Bitcoin ETFs see outflows once again – ‘Becoming comical now’

- Bitcoin ETFs saw significant inflows of $192.4 million after a brief outflow phase.

- Ethereum ETFs continue to struggle with inconsistent inflows, highlighting market volatility.

Institutional investors have momentarily halted their aggressive accumulation of Bitcoin [BTC], as the price of BTC enters a consolidation phase.

As per recent data from various sources, including UK-based investment firm Farside Investors, inflows into U.S. spot Bitcoin exchange-traded funds (ETFs) have turned net negative for the first time in two weeks.

This pause in buying activity highlighted growing caution among investors as they assess the next move in BTC’s volatile market.

Bitcoin ETF analyzed

According to the latest update, Bitcoin ETFs experienced a significant outflow of $79.1 million on the 22nd of October.

Notably, Ark’s 21Shares BTC ETF led the downturn with the largest outflow, amounting to $134.7 million.

However, not all ETFs saw negative movement—other Bitcoin ETFs registered net inflows, with BlackRock’s iShares Bitcoin Trust (IBIT) standing out by recording the highest inflow of $43 million.

This divergence in fund movements reflects varying investor sentiment across different Bitcoin ETF products.

Additionally, as of the 23rd of October, BTC ETFs reversed course with a substantial inflow of $192.4 million.

Despite Ark’s 21Shares continuing to lead outflows with $99 million, followed by Bitwise’s BITB losing $25.2 million and VanEck’s HODL down by $5.6 million, the overall trend shifted.

Notably, BlackRock’s iShares Bitcoin Trust ETF (IBIT) recorded a remarkable inflow of $317.5 million, underscoring its ongoing appeal among investors.

This consistent influx highlights growing investor confidence in BlackRock’s Bitcoin ETF as a preferred choice for market exposure.

Execs weigh in

Remarking on the same, Nate Geraci, cofounder of the ETF Institute, took to X (formerly Twitter) and noted,

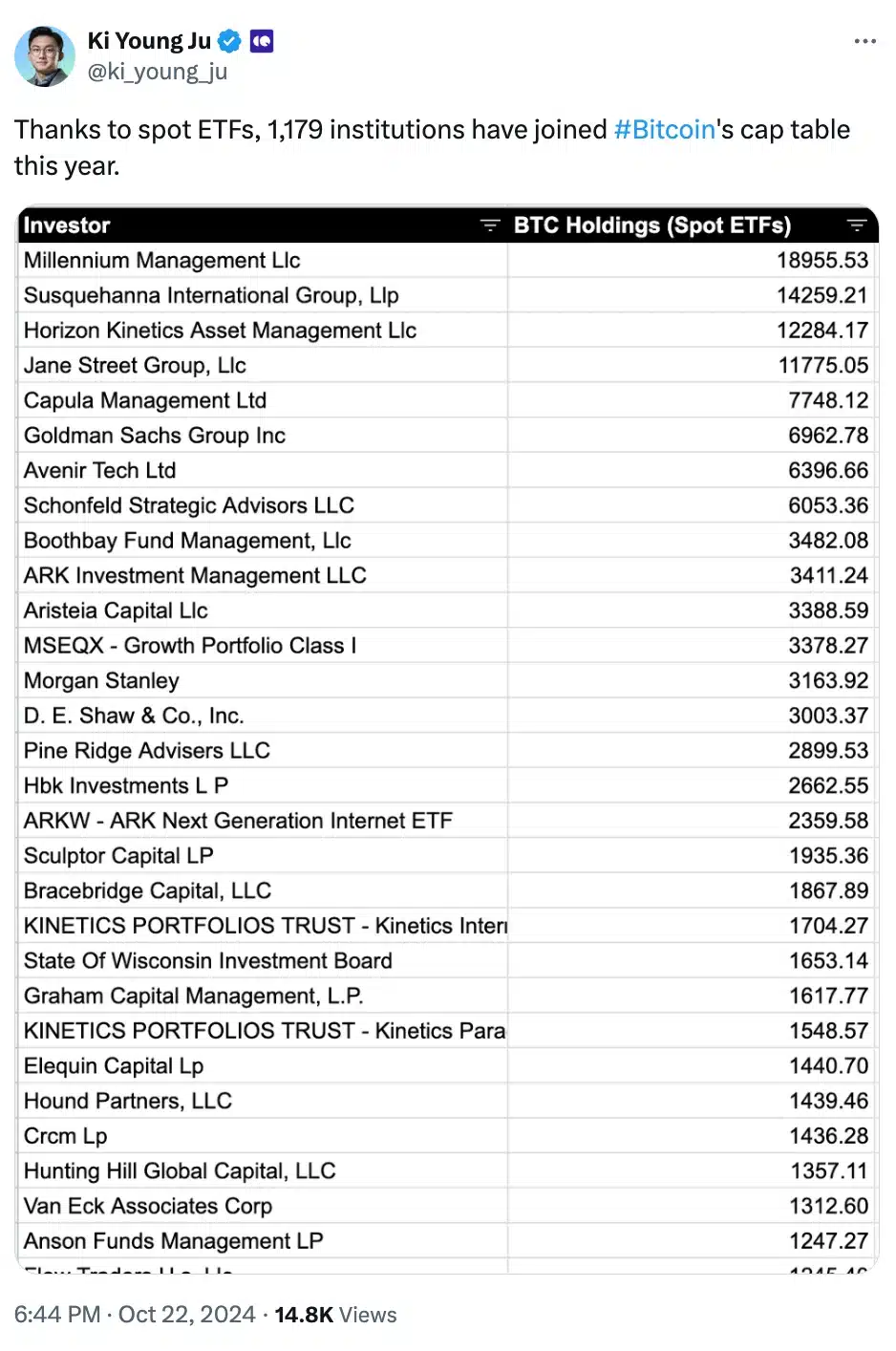

Adding to the fray was Ki Young Ju, co-founder of onchain analytics platform CryptoQuant who said,

Ethereum ETF update

On the other hand, Ethereum [ETH] ETFs experienced mixed results on both the 22nd and the 23rd October, although they have not garnered the same level of interest as Bitcoin ETFs.

On the 22nd of October, ETH ETFs saw a total outflow of $11.9 million, with only BlackRock’s ETHA reporting any inflows, while all others remained stagnant.

The following day, Ethereum ETFs saw modest inflows of $1.2 million.

However, Grayscale’s ETHE faced outflows of $7.6 million, while only Fidelity, 21Shares, and Invesco’s Ethereum ETFs managed to record inflows, indicating the volatile nature of ETH ETF investments.

ETH’s and BTC’s price action explained

Meanwhile, as of the latest market updates, Bitcoin is trading at $66,811.00, reflecting a 0.51% increase over the past 24 hours, showing steady momentum.

In contrast, Ethereum experienced a downturn, with its price dropping by 2.29% to $2,519.34 according to CoinMarketCap data.

These fluctuations highlight the ongoing volatility in the crypto market, with BTC maintaining its upward trend while ETH faces short-term declines.