Bitcoin ETF update: Rising interest with weekly net inflows of $535M

- Bitcoin has entered the $69,000 price zone.

- The new price zone could impact the week’s ETF flow.

The latest Bitcoin ETF update revealed that most ETF firms experienced positive capital inflows over the past week, indicating strong investor interest.

Only one major ETF firm reported a negative flow, marking it as an outlier in an otherwise bullish trend in ETF investments. Additionally, except for one, every day of the week saw positive flows.

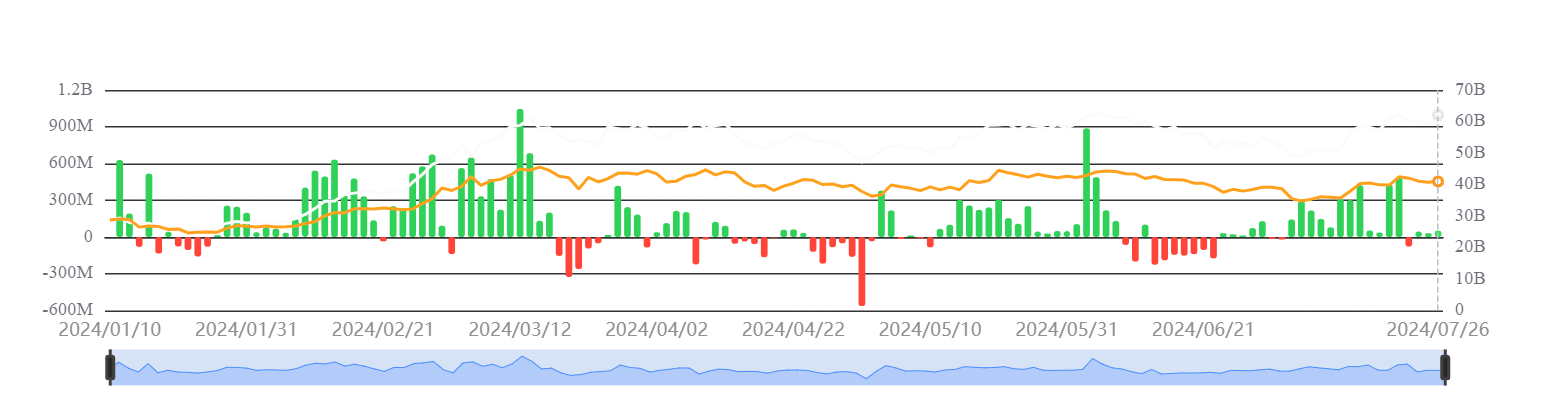

The Bitcoin ETF flow trend

According to the latest Bitcoin ETF update data from Sosovalue, spot ETFs experienced a net inflow of $535 million in the past week.

However, not all funds saw positive movements; Grayscale (GBTC) reported a net outflow of $120 million, making it the only ETF with a negative flow for the week.

On the other hand, BlackRock’s Bitcoin ETF (IBIT) recorded the highest inflow, with $758 million coming in over the week. Fidelity’s Bitcoin ETF (FBTC) also saw a healthy inflow, adding $29.61 million.

Bitcoin spot ETFs’ total net asset value now stands at $62.095 billion. The ETF net asset ratio, which measures the market value of these ETFs relative to Bitcoin’s total market value, is currently 4.67%.

Additionally, the historical cumulative net inflow into Bitcoin spot ETFs has reached $17.587 billion, indicating a significant and growing interest in Bitcoin through these investment vehicles.

Bitcoin starts the week strong

The Bitcoin price trend has shown a positive start to the week, with its current trading price around $69,500, marking an increase of over 1.8%. This rise brings it back into the $69,000 price range for the first time in over a month.

Also, it edged closer to the significant $70,000 threshold.

Furthermore, this upward movement has also nudged it closer to the overbought territory, as indicated by its Relative Strength Index (RSI), which currently stands at around 69.

Read Bitcoin’s [BTC] Price Prediction 2024-25

How the price could affect Bitcoin ETF trends

Given this strong start to the week, we might anticipate a reactive movement in the Bitcoin ETF market, as ETFs often respond to significant price movements in the underlying asset.

Also, this could increase trading volumes and potential adjustments in ETF holdings and strategies.

![Story [IP] price prediction - Traders, look out for this key divergence!](https://ambcrypto.com/wp-content/uploads/2025/06/Story-IP-Featured-400x240.webp)