Bitcoin ETFs: Retail left behind as institutions buy 893K BTC – What this trend suggests

- Professional investors’ dominance in U.S. spot BTC ETFs tripped in the last quarter.

- In 2024, retail sold 525K BTC, while funds, ETFs and businesses bought 893K BTC.

Institutional ownership in Bitcoin ETF assets increased threefold in the last quarter. According to asset manager Bitwise, institutions owned 28% of Bitcoin ETF assets, worth $38.7B, as of Q4 2024.

In contrast, the big players owned only $12.4B in Q3 2024, marking a declining trend around retail market share in BTC ETFs.

The institutional ownership in BTC ETF could surge to 40% by the end of 2025, according to Matt Hougan, CIO at Bitwise.

“Professional investors now own 28% of Bitcoin ETF assets, up from 17% in Q3. This will be north of 40% by year-end.”

BTC vs. gold

Bloomberg ETF Eric Balchunas echoed Hougan’s projection and noted that a 40% institutional dominance in BTC ETF could mirror gold market share. He stated,

“Institutional adoption of the bitcoin ETFs *tripled* in Q4 to $38b and the % of the assets claimed by 13F filers is up to 25-30% for most of them. For context, $GLD is 40% and where I think these will end up.”

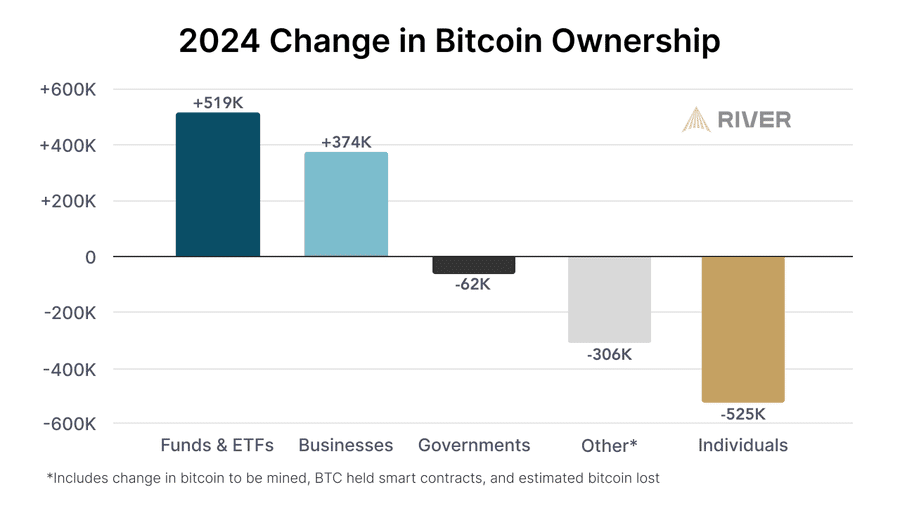

The pace of BTC offloading by retail as institutions stack further cemented the above projections. According to the crypto trading platform River, ETFs, funds, and businesses acquired 893K BTC in 2024.

On the contrary, the same amount of BTC was sold by governments and individuals. In particular, individuals sold 525K BTC last year.

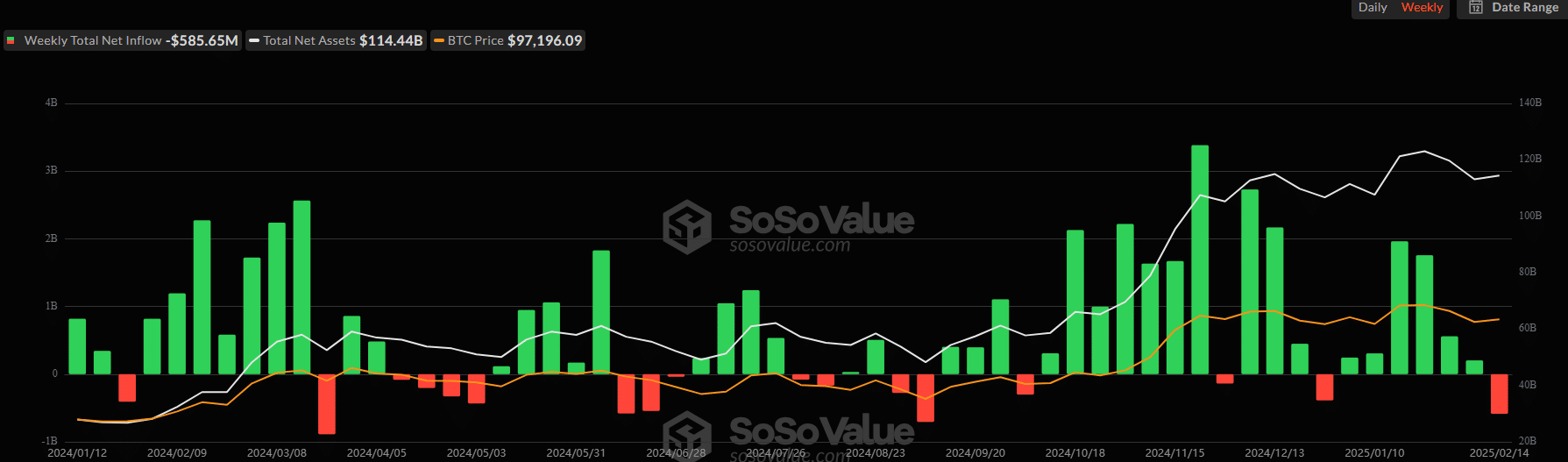

That said, ETF data tracked by SoSo Value revealed that U.S. spot ETF products had $114.44B in total net assets as of early 2025.

The sustained institutional growth could be attributed to the second phase of BTC ETF adoption, as wirehouses like Morgan Stanley began recommending the products to their risk-tolerant wealthy clients last August.

That said, it remains to be seen how the continued institutional growth in BTC ETFs will be reconciled with centralization concerns.

At press time, BTC was valued at $95.6K and was still stuck within the $90K-$110K price range.