Bitcoin

Bitcoin exchange balance drop sharply, and that means BTC will now…

The Bitcoin Exchange Balance has dropped to a multi-year low of 2.4 million BTC, signaling increased accumulation and reduced selling pressure. .

- More BTC LTHs have sold their holdings in the past week.

- The market remained in the “Greed” phase despite these sell-offs.

The Bitcoin[BTC] Exchange Balance has significantly declined, reaching levels not observed since early 2023. This sharp drop, combined with bullish price trends and changes in long-term holder behavior, paints a compelling picture of current market dynamics.

By analyzing on-chain metrics such as exchange balances, long-term holder positions, and the Fear & Greed Index, AMBCrypto deciphered what this trend means for Bitcoin’s price trajectory and the broader crypto market.

Bitcoin exchange balance hits multi-year lows

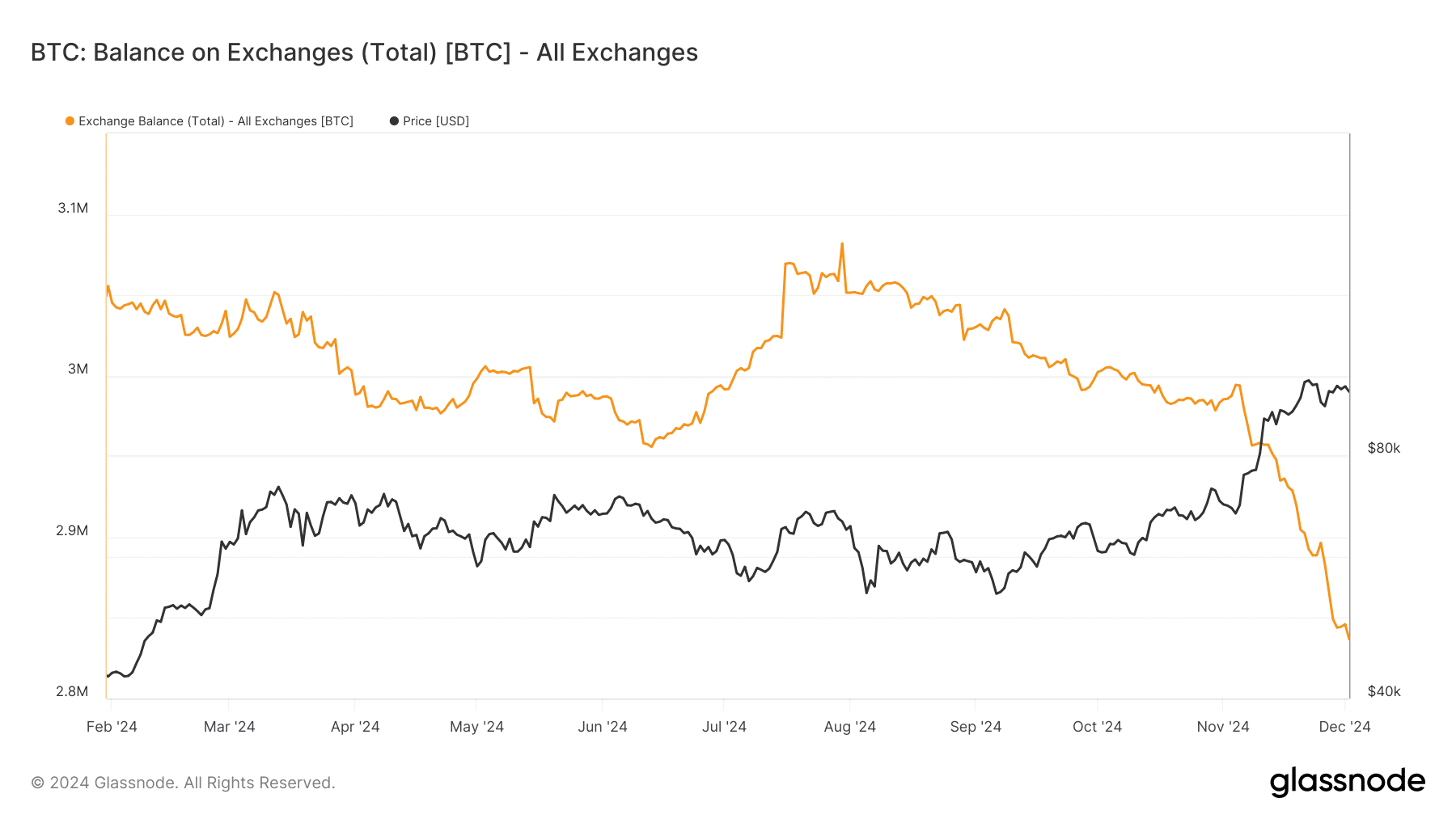

Data shows that Bitcoin’s total balance across all exchanges has fallen to approximately 2.8 million BTC, down from over 3.2 million BTC, earlier this year.

This significant reduction in exchange reserves often correlates with bullish market sentiment, suggesting a decreased likelihood of selling pressure.

Investors withdrawing Bitcoin to private wallets often indicate long-term holding behavior or a move toward self-custody, reflecting confidence in the asset’s future price appreciation.

Interestingly, this trend aligns with Bitcoin’s price surging above $90,000, highlighting a potential accumulation phase by both retail and institutional investors.

The relationship between declining exchange balances and rising prices signals tightening liquidity on exchanges, which could lead to increased price volatility if demand spikes.

More BTC goes off exchanges

Complementing this trend, the supply of Bitcoin outside of exchanges has risen steadily, surpassing 18.18 million BTC.

Historically, such moves away from exchanges correlate with reduced selling pressure, contributing to tighter supply dynamics. These factors often create favorable conditions for upward price movements, especially during heightened demand.

Long-term holders shift gears

Analysis of the Long-Term Holder (LTH) net position change reveals a crucial narrative. After months of accumulation, LTHs have started to reduce their positions. This net reduction indicates profit-taking at current price levels, a typical behavior during bullish market cycles.

However, the reduction in LTH positions is not necessarily bearish, as it is offset by increased activity among short-term participants and a surge in self-custody.

Sentiment remains positive amid declining balance

The Fear & Greed Index signals “Greed,” reflecting Bitcoin’s recent price highs and bullish sentiment. The index has stayed in the “Greed” or “Extreme Greed” zone for several weeks, which is linked to increased retail participation and speculative buying.

While high levels of greed can signal overbought conditions, they are also consistent with strong upward momentum in the short to medium term.

The trend and declining Bitcoin Exchange Balance indicate a potential supply crunch that could push Bitcoin prices higher, barring any significant macroeconomic disruptions.

What does this mean for Bitcoin

Bitcoin’s sharp decline in exchange balances and the corresponding rise in supply outside of exchanges highlight a market in transition. The combination of reduced exchange balances, profit-taking by long-term holders, and high levels of greed suggests a complex but bullish market dynamic.

Declining exchange reserves indicate a tightening supply. However, profit-taking by long-term holders introduces the possibility of short-term volatility as the market digests these sales.

Read Bitcoin (BTC) Price Prediction 2024-25

Looking ahead, Bitcoin’s ability to sustain its bullish momentum will depend on continued accumulation trends, stable macroeconomic conditions, and its ability to attract new capital inflows.

If the current trends persist, Bitcoin could continue its climb toward new all-time highs, supported by strong on-chain metrics and positive sentiment. At the time of writing, BTC was trading at around $95,000.

![Toncoin [TON] price prediction - Watch out for THESE short-term targets!](https://ambcrypto.com/wp-content/uploads/2025/03/Toncoin-Featured-1-400x240.webp)