Bitcoin, Ethereum: Two levels where a swing trade could be profitable

- Ethereum has a slightly more bullish bias for the coming week.

- The Bitcoin consolidation phase was still ongoing, and a revisit to $60k was growing more likely.

Bitcoin [BTC] traders were going through a relatively tough period after the easy, straightforward rallies that have been the norm since last October.

Ethereum [ETH] has been more complicated, but BTC’s halving event last month has changed the market conditions to chop and range formations all over the market.

AMBCrypto investigated what the market sentiment was looking like over the weekend, and where this week’s price action could go.

One of the two has speculators expectant of bullish returns in the near term

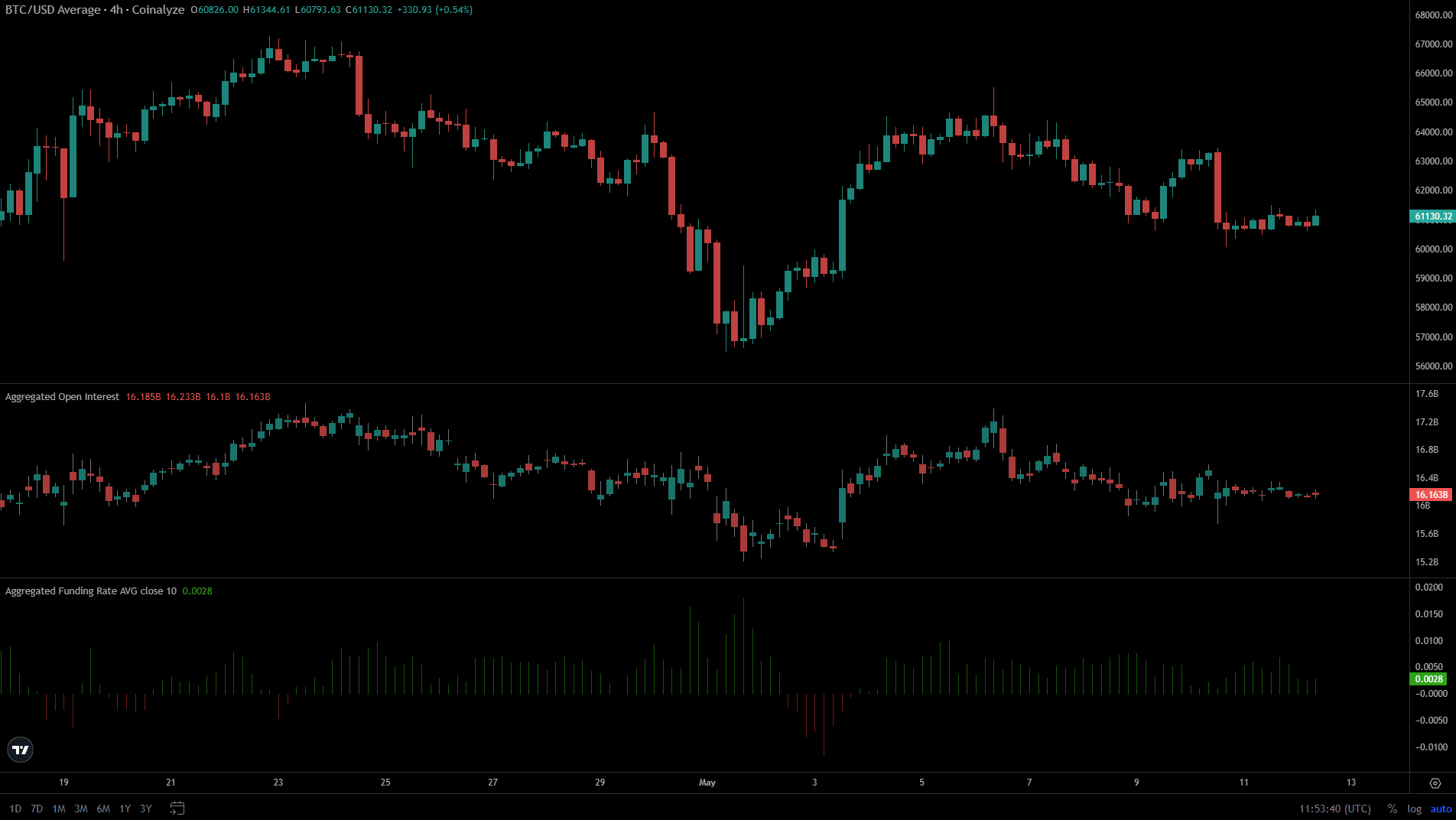

Source: Coinalyze

The 10th of May saw an increase in the Bitcoin Open Interest, but the OI has been trending downward since the price spike on the 6th of May.

Meanwhile, the price also formed a series of lower highs over the past week, descending from $64k to $61.1k at press time.

The Funding Rate was negative at the start of May when Bitcoin plummeted to $56k. Since then, the Funding Rate has recovered.

However, in the past few days, it has been barely above zero, which indicated the sentiment was not strongly bullish.

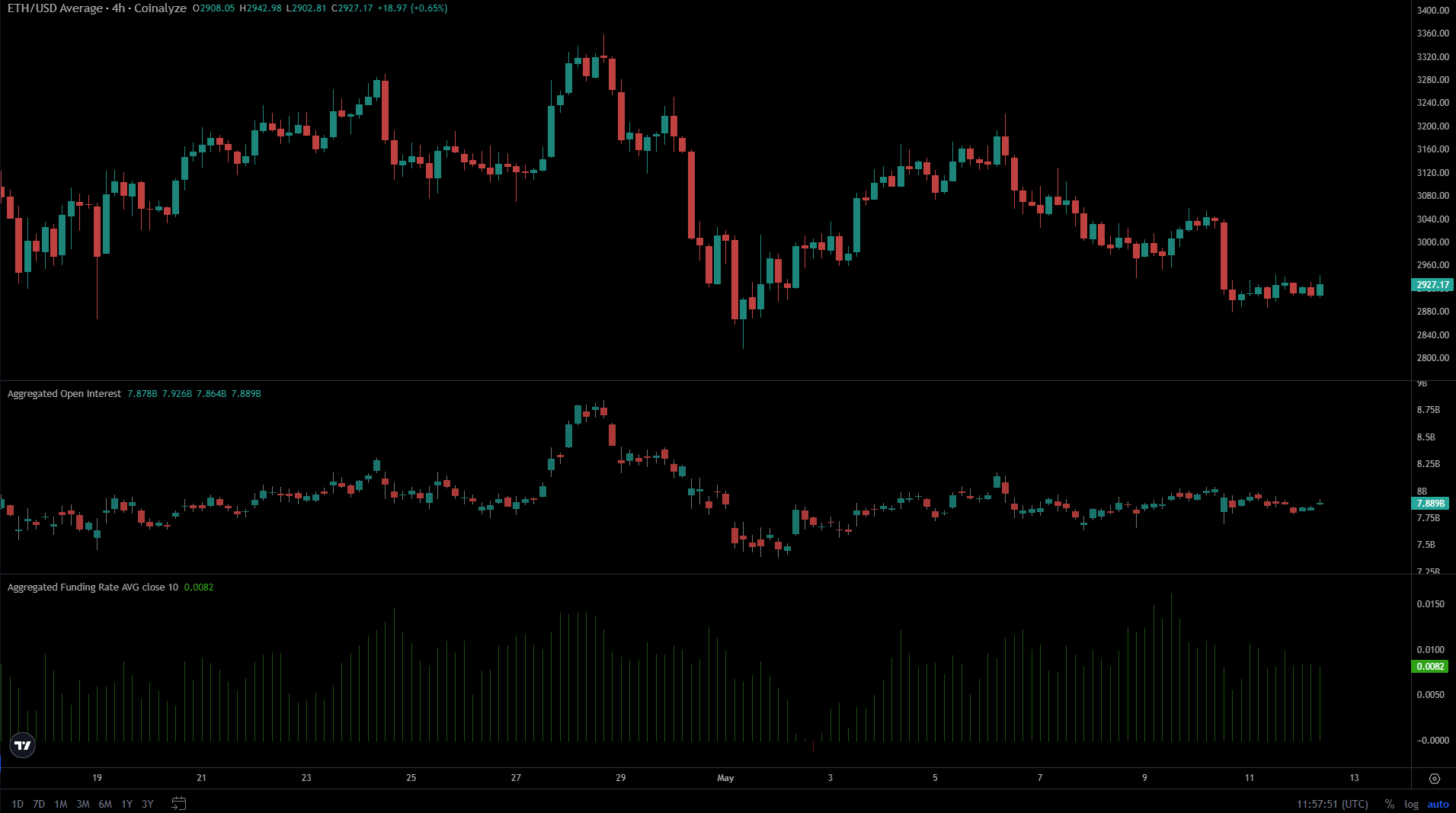

Source: Coinalyze

Ethereum also saw Funding Rates slip into the negative territory in early May but has since recovered. The past week’s downtrend saw the funding rate hover around the baseline +0.01 mark.

A slight bounce from $2980 to $3040 on the 9th of May saw the Open Interest and the funding rate jump higher.

This did not repeat with Bitcoin despite a similar price bounce, which suggested that speculators were more eager to long ETH than BTC.

What are the next liquidity pockets that could attract prices?

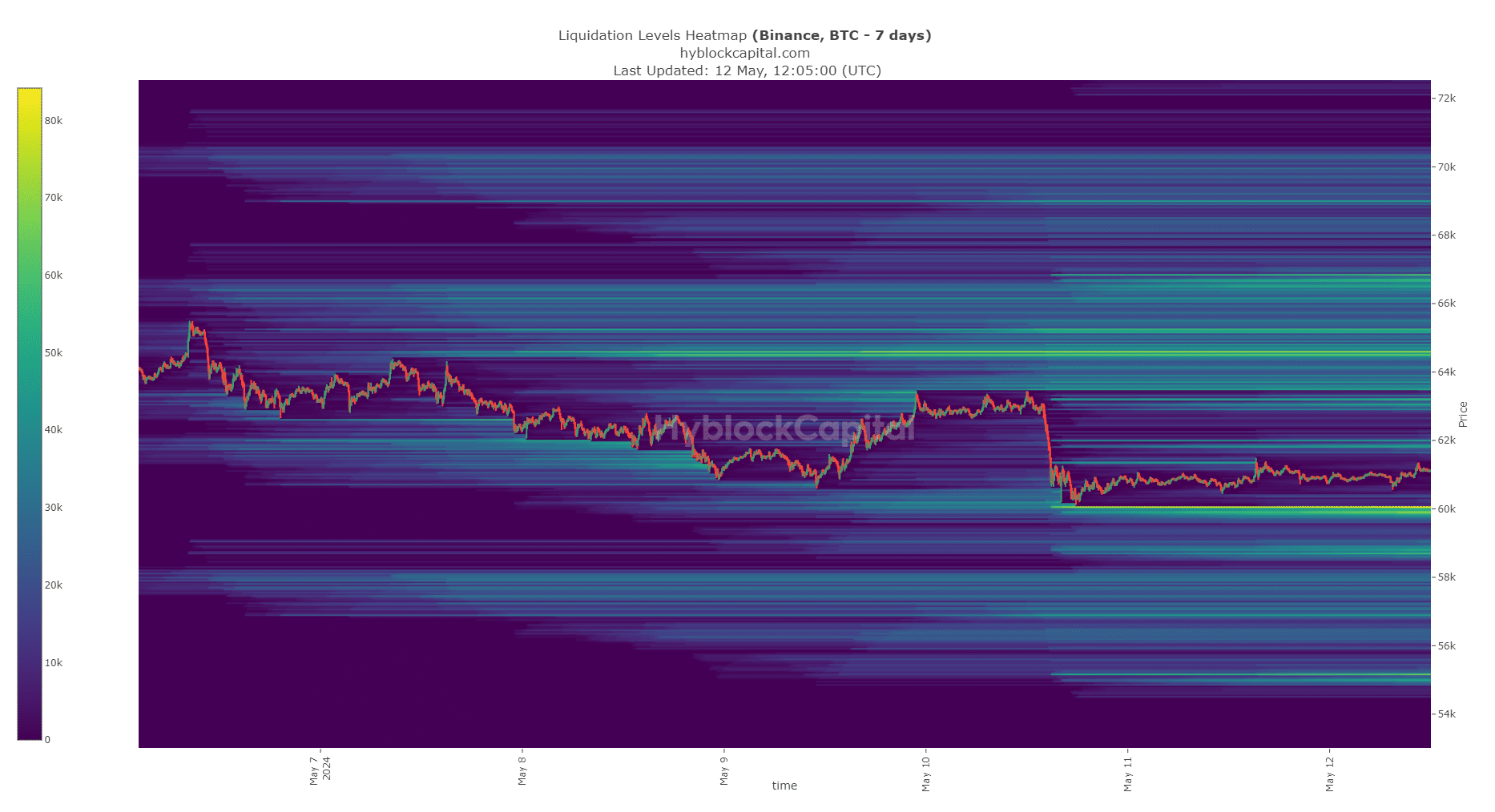

Source: CryptoQuant

The 7-day liquidation heatmap of Bitcoin showed a bright cluster of liquidations at the $60k area. To the north, $61.8k and $63k are the next bullish targets.

On the 5th of May, we saw prices jump above the $64k mark to collect liquidity before a brutal short-term reversal.

Similarly, we might see a downward plunge on Monday to collect the liquidity at $60k before rebounding higher. Hence, BTC traders would want to buy the dip to the $50.6k-$60k region.

However, traders must also be prepared for a move below $59.4k for BTC, and set their stop-losses accordingly in the event of a dip to $60k.

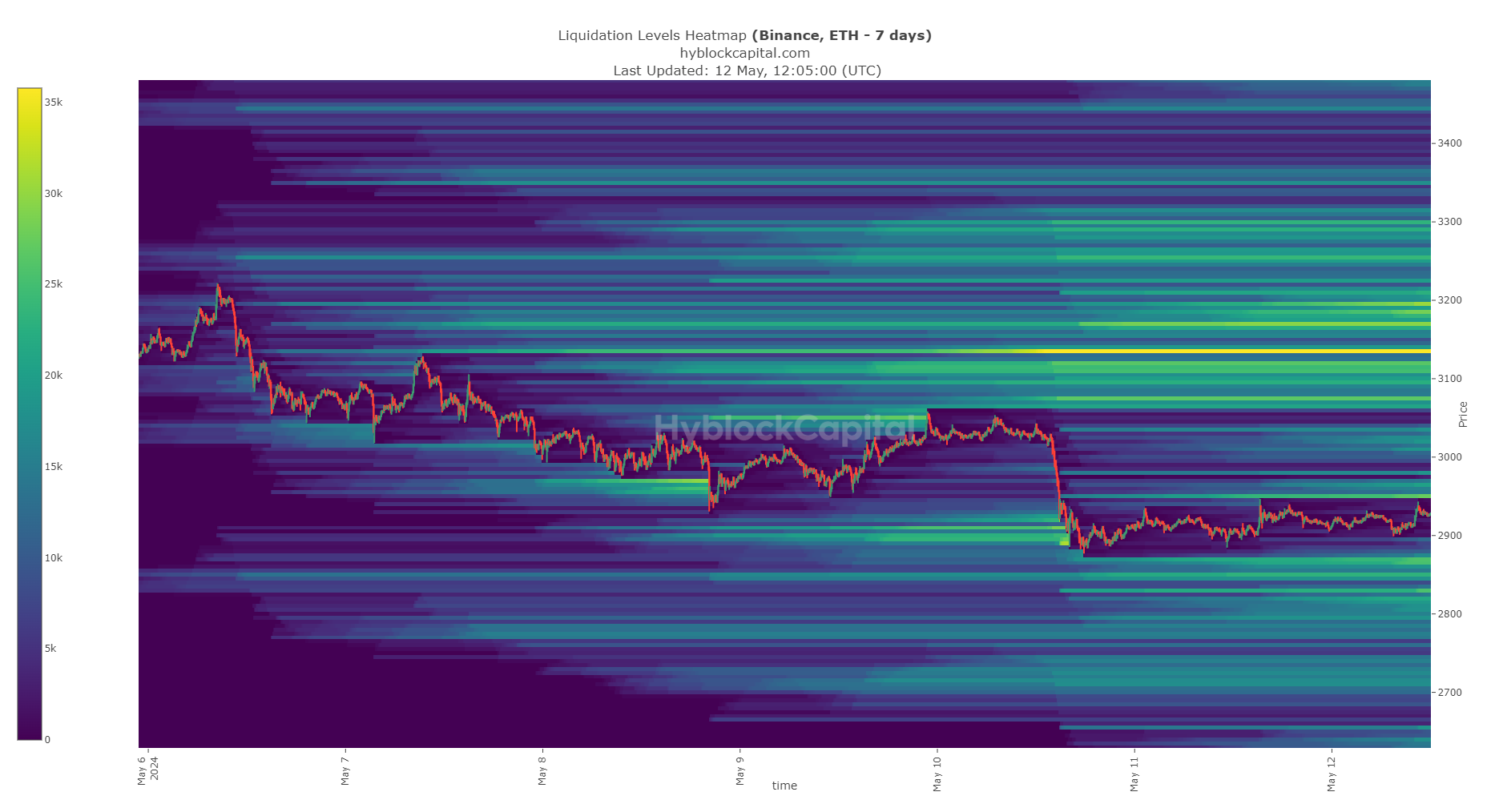

Source: CryptoQuant

Read Bitcoin’s [BTC] Price Prediction 2024-25

On the other hand, Ethereum has a cluster of liquidity nearby to the north at $2950. This was close to the current market price of $2928. A dip to the $2860 region would likely present a buying opportunity.

The liquidation levels around the $3.1k-$3.2k area present an attractive target. A drop below $2.8k would likely herald a strong short-term downtrend, and traders can cut their losses in this scenario.

![Sei [SEI]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-13-400x240.webp)