Bitcoin ETFs hit $16B milestone – What’s next for BTC?

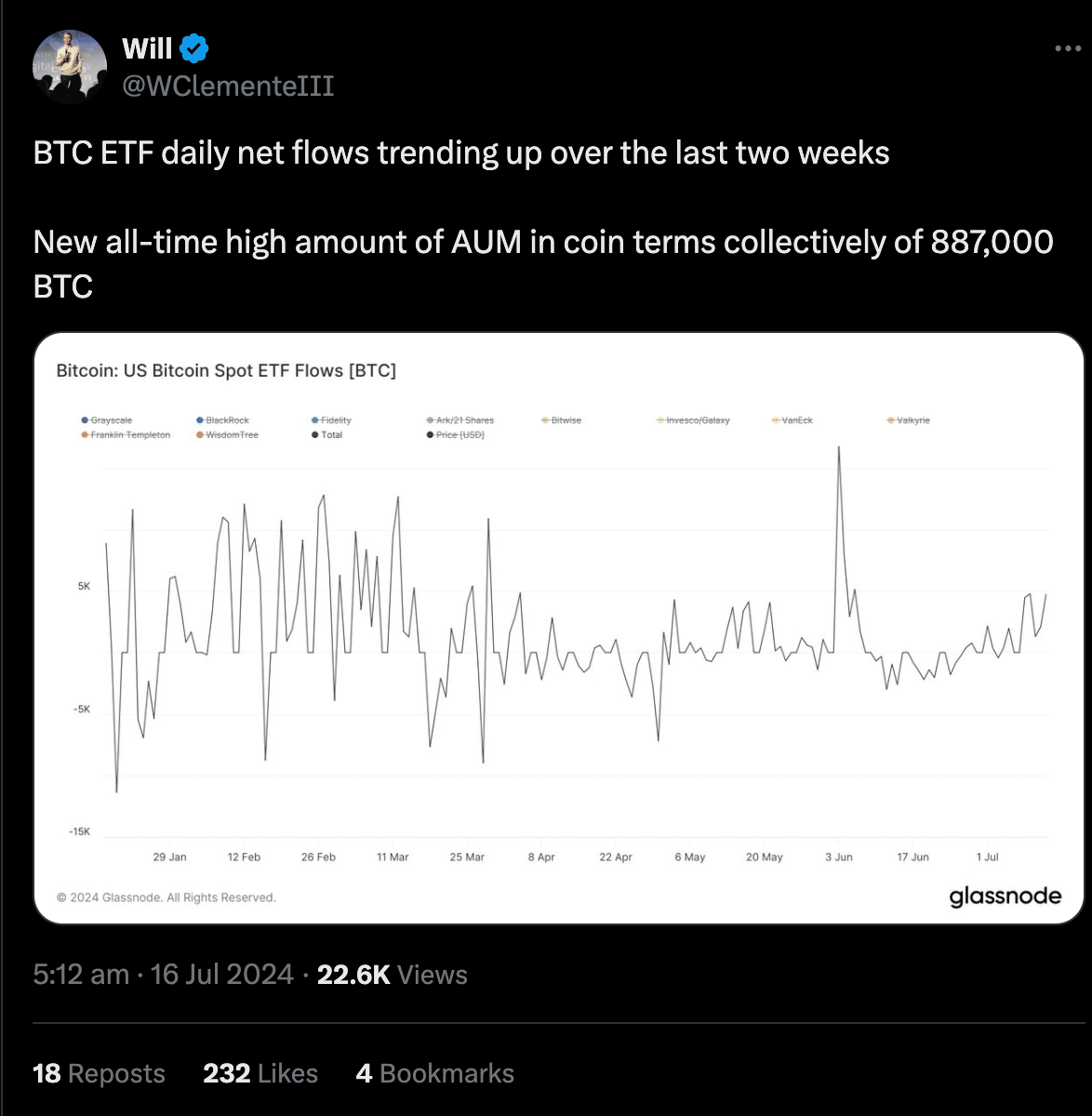

- Bitcoin ETF inflows surged over the past week as prices increased.

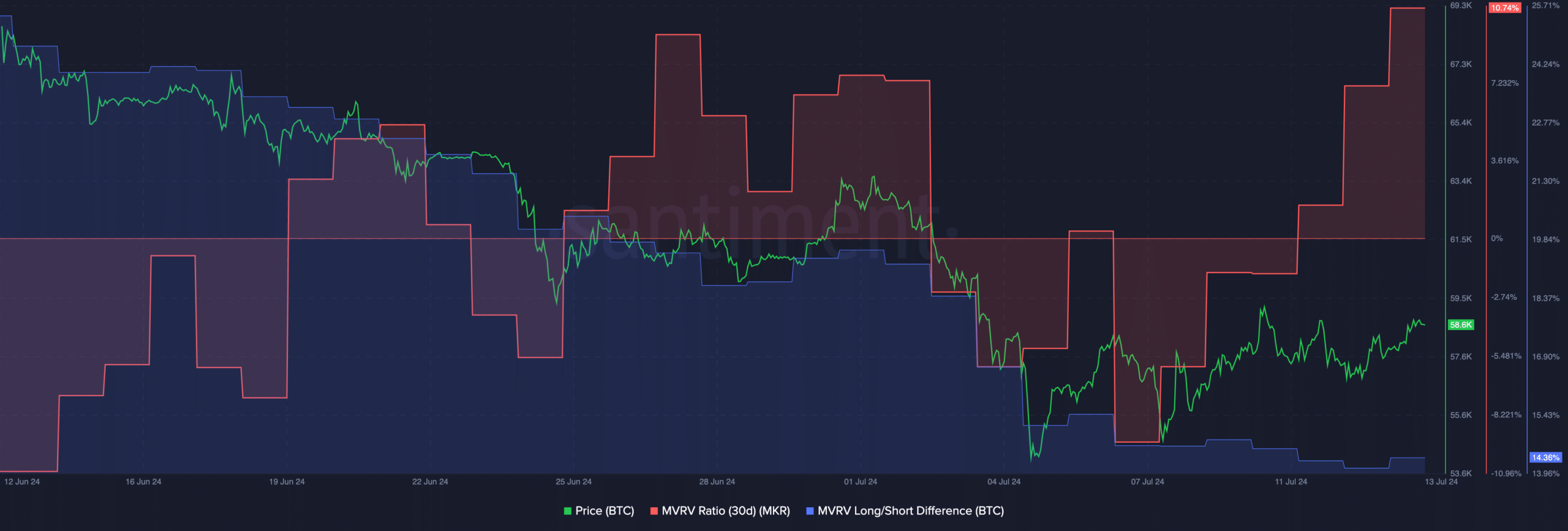

- MVRV also spiked, indicating that profitability of holders had surged.

Bitcoin [BTC] has managed to make a comeback over the last few days and has seen a massive surge in price with Exchange-Traded Funds (ETF) playing a big role.

ETFs come to the rescue!

Bitcoin ETFs have seen a remarkable influx of capital since their launch in January 2024, totaling a staggering $16.35 billion. This surge in investor interest has culminated in a record-breaking week, with inflows reaching $1.05 billion by 15th July.

The substantial growth of Bitcoin ETF assets under management is viewed by market analysts as a bullish indicator, fueling speculation that the cryptocurrency may have bottomed out.

Collectively, these ETFs now hold an unprecedented 888,607 Bitcoin, accounting for approximately 4.5% of the total circulating supply.

This investment frenzy is being driven by both institutional and retail investors, with some funds experiencing inflows as substantial as $310 million in a single week.

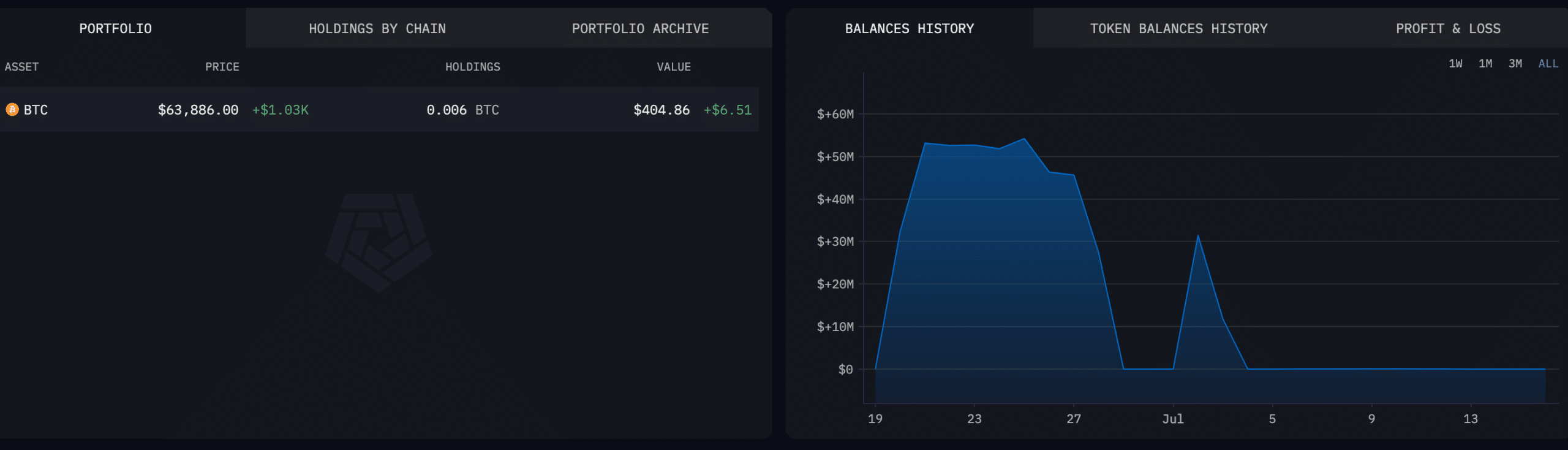

Germany’s BTC holdings

One of the reasons for the recent decline in price before the uptick was the German government’s actions.

The Germany’s recent $3 billion Bitcoin sell-off, executed through various crypto exchanges and trading firms, sent shockwaves through the cryptocurrency market. However, the massive offloading concluded late last week.

Surprisingly, since then, the government has received a modest influx of Bitcoin, totaling approximately $420, from multiple wallets.

These incoming funds were dispersed across over four dozen transactions, the largest of which amounted to $118 and occurred on 13th July, as revealed by blockchain data analyzed by Arkham.

The German government has quietly amassed a small Bitcoin portfolio through a series of these transactions. This BTC was sent by users who wanted to express their discontent with the German government.

Some of these transactions included unusual references, such as the names Adolf Hitler and Elon Musk, and also other expletives.

Read Bitcoin (BTC) Price Prediction 2024-25

At press time, BTC was trading at $63,882.81 and its price had grown by 1.53% in the last 24 hours. The MVRV ratio for BTC had surged due to the surge in the price of BTC. This meant that most addresses were profitable.

Even though the profitability can impact sentiment positively, there is an incentive to sell their BTC holdings for the holders which can add selling pressure on BTC.