Bitcoin ETF options could arrive by Q4 2024: Here’s what to expect

- Cboe has re-filed its Bitcoin ETF application to include options.

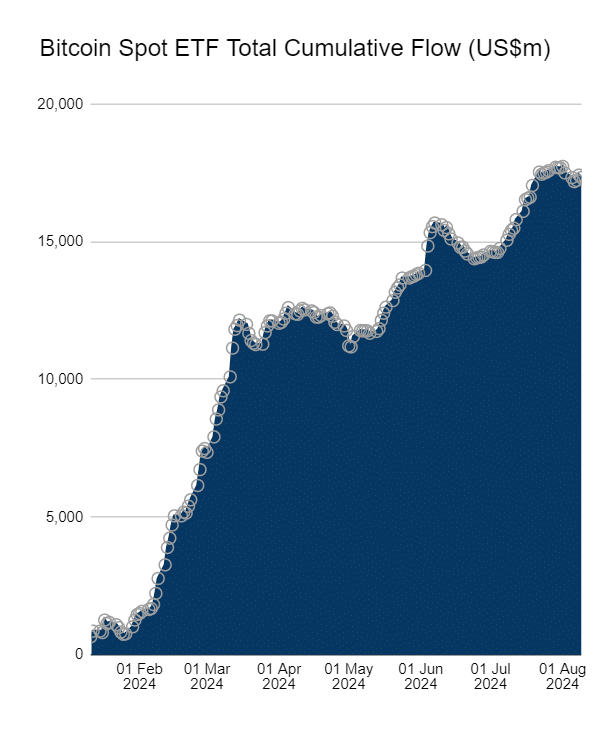

- BTC ETF has seen an outflow of over $17 billion.

Months ago, the approval of the Bitcoin ETF marked a significant milestone. It broadened the scope for trading opportunities and facilitated increased institutional involvement.

As the market adjusts to this development, the BTC ETF options are on the horizon and could arrive sooner than many anticipated.

Bitcoin ETF options applications see movements

Recent developments suggest that Bitcoin ETF options could be available as soon as the fourth quarter of 2024.

This speculation has been fueled by comments from Bloomberg Intelligence analyst James Seyfarrt, who expressed optimism about the timeline for these options.

Further evidence of movement in this direction came when Cboe re-filed its application to list options on spot Bitcoin exchange-traded funds (ETFs) after initially withdrawing it. This refiling occurred late on a Thursday, as noted by industry commentators.

Eric Balchunas, another analyst, highlighted that the Securities and Exchange Commission’s (SEC) comments on Cboe’s application were encouraging, drawing parallels to the regulatory feedback received before the approval of Bitcoin ETFs.

This comparison has raised expectations that the path towards launching Bitcoin ETF options is becoming clearer.

A Bitcoin ETF option would allow investors to engage with Bitcoin in a way that offers both the flexibility of options trading and the regulatory safeguards associated with traditional ETFs.

Investors would have the right, though not the obligation, to buy or sell shares of a BTC ETF at a set price before the option expires, adding a layer of potential strategic investment in the cryptocurrency space.

How the Options ETF could Impact Bitcoin

Approving Bitcoin ETF options could significantly enhance liquidity and improve price discovery. This would attract more institutional investors to the market.

Also, this development might introduce increased volatility due to speculative trading and potential market manipulation.

Furthermore, the price of Bitcoin could see a bullish impact from heightened demand while bringing the crypto market closer to traditional financial systems.

However, increased regulatory scrutiny and the potential for Bitcoin to become more correlated with traditional markets could also follow.

BTC ETF in the past week

According to sosovalue, Bitcoin spot ETFs experienced a net outflow of $169 million in the past week. Grayscale ETF GBTC saw a significant weekly outflow of $392 million, while BlackRock ETF IBIT and WisdomTree ETF BTCW had inflows of $220 million and $129 million, respectively.

Furthermore, cumulative data from Farside Investors shows that U.S. BTC spot ETFs have garnered a net inflow of $17.341 billion since their inception.

Grayscale GBTC had a net outflow of $19.451 billion, contrasted by BlackRock IBIT’s net inflow of $20.317 billion and Fidelity FBTC’s $9.722 billion inflow.