Bitcoin

Bitcoin exchange deposits plummet to six-year low – What it means for BTC

Bitcoin exchange deposits are at a six-year low, fueling optimism. Yet, the path to a new ATH remains complex.

- Bitcoin exchange deposits have hit a six-year low, marking the lowest level of BTC deposits in that time.

- That being said, HODLERS are key in preventing a drop to the $55K support.

Bitcoin [BTC] bulls faced another setback after a brief weekend spike that pushed BTC above $60K. With three consecutive red candles, BTC has retreated to $58K.

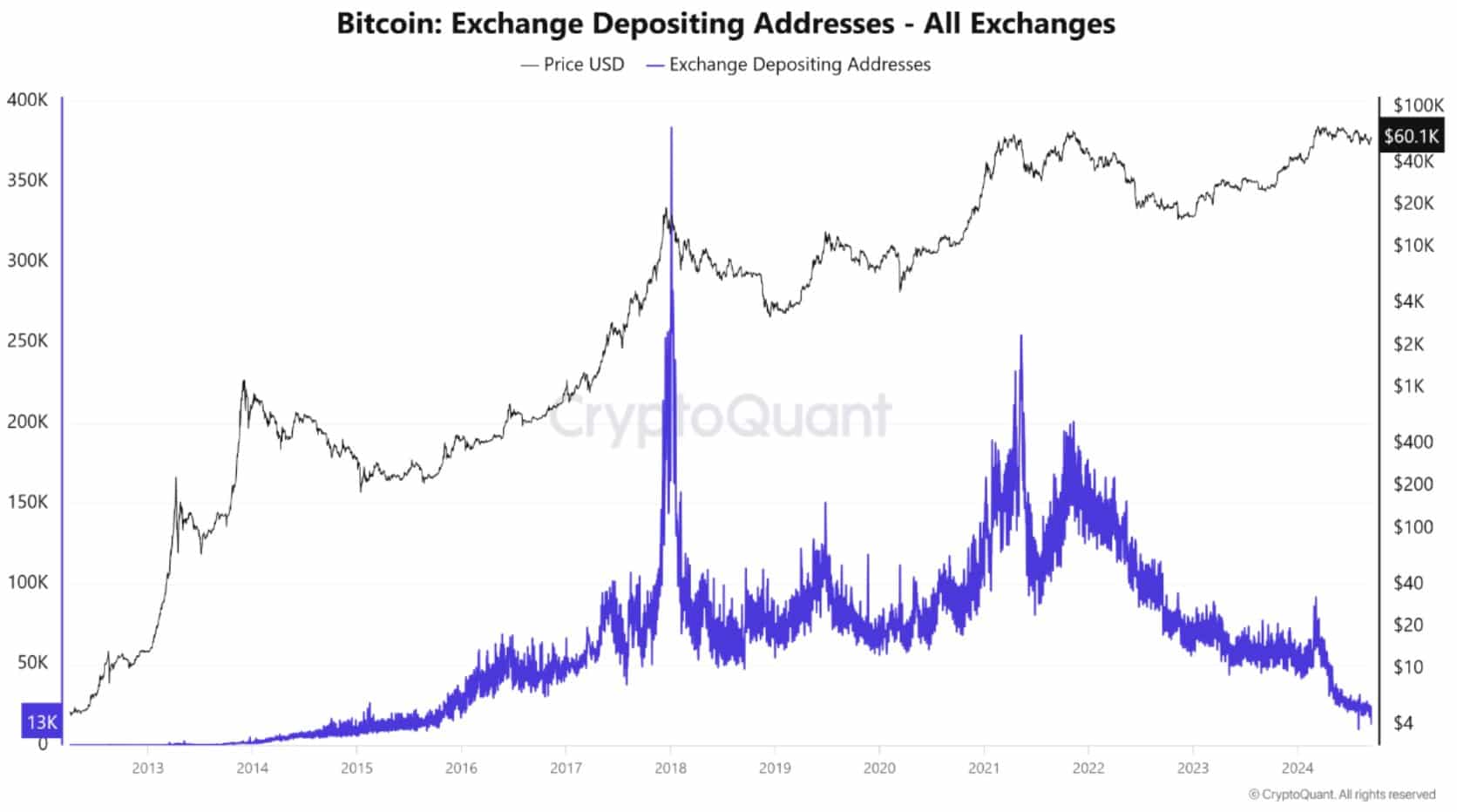

While analysts are split on whether $60K is support or resistance, a new CryptoQuant report shows Bitcoin exchange deposits have hit a six-year low of 132,100, signaling reduced selling pressure.

Could this milestone help BTC avoid a drop to $55K?

Drop in BTC exchange hints at rising hodler dominance

The chart reveals fewer Bitcoin exchange deposits, typically a bullish signal. Economically, reduced supply can inflate each BTC token’s value.

While for investors, less BTC on exchanges suggests confidence in price recovery.

Moreover, AMBCrypto’s analysis shows that spikes in BTC exchange deposits typically align with BTC testing high price levels, indicating profit-taking strategies and often leading to steep declines, suggesting potential accumulation.

Conversely, fewer deposits point to increased control by long-term hodlers, as observed in the past six years since the last spike.

Put simply, the Bitcoin space is now dominated by hodlers confident in a price correction.

As expected, the hodler count has surged to 38 million, marking a staggering 375% increase from 8 million six years ago. Notably, hodlers holding BTC for over a year now represent 70.77% of total addresses.

Surprisingly, this percentage exceeds the count observed during the mid-March rally, when BTC hit its ATH.

In short, long-term holders are key to preventing a drop to $55K – but what are the odds?

The odds are intriguing

Currently, 58.27% of LTH are in profit, down from a peak of 74% on March 13—a 16% decline. Historically, a drop in the profit margin after hitting highs can signal a potential bear market months later.

In short, while most LTH remain profitable, the weakening margin could suggest a slowdown or bearish trend ahead.

However, despite increasing losses since the March peak when BTC tested $70K, LTHs continued support indicates belief in a potential price correction.

If this trend continues, LTH might hold off on selling, as evidenced by reduced BTC exchange deposits.

Additionally, a potential Fed interest rate cut could drive BTC to a new ATH, assuming BTC deposits on exchanges continue their downward trend – Will they?

Time will tell

On the 30-day lookback period, LTHs sold a significant portion of their holdings for the first time on September 16th, coinciding with BTC’s retracement to $58K.

As mentioned earlier, for a recovery, LTHs need to support their positions by avoiding further sales. However, this downtick was a rare occurrence, still aligning with AMBCrypto’s earlier projections.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

If LTHs can prove this event to be an anomaly, and Bitcoin exchange deposits remain low, the door to a new ATH could still be wide open.

Conversely, if LTHs continue to sell, the $55K support may be at risk, and the path forward could become much more uncertain.