Key Bitcoin metric falls to a 5-year low: What this means for BTC

- Bitcoin exchange reserves dropped to a 5-year low, signaling potential bullish rally.

- The majority of Bitcoin holders were enjoying profits, contributing to the market’s positive sentiment.

Bitcoin [BTC] remained in the headlines as it continued to show bullish momentum throughout the week.

The crypto market has witnessed a significant shift as BTC broke out of a bullish flag pattern recently, sparking hopes for further price growth.

From plummeting exchange reserves to surging profits for holders, here’s why the market is buzzing with optimism.

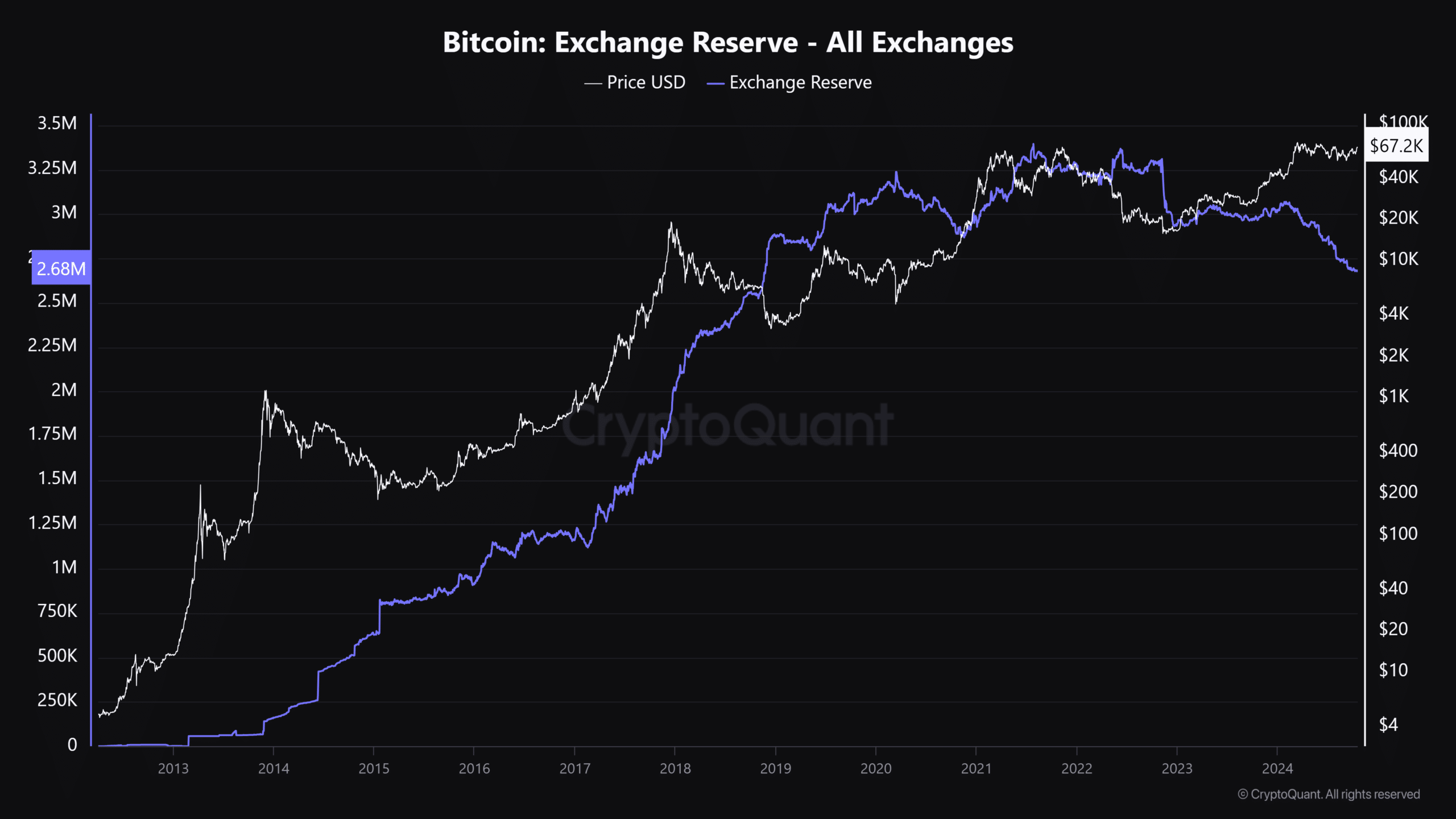

Bitcoin exchange reserves plummet

BTC reserves on exchanges have fallen to their lowest levels since 2017, according to CryptoQuant data. Historically, plummeting exchange reserves pointed to an increasing buying pressure.

For Bitcoin, given its current price rally, the sentiment may suggest a further price rally following the inflow influx.

Low reserves mean less BTC is available for immediate liquidation, which can fuel price surges in the coming days.

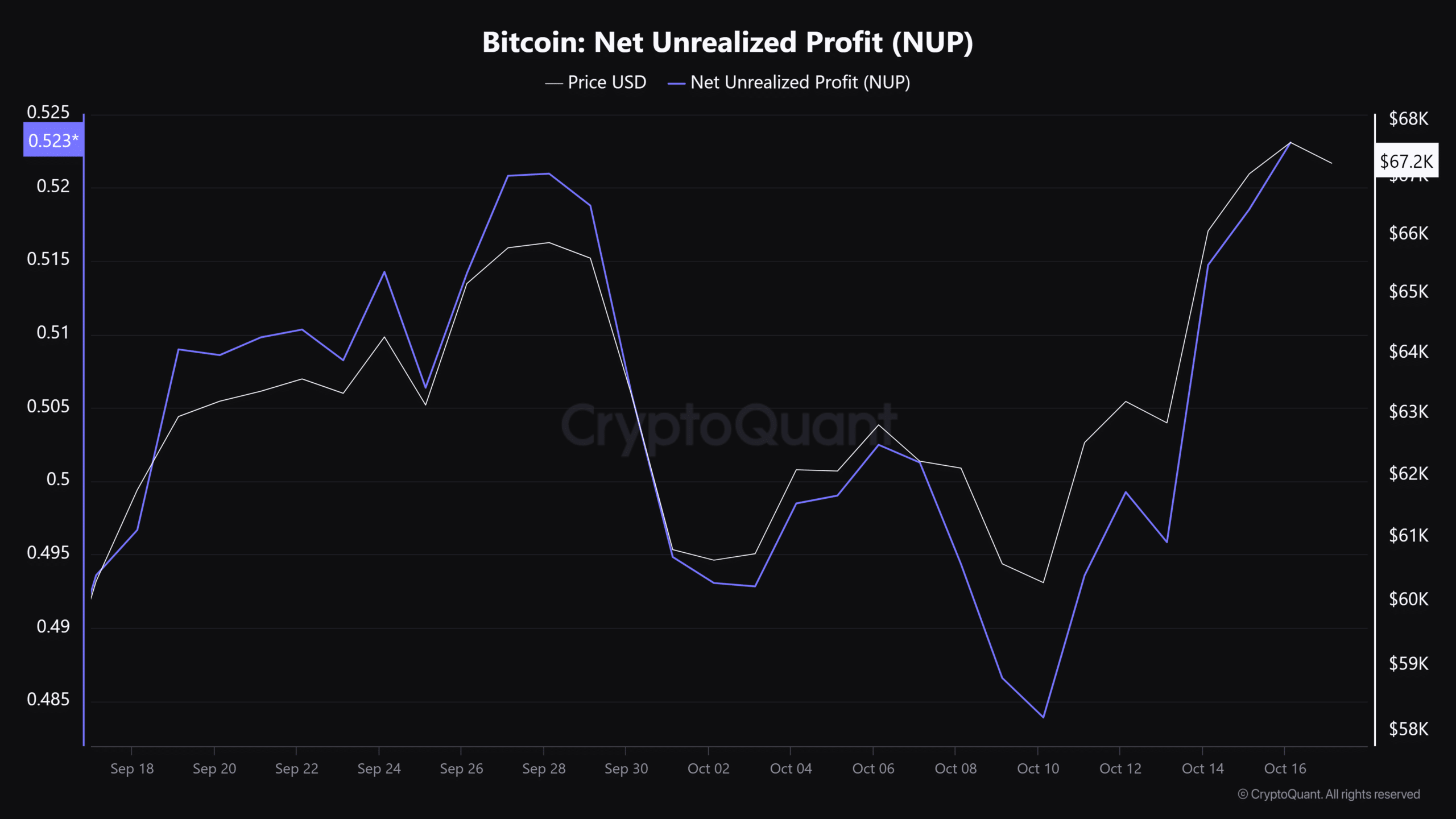

Net unrealized profit spikes

Within the last 24 hours, Bitcoin’s net unrealized profits have gone through the roof, indicating that a large portion of BTC holders are sitting on unrealized gains.

This reflected surging confidence in the market, with more holders holding onto their profits—a snowballing effect of reduced selling pressures and growing bullish sentiments for Bitcoin.

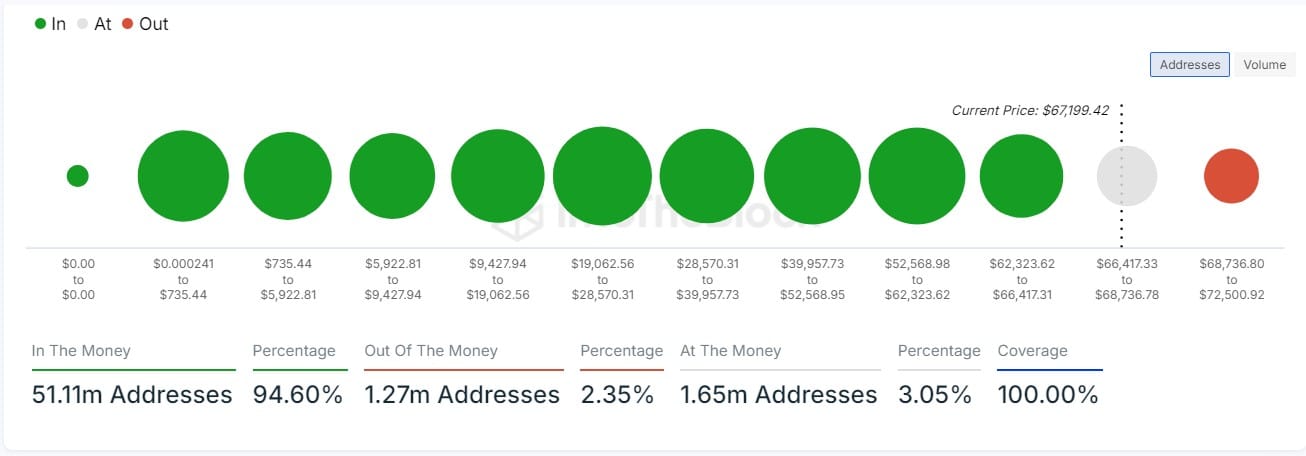

94% of Bitcoin holders are winning

AMBCrypto’s analysis of IntoTheBlock revealed that a whopping 94% of Bitcoin holders were in profit at press time. This created a bullish undertone in the market.

When holders are already in profit, they resist selling during short-term fluctuations, further tightening Bitcoin’s supply.

With a spike in the unrealized profit surge backed by the bigger portion of holders in profit at the current price, the Bitcoin bullish rally is more likely to hold on the long term.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

To top it all, the king coin recently broke out of a bullish flag pattern. Historically, this technical signal indicates further price gains.

The fact that the exchange reserve is still falling and that unrealized profits remain strong, the breakout only strengthens the case for an extended BTC rally.