Bitcoin, Ethereum ETFs see record volumes amid market recovery

- Trading volume of BTC ETFs hits $5.7 billion.

- BTC and ETH recovers from market downturn.

Over the last 30 days, Cryptocurrency markets have experienced extreme volatility. The last two days have seen crypto markets crash and recover, with BTC hitting below $49k as altcoins also declined simultaneously.

However, while the crypto markets crashed, the BTC spot ETF trading volume doubled.

BTC ETF trading volume hits $5.7 billion

Source: Coinglass

Amidst the market crash, trading volume for Bitcoin ETFs has surged to over $5.7 billion. According to the report, the recent surge arose after 48 hours of heightened crypto market volatility.

Data from Coinglass showed that ETF outflows have decreased and remained steady for the last 48 hours, hitting a moderate level of $84.1 million.

Equally, Coinglass showed that the net assets remain at $48 billion. The data shows a positive market response to ETFs as crypto tokens continue to show uncertainty.

BTC and ETH ETFs rebound after high outflows

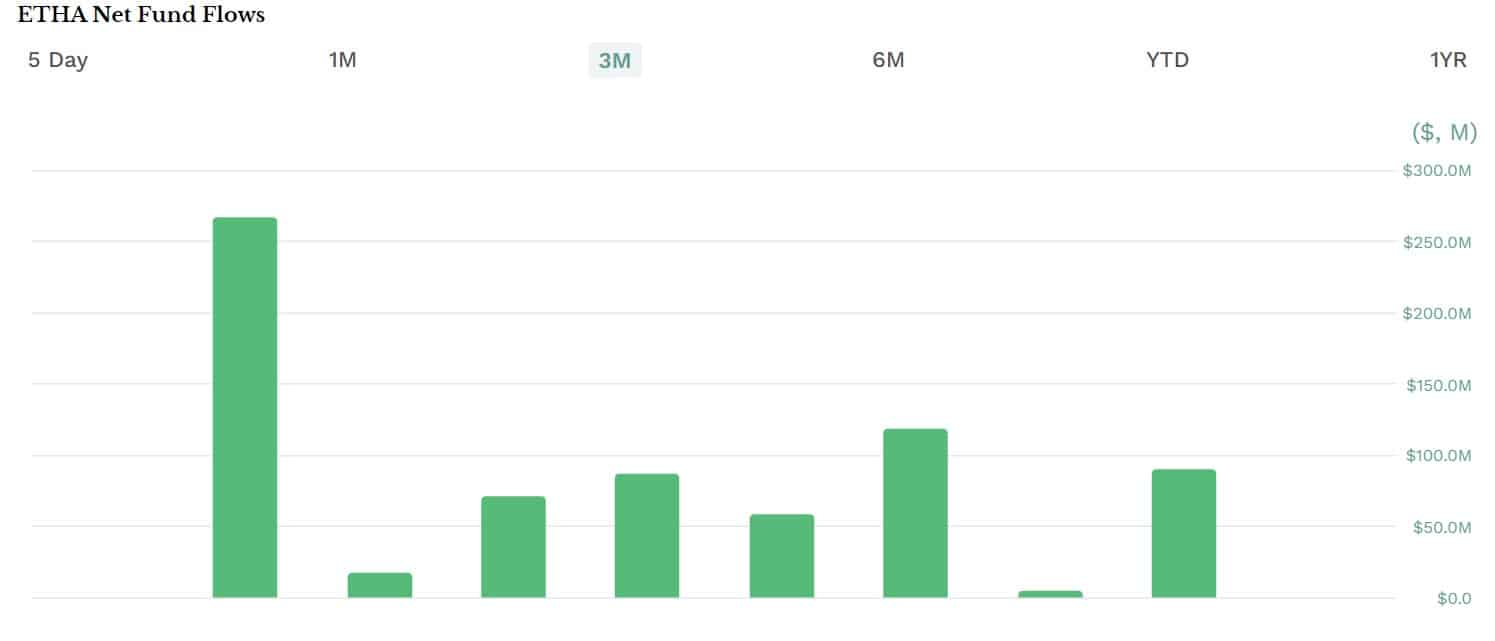

Since the launch of Ethereum ETFs last month, they have reported high outflow, which has affected ETH prices.

ETH ETFs have recorded high outflows for the last few weeks, hitting over $2 billion. ETHE reached $2.1 Billion in outflows, causing concerns over ETH ETF’s ability to compete with Bitcoin ETFs.

Equally, Bitcoin ETF Outflows had hit a record high for the past 6 months. On 5th, as the market crashed, BTC ETFs outflow hit $168.4 million, with Grayscale BTC Trust ETFs and ARK 2iShares BTC ETFs leading in outflows.

However, in the last 24 hrs, BTC ETFs have hit a record high, with trading volume surpassing $1.3b in the first minutes of business on 6th July.

With the surge, iShares Bitcoin Trust made the highest in trading activity, surpassing $1.27 billion.

Impacts on BTC and ETH?

ETH and BTC’s market prices have notably recovered after hitting low months. Bitcoin hit a two-month low after falling below $50k, while Ethereum recorded a low of $2116.

The decline resulted from increased sales of $1.2 billion in crypto liquidation following a ripple effect from the crash in global stocks.

Despite the decline, BTC prices have been recorded, and data shows that ETF holders held their positions during the market downturn. BTC is trading at $56888 after a 1.97% increase in 24 hrs and a considerable recovery from a low of $49577.

Therefore, with ETF holders holding positions, BTC ETF trading volume soared to $5.2 billion, even outpacing January trading volume after the launch.

Equally, Ethereum ETFs that have recorded massive outflows in the past have recorded an inflow of over $49 million.

Thus, the increased ETF trading volume and inflows have played a vital role in driving BTC and ETH prices up after recording 2-month lows.

BlackRock, Nasdaq File for spot Ethereum ETF

Another boost to Ethereum ETFs amidst increased market uncertainty is the recent move by Blackrock and Nasdaq.

According to reports, the two firms have decided to add options to Ethereum ETFs to ETHA (iShares Ethereum Trust). The SEC filing by Nasdaq and Blackrock proposed a rule change to allow options trading of the iShares Ethereum Trust (ETHA).

The filing stated that,

“The Exchange believes that offering options on the Trust will benefit investors by providing them with an additional, relatively lower-cost investing tool to gain exposure to spot ether as well as a hedging vehicle to meet their investment needs in connection with ether products and positions.”

The filling comes nearly three weeks after the launch of Ethereum ETFs. While Ethereum ETFs have experienced high uncertainty, the markets think it’s a success and require additions for trading options.

![dogwifhat's [WIF] 3-day rally has eyes glued, yet a hidden risk lurks](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-8-400x240.jpg)