Bitcoin

Bitcoin ETF options debut sparks record trading—BlackRock’s IBIT leads the way

Are we witnessing the dawn of a new era?

- IBIT’s options debut hit $4.28 billion, driving Bitcoin to a new all-time high.

- Grayscale’s upcoming launch of spot Bitcoin ETF options signals increasing competition in the crypto investment landscape.

On 19th November, options trading for the first spot Bitcoin [BTC] ETF made its debut, fueling Bitcoin’s ascent to yet another all-time high.

As expected, BlackRock’s iShares Bitcoin Trust (IBIT), the inaugural spot Bitcoin ETF approved for options trading, spearheaded this milestone.

Seyffart on Bitcoin ETF options

The launch generated significant market activity, with nearly $1.9 billion in notional exposure traded, as highlighted by Bloomberg Intelligence ETF analyst James Seyffart.

Remarking on the same, Seyffart noted,

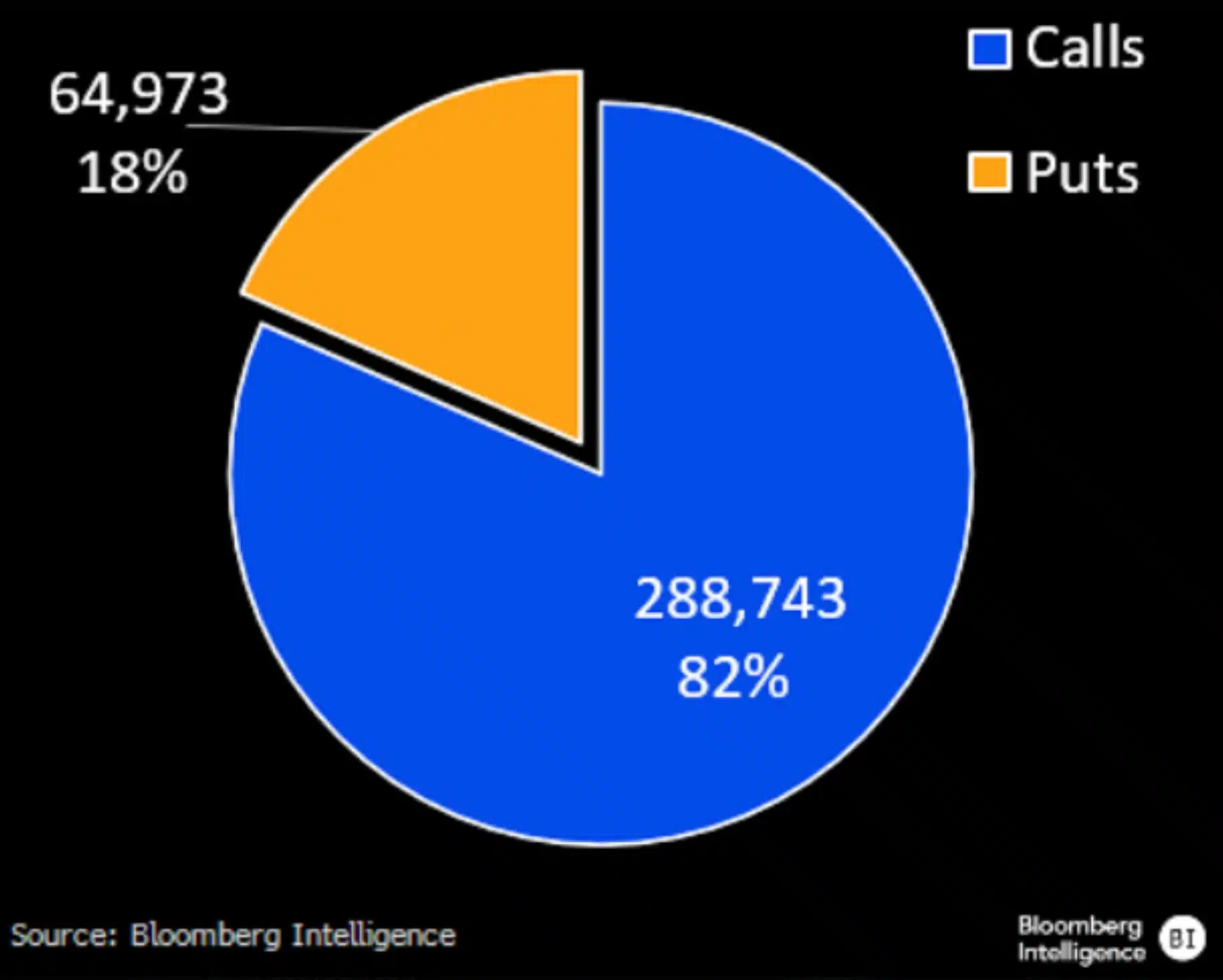

“Final tally of $IBIT’s 1st day of options is just shy of $1.9 billion in notional exposure traded via 354k contracts. 289k were Calls & 65k were Puts.”

He added,

“That’s a ratio of 4.4:1. These options were almost certainly part of the move to the new #Bitcoin all time highs today.”

How will the options trading help Bitcoin ETF?

For those unaware, in the realm of options trading, a call option grants the buyer the right, but not the obligation, to purchase an asset at a predetermined price within a set timeframe.

If exercised, the seller of the call is required to sell the asset at the agreed price.

Conversely, a put option allows the holder to sell the asset at a specified price on or before its expiration date, providing a strategic mechanism for hedging or profiting from price movements in the market.

When compared to the ProShares Bitcoin Strategy ETF (BITO), the first ETF offering Bitcoin exposure in the U.S., the recent activity in Bitcoin options trading stands out significantly.

For instance, BITO, which launched with much anticipation, recorded $363 million in trading volume on its debut.

Balchunas echoes a similar sentiment

Bloomberg’s senior ETF analyst, Eric Balchunas, highlighted this comparison to underscore the substantial momentum behind the new options market, reflecting the growing investor interest in Bitcoin-related financial products and said,

“$1.9 billion is unheard of for day one.”

Balchunas further emphasized the remarkable growth of a newly launched Bitcoin-related ETF, which has already reached $1.9 billion in trading volume despite operating under a 25,000 contract position limit.

This performance far surpasses the $363 million milestone achieved by $BITO over four years.

However, when compared to well-established ETFs like $GLD, which recorded $5 billion in a single day, the new ETF still has room for growth.

These figures highlight its strong potential to attract even greater investor interest as it continues to build momentum in the market.

What’s next?

Needless to say, the phenomenal success of IBIT’s options trading debut has driven an impressive $4.28 billion in value traded on 19th November, a milestone often associated with combined flows from multiple high-performing funds rather than a single entity.

This achievement underscores the growing appetite for Bitcoin-related financial instruments.

Meanwhile, Grayscale is set to intensify competition with the launch of options for its spot Bitcoin ETFs on 20th November.

Thus, it would be interesting to see how this would signal a rapidly evolving landscape for institutional-grade crypto investment products in the United States.