Bitcoin, Ethereum, Solana price predictions – What to expect this week

- Bitcoin and Ethereum have seen a deeper retracement than Solana.

- SOL bulls might have to wait for sentiment to shift in their favor once more before going long.

Bitcoin [BTC] and Ethereum [ETH] saw some of their gains from earlier this month retraced. As the halving approaches, we could see a short-term “sell the event” type of drop in prices before bulls pick up the pieces once more.

On the other hand, Solana [SOL] maintained its bullish strength, although it has also slowed down over the past ten days. AMBCrypto assessed their price charts against one another to understand where prices could be headed next.

Bitcoin bulls might have to wait for some more retracement

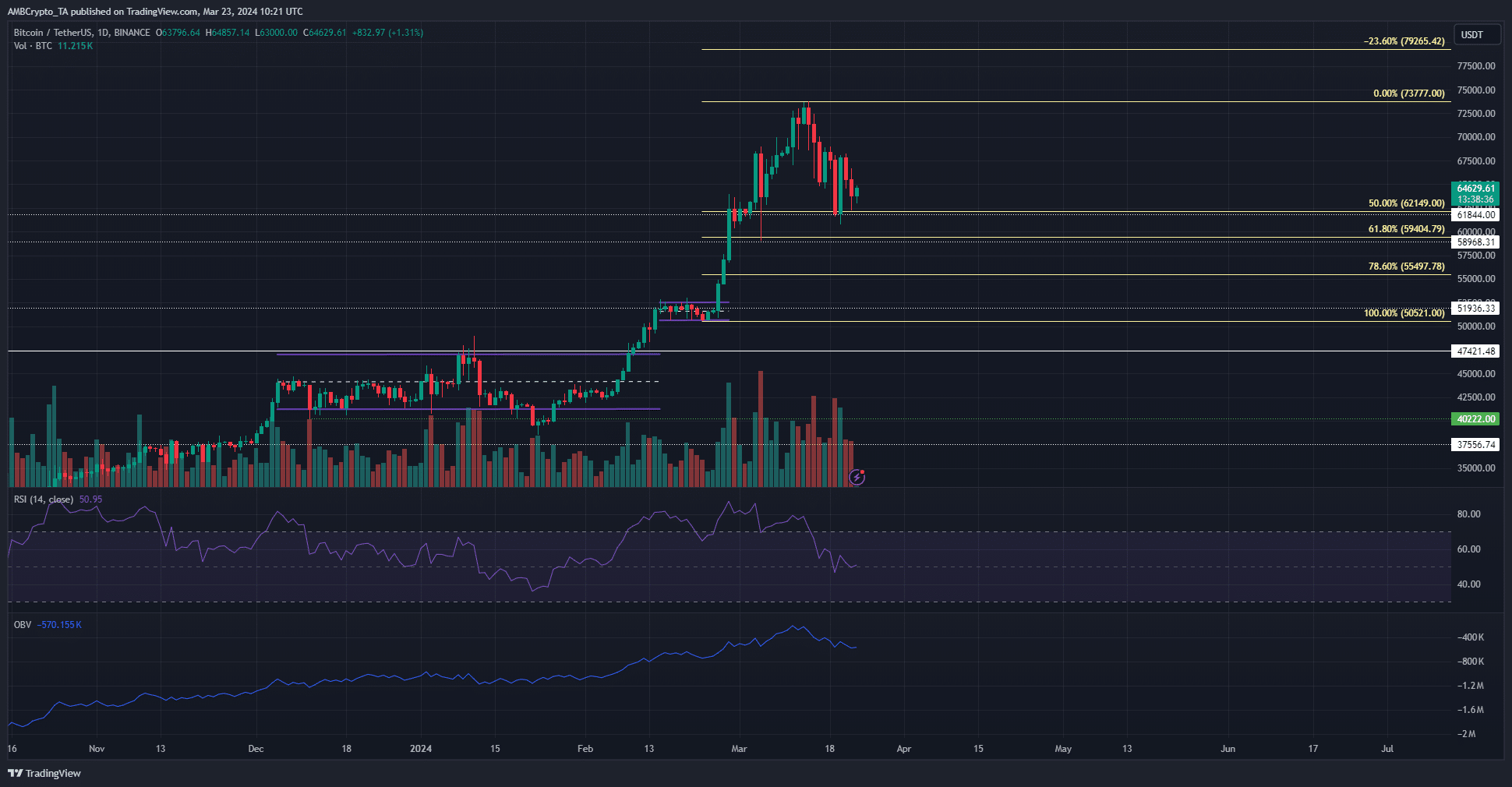

The one-day market structure of BTC was bullish. A move below $50.5k would flip it bearishly, while a move above $73.7k would signal a bullish continuation. At press time, the $59.4k and $55.5k Fibonacci retracement levels (pale yellow) were important support levels.

AMBCrypto expects that one of these levels would likely be tested in search of liquidity before the uptrend can resume. This retest could occur quickly, in the form of a liquidation cascade, or it could be a protracted move.

The RSI showed momentum was neutral and buyers have lost their advantage recently. The OBV also approached a support level in early March. Together, it signaled that buyers might not be able to hold prices above the $60k mark.

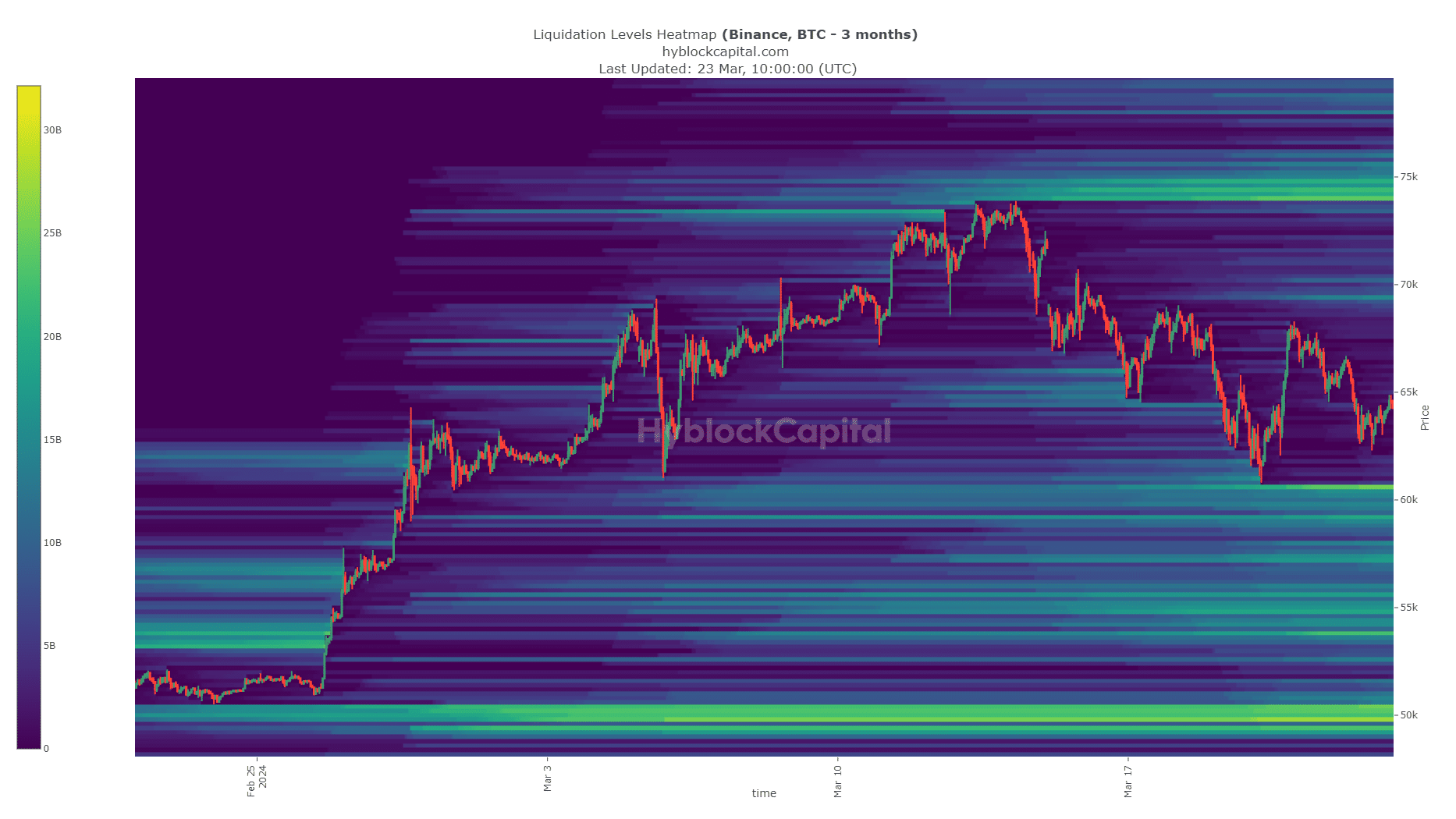

Source: Hyblock

Examining the liquidation levels showed where BTC could be attracted to next. The $50k psychological level was bright on the heatmap, but such a drop was unlikely based on the evidence at hand.

Closer to current market prices, the $60.8k, $57.2k, and $55k levels were more attainable targets for the bears. A sweep of these liquidity pockets could pave the way for Bitcoin to resume its uptrend in earnest.

Ethereum had a perfect retest but faced rejection anyway

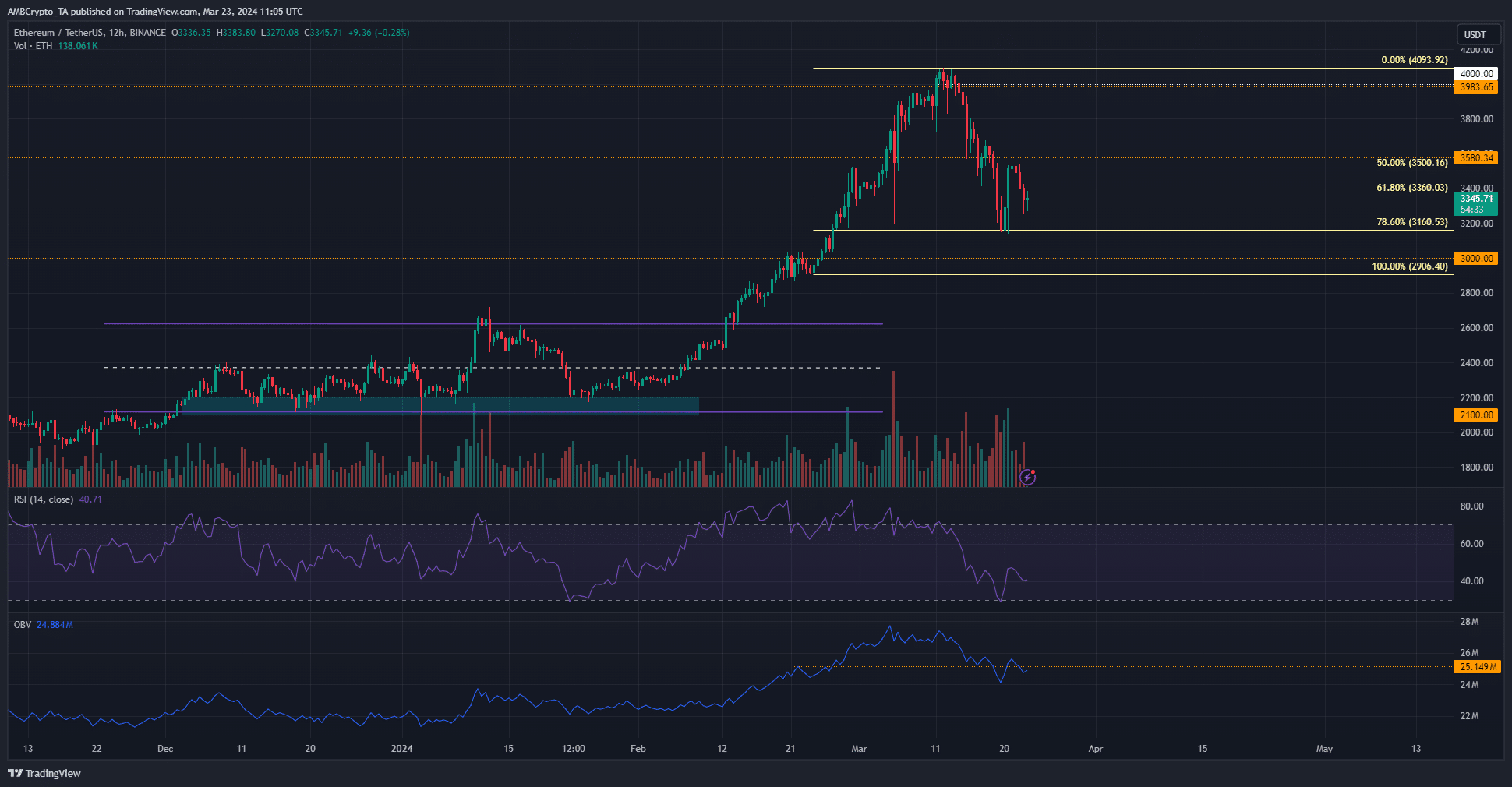

Unlike Bitcoin, Ethereum already tested its 78.6% retracement level based plotted based on a recent rally. The drop to the $3160 level saw a strong, quick bullish reaction that drove prices to $3580.

Yet it was not enough and the bulls faced rejection just below $3600. The OBV also sank to a local high it had made on the 21st of February when the $3000 mark was a resistance zone.

The RSI has been below neutral 50 for the past ten days and showed bearish momentum was strong. Together, the indicators and price action showed that the retracement was not necessarily over. We could see ETH drop to $3160 or lower once more.

There was a significant pocket of liquidity at $3000 that prices could test shortly.

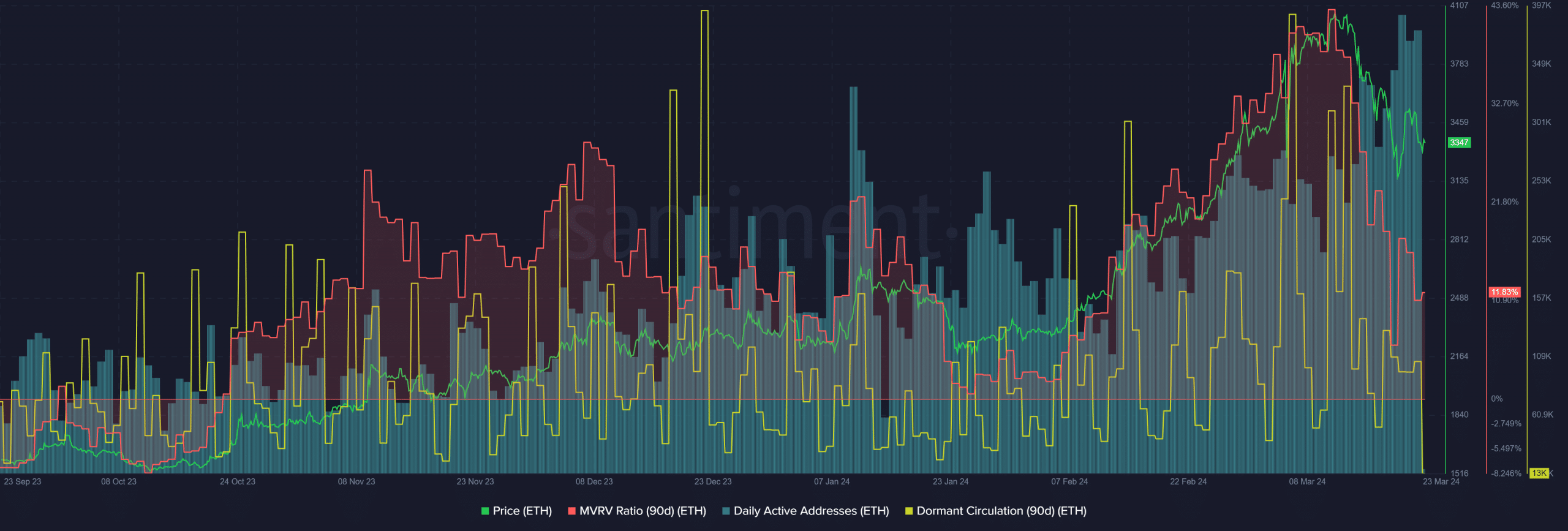

Source: Santiment

The on-chain metrics were slightly more encouraging. The MVRV ratio remained positive and showed holders were at a profit. The daily active addresses metric has been trending higher since the 10th of February.

The dormant circulation metric has been successful in recent months in marking a local top. Surges in this metric can also indicate panic selling near the bottom. Therefore, swing traders would want to see a sharp drop in prices to key demand zones highlighted earlier.

A spike in dormant circulation alongside this could well mark the local bottom and a good buying opportunity.

Solana to $130 or $260 next?

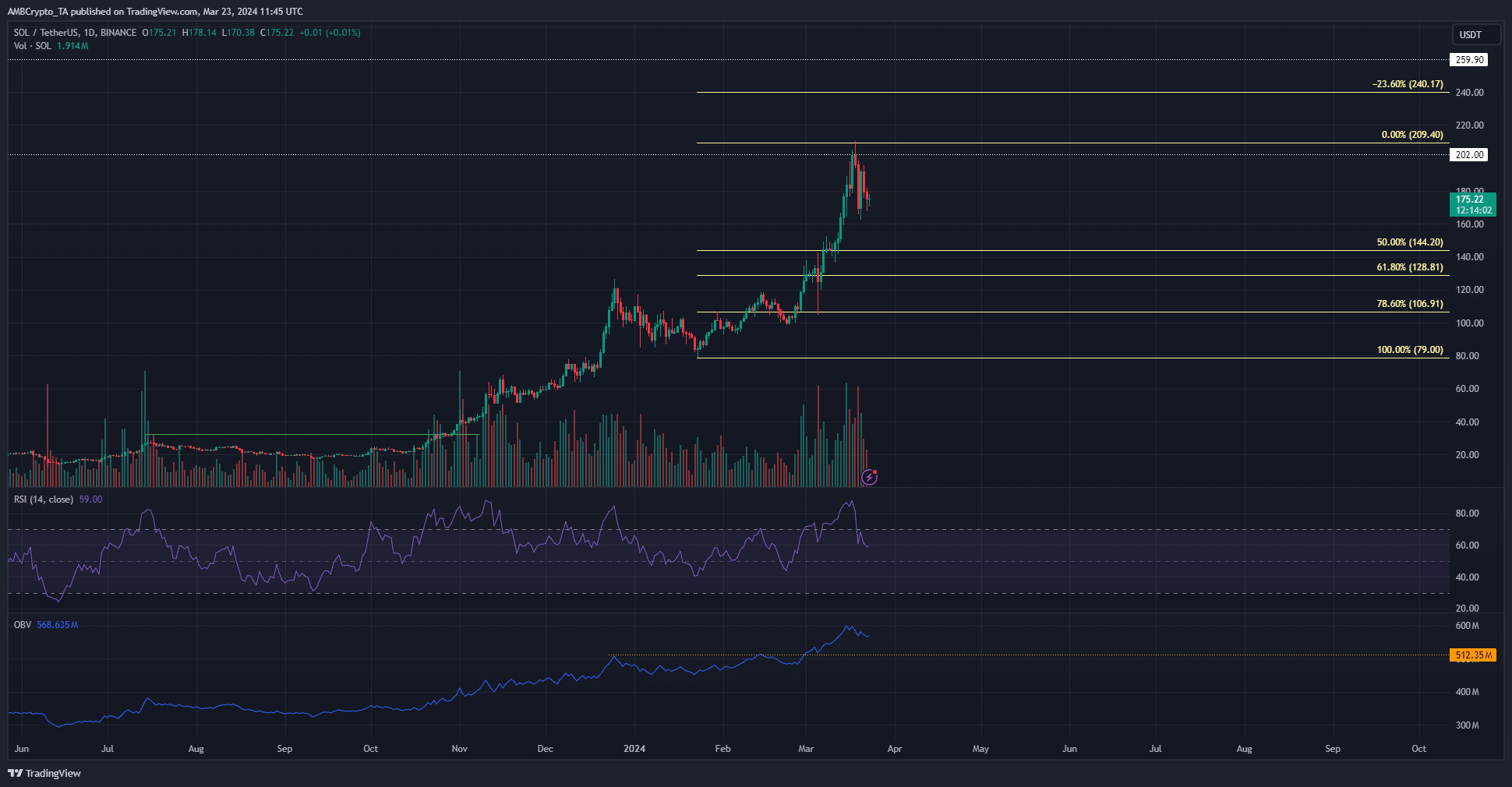

While BTC and Ethereum saw notable retracements, SOL maintained its upward trajectory. It hasn’t closed in on the 50% retracement level yet from the previous swing low. Although the bulls were unable to climb above the psychological $200, it still suggested bulls had strength.

This was further reinforced by the OBV staying well above a resistance level it broke after much effort late in February. Meanwhile, the RSI continued to move above neutral 50 to show bullish momentum was dominant.

The $106.9 and $128.8 support levels could still be retested if Bitcoin falls below the $60k mark. However, the indicators do not suggest that such a deep retracement was likely in the coming days.

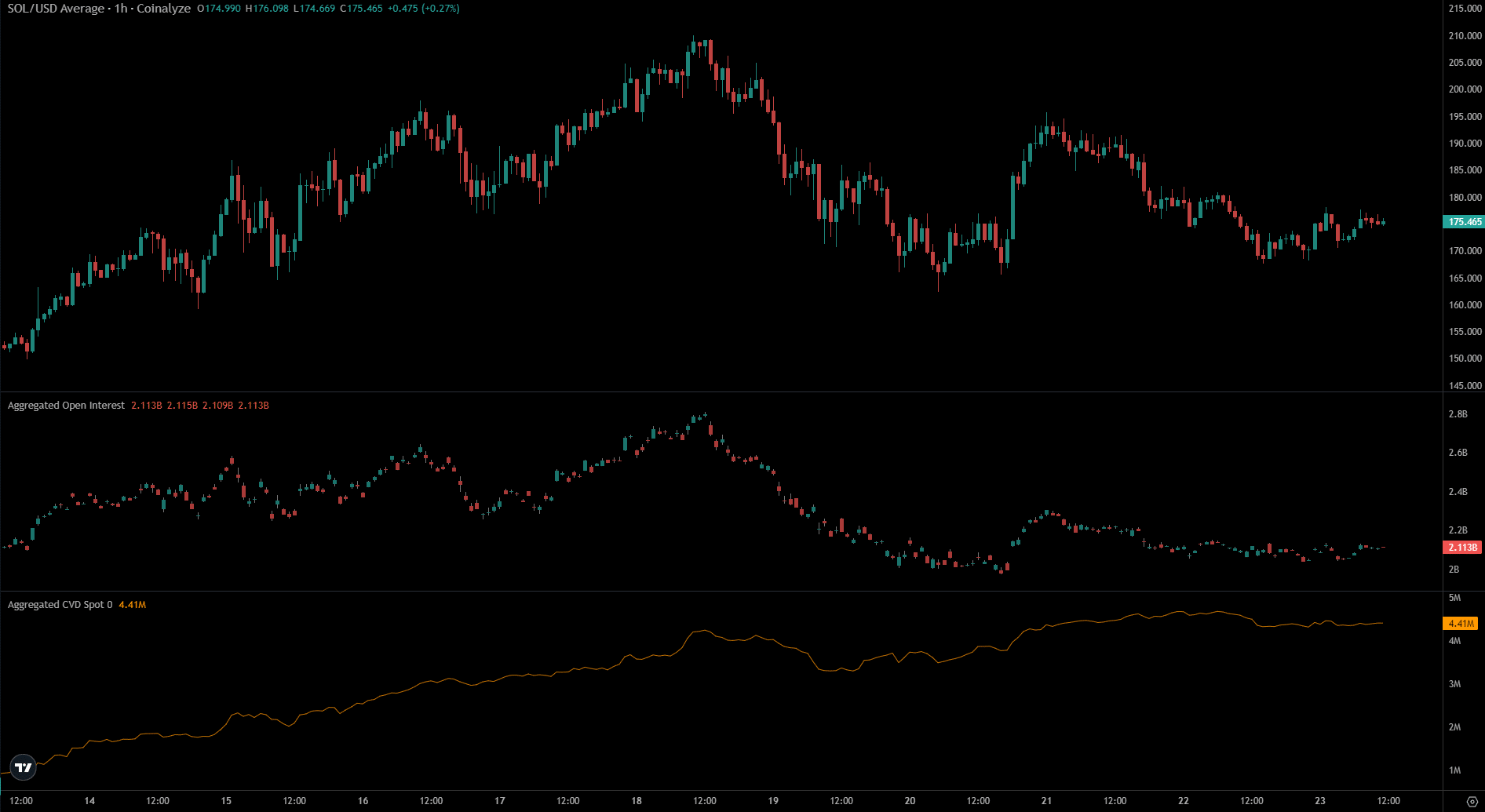

Source: Coinalyze

The spot CVD has moved sideways over the past two days, but was in an uptrend earlier. The spot demand slowed down alongside the Open Interest as prices remained below $200 over the past week.

This suggested that bullish conviction was not strong yet, but also that selling pressure has not been remarkable in the spot markets. The bulls could pull off a recovery, provided sentiment behind BTC could shift bullishly as well.

Is your portfolio green? Check the Bitcoin Profit Calculator

Overall, all three markets had a long-term bullish bias. A Bitcoin move back above the $73k level appears to be a question of when, not if, given the recent demand.

Over the coming months, the losses of the past two weeks could be just a blip.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.