Bitcoin, Ethereum, and beyond: All about Hashdex’s new crypto ETF

- Hashdex filed for the first index-based US crypto ETF holding Bitcoin and Ethereum.

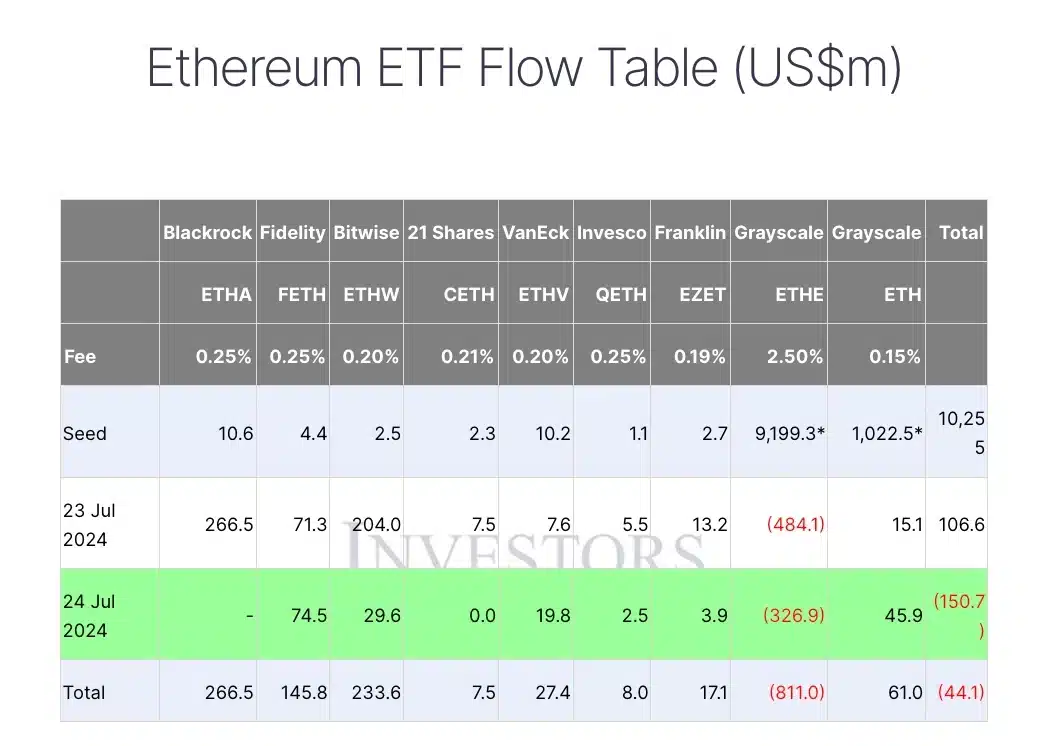

- ETH ETFs saw $176.2 million inflows; Grayscale experienced $326.9 million outflows.

Crypto asset management firm Hashdex has taken a significant step towards launching a groundbreaking exchange-traded fund (ETF) that directly holds spot Bitcoin [BTC] and Ethereum [ETH].

In a move that could establish the first index-based crypto ETF in the United States, Hashdex submitted its S-1 registration statement with the U.S. Securities and Exchange Commission.

Hashdex’s ETF plans

The proposed fund, named the Hashdex Nasdaq Crypto Index US ETF, aims to include BTC and ETH initially, with the potential for more assets as regulatory conditions evolve.

This milestone follows weeks of preparation and marks a major advancement in Hashdex’s vision within the crypto investment landscape.

Expanding on the same, the S-1 filing filed by Hashdex noted,

“If any crypto asset other than bitcoin and ether becomes eligible for inclusion in the Index, the Sponsor will transition to a sample replication strategy, with only bitcoin and ether in the same proportions determined by the Index.”

Reiterating the same, Bloomberg ETF Analyst James Seyffart took to X and said,

“Will start with just #Bitcoin & #Ethereum but can add other assets if and when approved by the SEC.”

In a separate post, the analyst emphasized that this move was not unexpected, and added,

“Shouldn’t be a surprise to anyone — makes a lot of sense.”

What’s more to it?

Seyffart also hinted at a potential date for the SEC’s final decision on the Hashdex Nasdaq Crypto Index US ETF, stating that the approval deadline “should be sometime around the first week of March 2025.”

That being said, Hashdex’s recent filing coincides with the final approval for spot Ethereum ETFs that started trading just two days ago.

Additionally, unlike these newly sanctioned ETFs, Hashdex’s proposed combined spot cryptocurrency ETF notably excludes Ether staking from its offerings.

Bitcoin & Ethereum ETF analysis

In the meantime, ETH ETFs saw substantial inflows, while the Grayscale Ethereum Trust experienced significant outflows of $326.9 million on 24th July. In contrast, BlackRock’s ETH ETF reported no activity.

On the Bitcoin side, BTC ETFs recorded inflows of $44.5 million, with Grayscale’s GBTC attracting $26.2 million and BlackRock’s IBIT bringing in $66 million on the same day as per Farside Investors.