Bitcoin: Euphoria ravages the market; bullish trend remains strong

- BTC’s social dominance has grown tremendously since the year began.

- Its price might increase even more as bullish sentiment lingers in the market.

The growth in the general cryptocurrency market since the commencement of the 2023 trading year has led to a rally in Bitcoin’s [BTC] dominance in the market. At 44.18% at press time, it has increased by 5% since 1 January.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Data from cryptocurrency social analytics platform LunarCrush revealed that the spike in BTC’s dominance and its price in the last 27 days has culminated in a spike in discussions around the king coin.

According to LunarCrush, “there are actually more people talking about $BTC now than the last time it was at its current market cap.”

But if we just look at #Bitcoin's market cap and social contributors, there are actually more people talking about $BTC now than the last time it was at its current market cap. ?

Insights: https://t.co/ZV1hYBzqmL pic.twitter.com/4rJmA3Qhh9

— LunarCrush (@LunarCrush) January 27, 2023

The king is not done, just yet

Typically, a surge in a crypto asset’s social dominance while its price also increases can suggest euphoric sentiment among investors and traders. This usually indicates that the crypto asset’s price may be nearing a peak, and a drawdown in price may follow.

However, an assessment of BTC’s performance on the daily chart revealed the uptrend remained strong.

How much are 1,10,100 BTCs worth today?

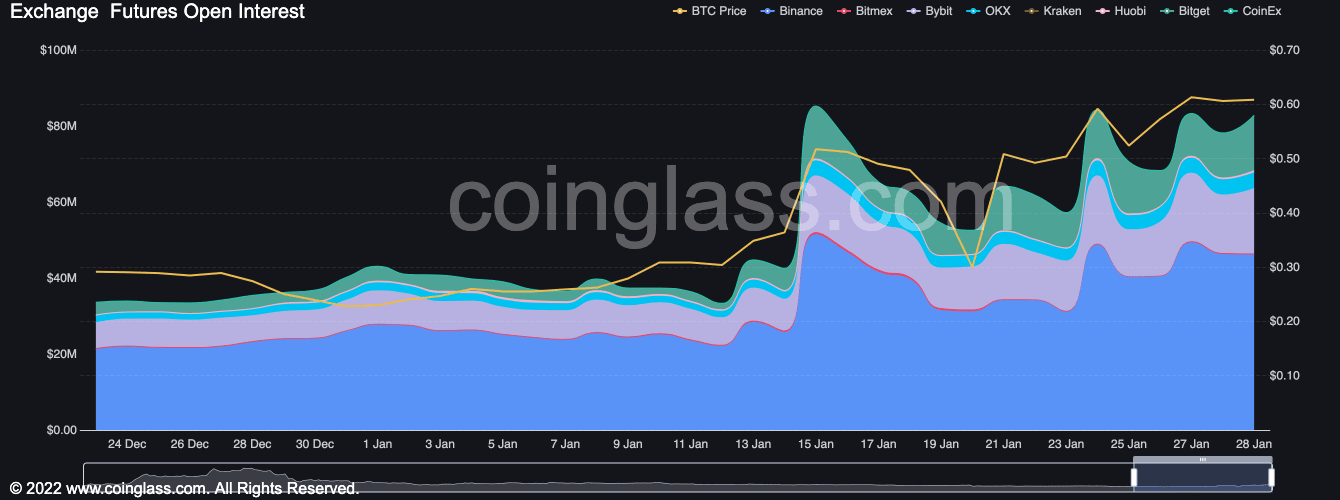

First, the leading coin’s Open Interest remained in an uptrend and has been since the year started. In fact, in the last month, BTC’s Open Interest has increased by 63%, per data from Coinglass.

An increase in an asset’s Open Interest suggests that more traders hold open positions in that asset. This can signal a growing demand, increased market activity, and liquidity in the market for that asset. At press time, BTC’s Open Interest sat at $82.83 million.

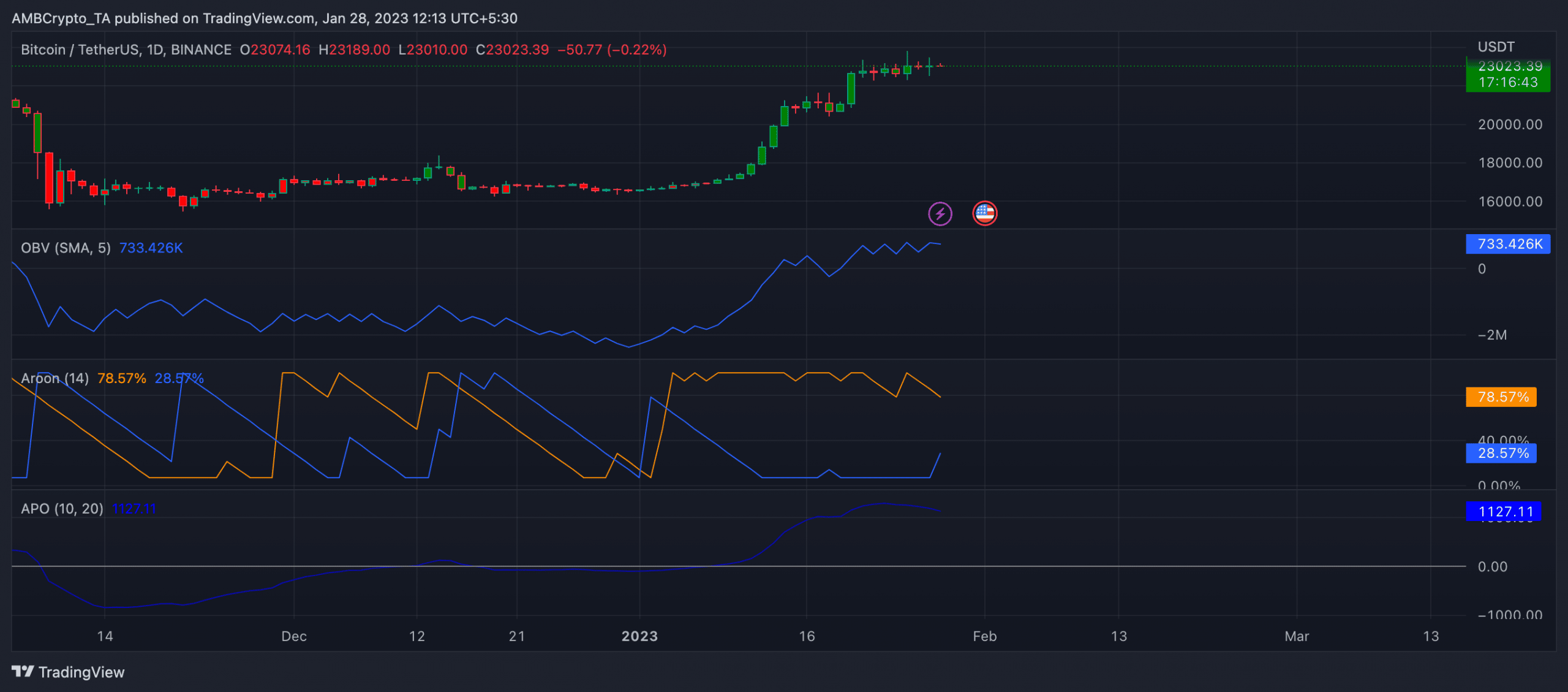

Also, in an uptrend at press time, BTC’s on-balance volume (OBV) was spotted at 733.426k. Since the year began, the king coin’s OBV has embarked on an upward rally.

A steady increase in an asset’s OBV often means more traders are buying the asset than selling it. Hence the buying pressure is stronger than the selling pressure.

Further, a look at BTC’s AROON indicator confirmed the strength of the bullish trend in the current market. As of this writing, the AROON Up line was pegged at 78.57%.

When the Aroon Up line is close to 100%, it indicates that the uptrend is strong and that the most recent high was reached relatively recently.

Lastly, BTC’s Absolute Price Oscillator (APO), which was in an uptrend at press time at 1127.11, lent credence to the strength of the bullish trend in the market.

![Polygon's [POL] short-term momentum faces strong resistance HERE](https://ambcrypto.com/wp-content/uploads/2025/03/Polygon-Featured-400x240.webp)