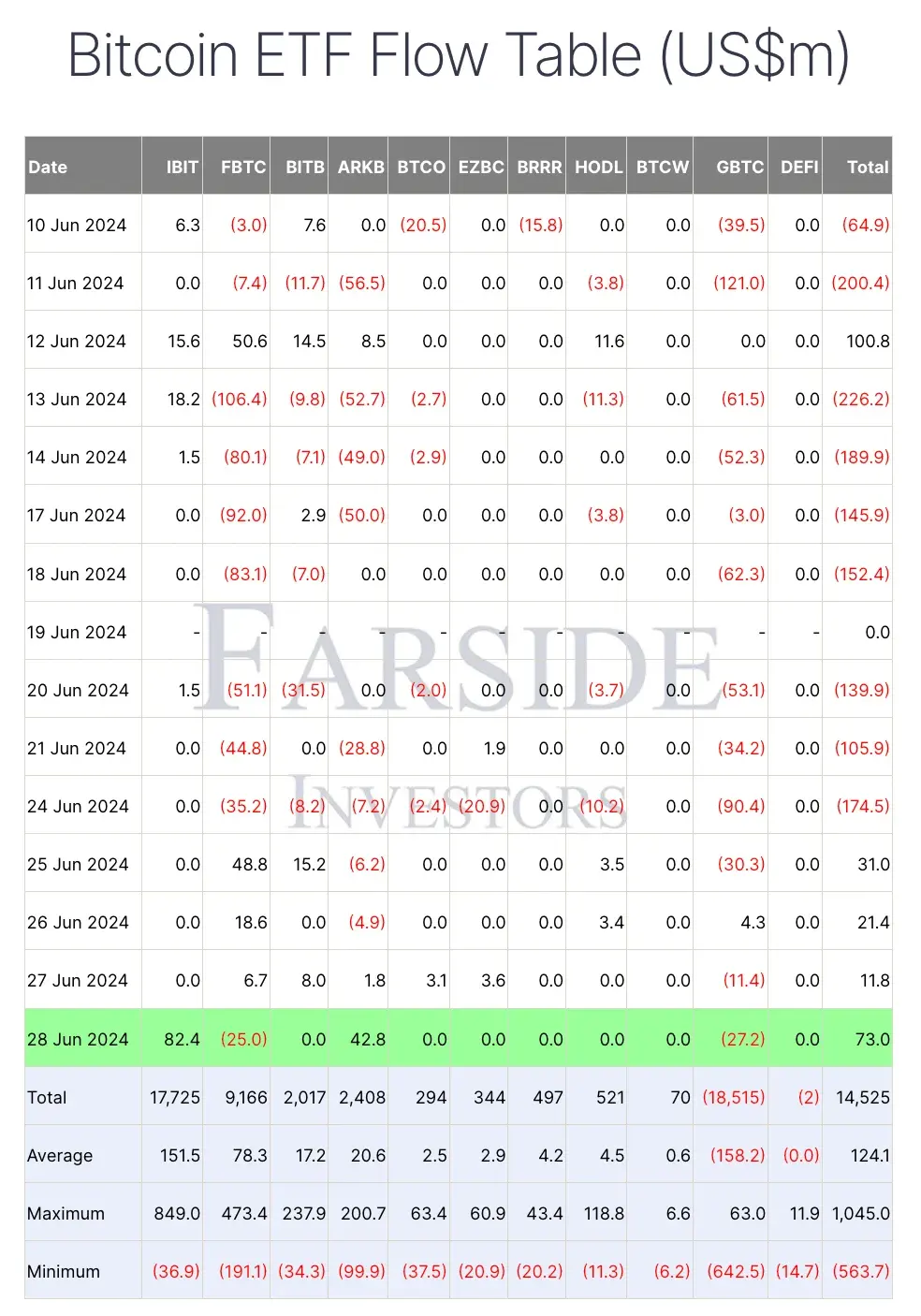

After experiencing continuous outflows, Bitcoin [BTC] ETFs appeared to be recovering. As of the latest update, on the 28th of June, BTC ETFs recorded a net inflow of $73 million.

Bitcoin ETF cashflow: Analysis

Leading the pack was BlackRock’s iShares Bitcoin Trust (IBIT) with $82.4 million in inflows. In contrast, Grayscale Bitcoin Trust (GBTC) saw outflows of $27.2 million, followed by Fidelity’s FBTC with $25 million in outflows.

This was quite the opposite of what happened on the 26th of June when FBTC and GBTC were the only ones to record inflows, with $18.6 million and $4.3 million respectively, along with VanEck’s HODL, which saw $3.4 million.

All other ETFs had net-zero flows, except for ARK 21Shares’ ARKB, which recorded outflows worth $4.9 million.

Peter Schiff critiques BTC ETF

Seeing the uncertainty around BTC ETFs, stockbroker and financial commentator Peter Schiff, the forever Bitcoin critic, decided not to miss this opportunity.

Drawing parallels with the Gold ETFs, Schiff took to X (formerly Twitter) and noted,

“#Gold closed Q2 with a 4% gain. #Bitcoin still has two more days left to trade, but as of now it’s down over 15%.”

He even went ahead and questioned various investors’ decisions and said,

“Investors who sold gold ETFs at the end of Q1 to buy Bitcoin ETFs are 20% worse off. The bad news for those investors is that it will likely get much worse from here.”

However, X user Bitcoin Clown responded to his tweet by asking,

Does Schiff’s analysis hold ground?

This highlighted that Schiff’s analysis of the underperformance of Bitcoin ETFs lacked proper evidence.

This is because, over the past four days, U.S. Spot Bitcoin ETFs have experienced increasing investment, with positive inflows recorded for three consecutive days.

In total, these ETFs have received $137.2 million in new investments during this period, indicating growing investor interest and confidence in these financial products.

Remarking on the same, an X user Lord Cryptotook to X and explained,

However, it remains uncertain whether this strong investor sentiment surrounding BTC ETFs will continue following the final approval and launch of Ethereum [ETH] ETFs for trading.

Additionally, with VanEck and 21Shares officially filing for a spot Solana [SOL] ETF, the uncertainties grow even further.

Impact on the token’s price

In the meantime, Bitcoin, along with Ethereum and Solana, showed bearish signals with declines of 0.88%, 1.68%, and 2.22%, respectively, in the past 24 hours, according to CoinMarketCap.

However, AMBCrypto’s analysis of Santiment data on price volatility revealed a decline, indicating that the asset’s price is becoming less volatile.

This means the price is experiencing smaller fluctuations and stabilizing, suggesting a more predictable and less risky market for investors.