Bitcoin ETF options reveal bullish sentiment: Are $170K predictions realistic?

- Bitcoin’s ETF options spark bullish sentiment, but low-cost contracts skew the true market outlook.

- Strategies like synthetic longs and covered calls offer income potential but come with risks.

On the 19th of November, Bitcoin [BTC] options for spot ETFs went live, driving the cryptocurrency to a new all-time high of over $94,000.

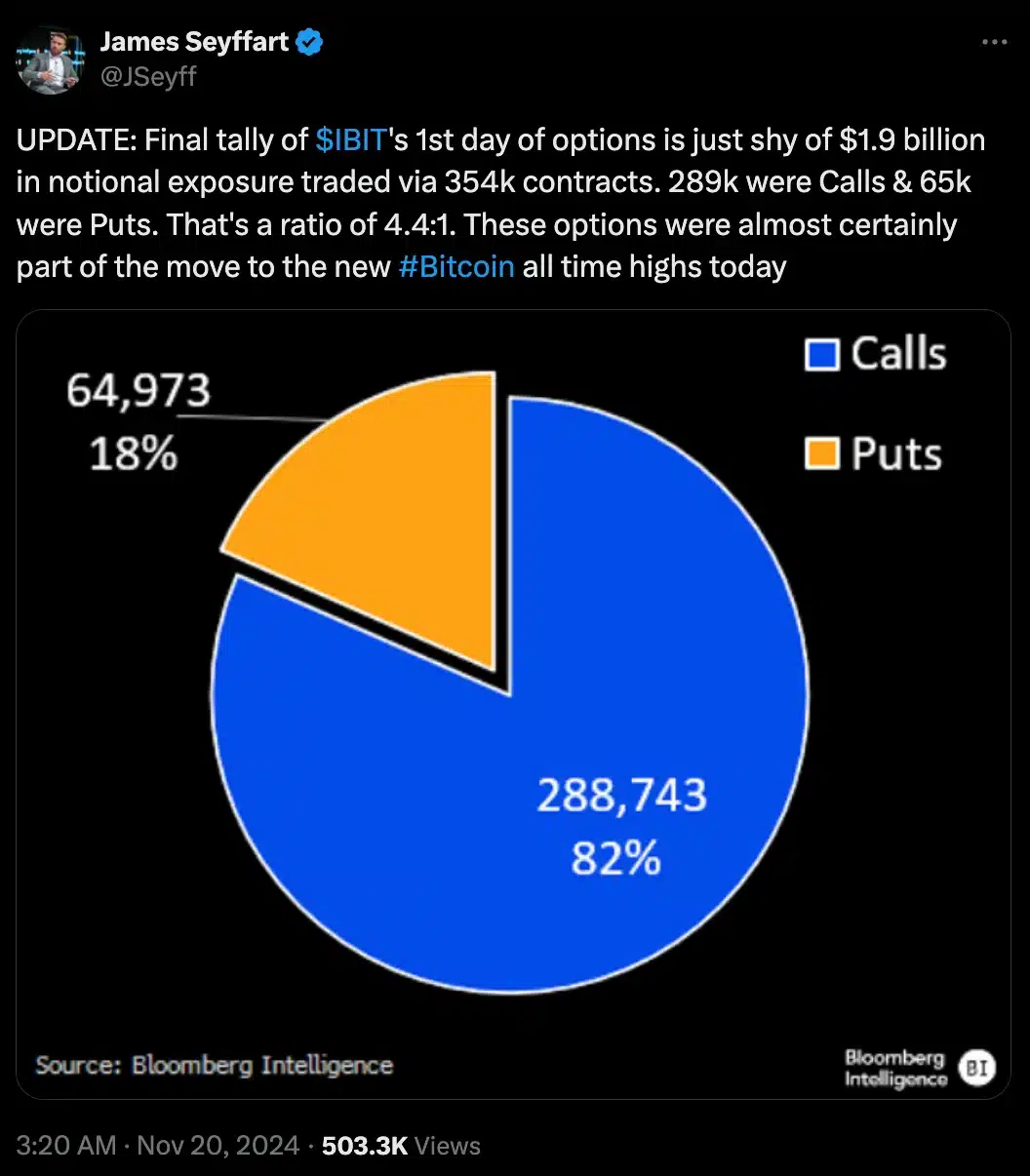

Analysts on X (formerly Twitter) quickly marked the launch as a success, with a striking 4.4:1 call-to-put ratio.

A total of 288,740 call options far outpaced the 64,970 put options, reflecting a surge in bullish sentiment and growing confidence in Bitcoin’s future.

Bloomberg ETF analyst James Seyffart remarked on the same thing and noted,

Why it matters

The spike in Bitcoin call options, particularly the $100 calls expiring on the 20th of December, initially suggested a bullish outlook, with some contracts hinting at prices above $170,000.

However, priced at just $0.15 each—only 0.3% of IBIT’s $53.40 value—these options pointed to a very slim chance of reaching $175,824.

Many view these low-cost options as speculative “lottery tickets,” distorting true market sentiment and creating a misleading sense of optimism.

For a clearer example, consider the $65 IBIT call option expiring on the 17th of January, priced at $2.40–4.5% of IBIT’s $53.40.

It will become profitable if Bitcoin hits $114,286, a 22% gain in two months.

Other possible strategies

That being said, advanced traders might also use strategies like synthetic longs.

For instance, an X user, “Ashton Cheekly,” shared a strategy of selling a $50 put and buying a $60 call for $2.15, replicating Bitcoin ownership without holding the asset directly.

Another popular strategy is the covered call, where an investor with IBIT sells a call option for immediate income.

For instance, if IBIT is at $53.40, selling a $55 call for $5.20 locks in the premium but limits the upside if IBIT rises above $55.

Now, if IBIT closes lower, the investor keeps the premium, reducing losses or boosting returns.

Hence, seeing the current trends, the $170,000 Bitcoin price projection, driven by speculative options, is unlikely to materialize.

Thus, while options offer leverage for significant gains, they come with the risk of becoming worthless.

Therefore, for retail investors, Bitcoin ETFs and options present new profit opportunities, but understanding the risks and mechanics is essential for success.