Bitcoin faces drop to $60K – Will the $64k support halt the sellers?

- Bitcoin breezed past the October range highs,

- A minor price dip before the uptrend resumes is the ideal outcome for bulls.

Bitcoin [BTC] has a comfortably bullish outlook, going by social media posts.

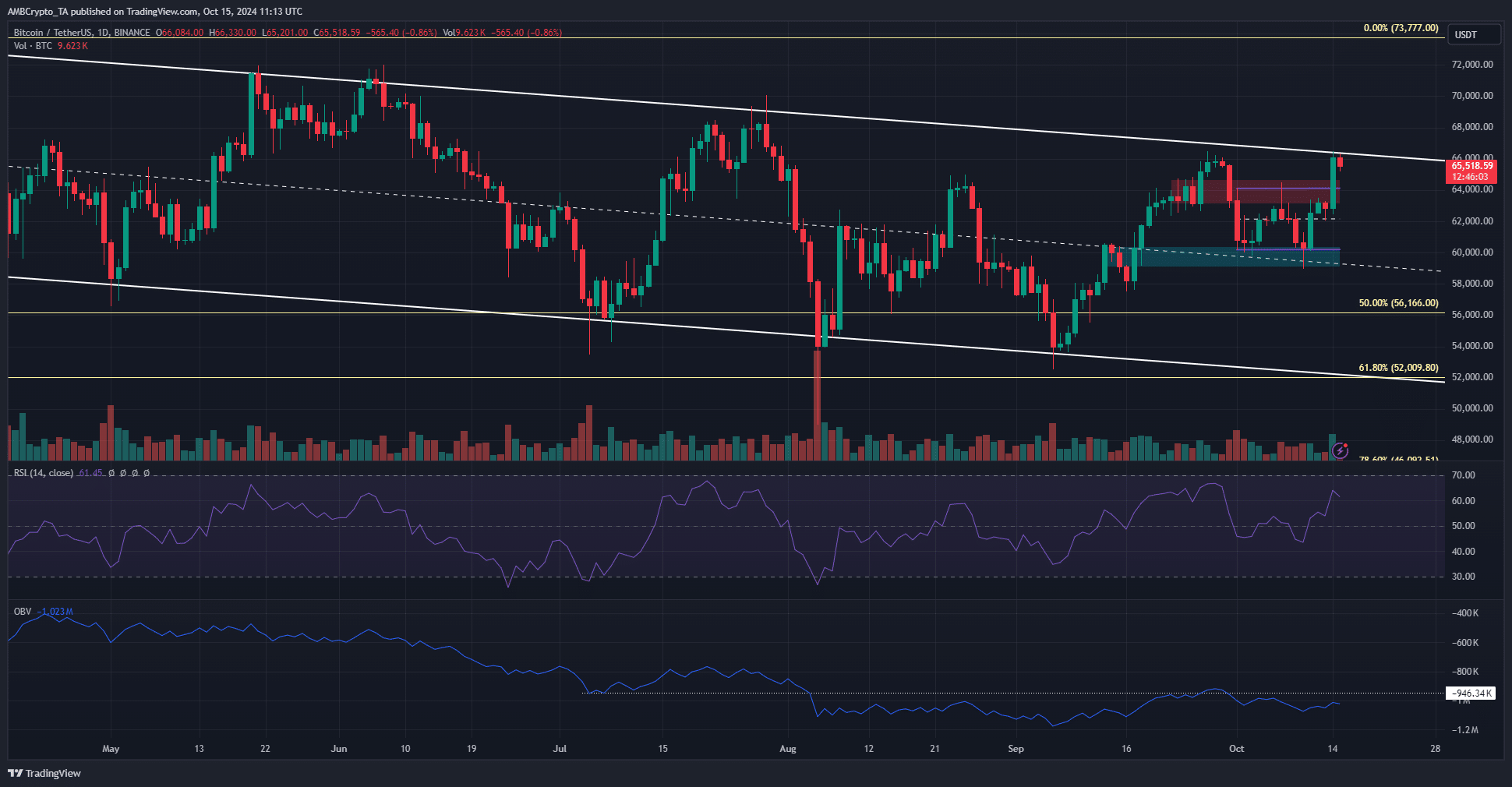

The rapid surge beyond the $64k resistance level that opposed the bulls in October was breached on the 14th of October, and the channel highs were retested.

The record-breaking Bitcoin spot ETF inflows likely aided this 5.1% price move. However, the ETF share is only a fraction of the total trading volume. Should investors brace for a breakout or another rejection?

Channel highs vs. range breakout

BTC has traded within a short-term range in October that extended from $60.2k to $64.1k. The daily trading session on Monday beat the resistance with ease, but faced opposition at the $66.5k mark.

This coincided with the descending channel’s highs, as well as with the local highs from the 27th of September. A session close above $66.5k would be a sign of firm bullish conviction.

The OBV was unable to clear the local highs, and was a noticeable distance lower, while the price was at the same resistance at $66.5k.

This was a sign that buying volume in recent weeks was not as high as the sessions where BTC noted losses.

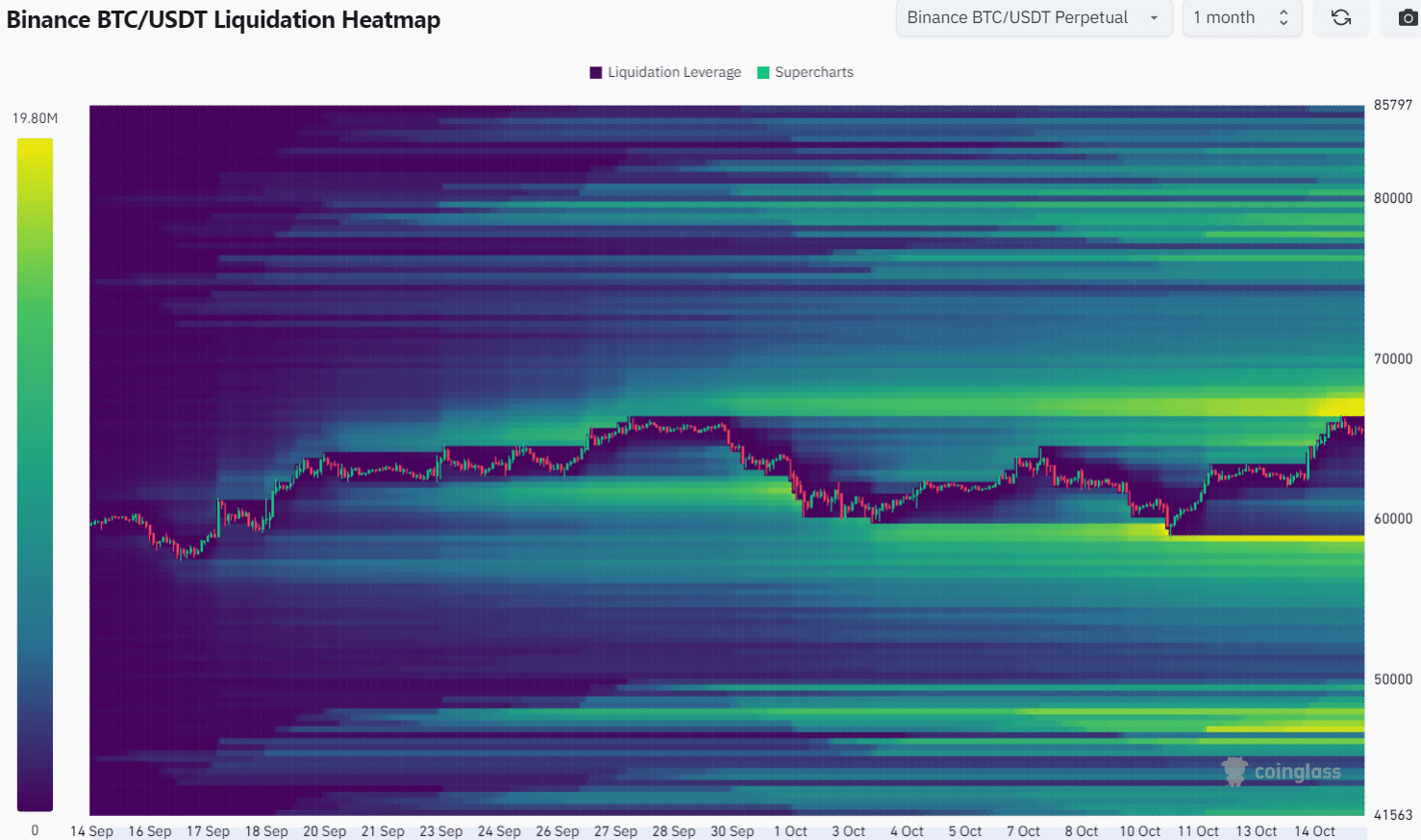

Potential short squeeze imminent

Source: Coinglass

The 1-month lookback period showed a concentration of liquidation levels at $66.6k to $67.4k. The proximity of this liquidity pool could attract prices higher before a reversal toward $60k.

Read Bitcoin’s [BTC] Price Prediction 2024-25

It is unclear whether Bitcoin is ready for the bull run expected in Q4 2024, or whether more consolidation is ahead. Based on the liquidation heatmap and the OBV, a rejection appeared likely.

A bullish reaction could follow at the former range highs at $64k and could present a buying opportunity, but swing traders should be prepared for a deeper dip and manage their risk accordingly.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion