Bitcoin eyes bullish breakout, but can BTC smash THIS major resistance?

- Bitcoin struggled against $67,583 resistance; breaking this level could trigger a move toward $70,000.

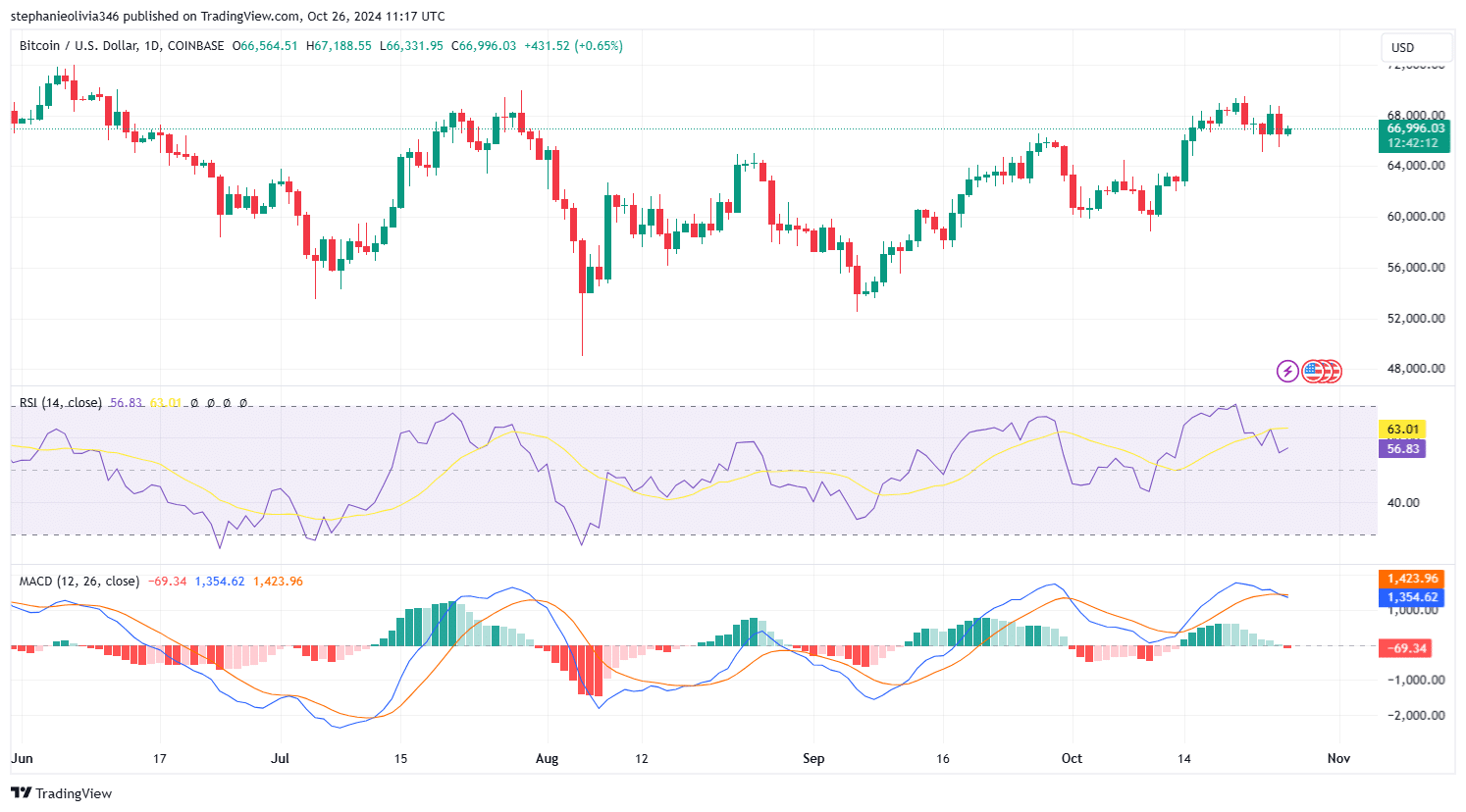

- RSI and MACD show weakening momentum, while rising active addresses suggest potential bullish activity.

Bitcoin [BTC] fell below $67,000, reaching an intraday low of $65,700 after losing its overnight gains. Priced at $66,972.95 at press time, it shows a 1.22% decline in the past 24 hours and 2.01% over the past week.

Despite the short-term dip, Bitcoin’s market cap remains at $1.32 trillion, with a circulating supply of 20 million BTC. In the last 24 hours, trading volume reached $46.32 billion, reflecting continued interest from traders.

Bitcoin has been trading within a clear descending channel. This pattern shows a series of lower highs and lower lows, indicating a bearish trend.

The upper boundary of this channel, near $69,000, has repeatedly acted as a strong resistance level, pushing prices lower after each attempt to break above it.

As seen on the chart, recent rejections have followed similar patterns, suggesting that this resistance remains a key challenge for further gains.

Support and resistance levels

Bitcoin’s press time upper resistance zone was between $67,583.25 and $69,000, a range that has consistently rejected bullish attempts.

If Bitcoin manages to break above this range, it could pave the way for an extended move toward $70,000.

However, failure to clear this level could see Bitcoin reverting lower within the descending channel.

Immediate support is identified around $66,423.76, marked as a critical level on the chart. Should Bitcoin breach this support, it could drop toward the lower boundary of the channel, projected between $60,000 and $62,000.

RSI and MACD analysis

At the time of this publication, Relative Strength Index (RSI) was at 56.75, positioned below its signal line at 63.00. This indicated that bullish momentum was weakening, approaching a more neutral zone.

Meanwhile, earlier in October, the RSI rose above 70, pointing to overbought conditions. The subsequent drop indicated a correction, yet the current RSI level still allows room for upward movement.

Maintaining above the 50 mark is important for bullish momentum to sustain.

The Moving Average Convergence Divergence (MACD) line remains above the signal line, suggesting an ongoing bullish trend. However, shrinking histogram bars hint at decreasing momentum.

If the MACD line crosses below the signal line, it may indicate short-term downside or a period of consolidation.

On-chain activity

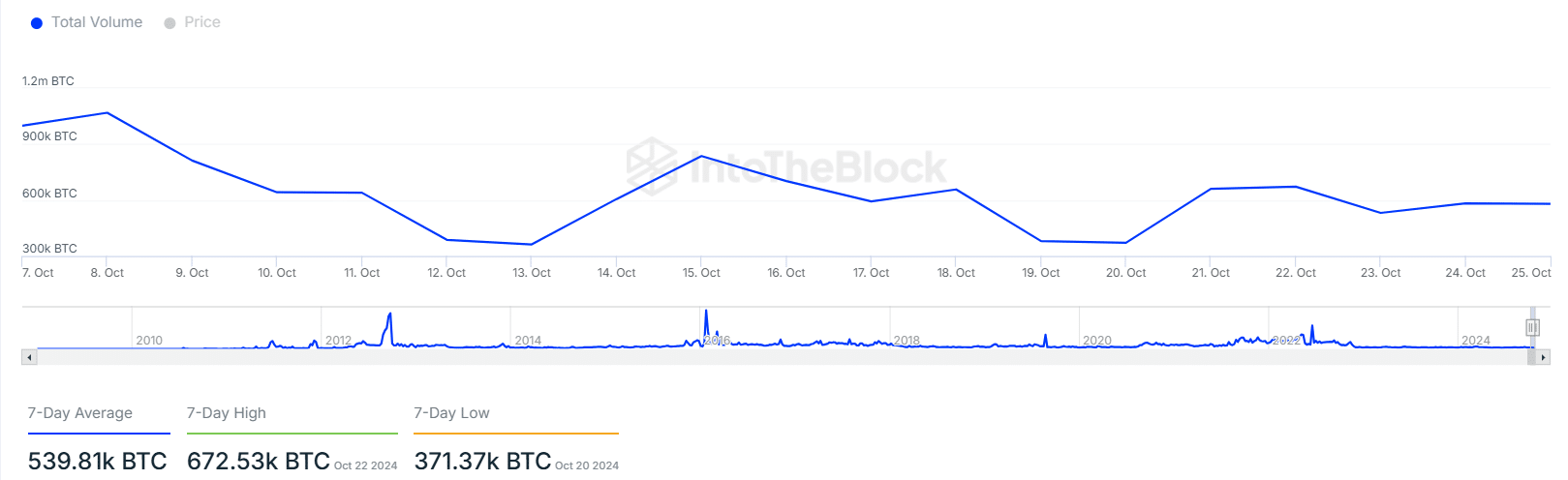

According to IntoTheBlock data, active Bitcoin addresses have increased by 5.20% in the last week, suggesting higher user engagement.

This contrasted with a 6.50% decline in new addresses, indicating that existing users were driving network activity.

Bitcoin’s 7-day average transaction volume stood at 539.81k BTC at press time, with a recent peak of 672.53k BTC on the 22nd of October and a low of 371.37k BTC on the 20th of October.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

The fluctuating volume reflects shifting market activity, with the recent spike indicating rising engagement.

This variability in transaction volume suggests ongoing changes in trading patterns, which could shape Bitcoin’s price movements in the coming days.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)