Bitcoin faces sell pressure: Will THESE demand levels prevent a freefall?

- BTC’s rally comes as its exchange reserve continues to decline.

- Sentiment suggests BTC might drop further until it finds a critical point for a rebound.

Bitcoin [BTC] market performance isn’t what you’d expect after a significant upswing last month, which brought it to a new all-time high with a 33.14% increase.

Currently, the 24-hour gain is minimal at 0.78%. While this indicates more buying activity than selling, the upward move is far from guaranteed, as AMBCrypto reports.

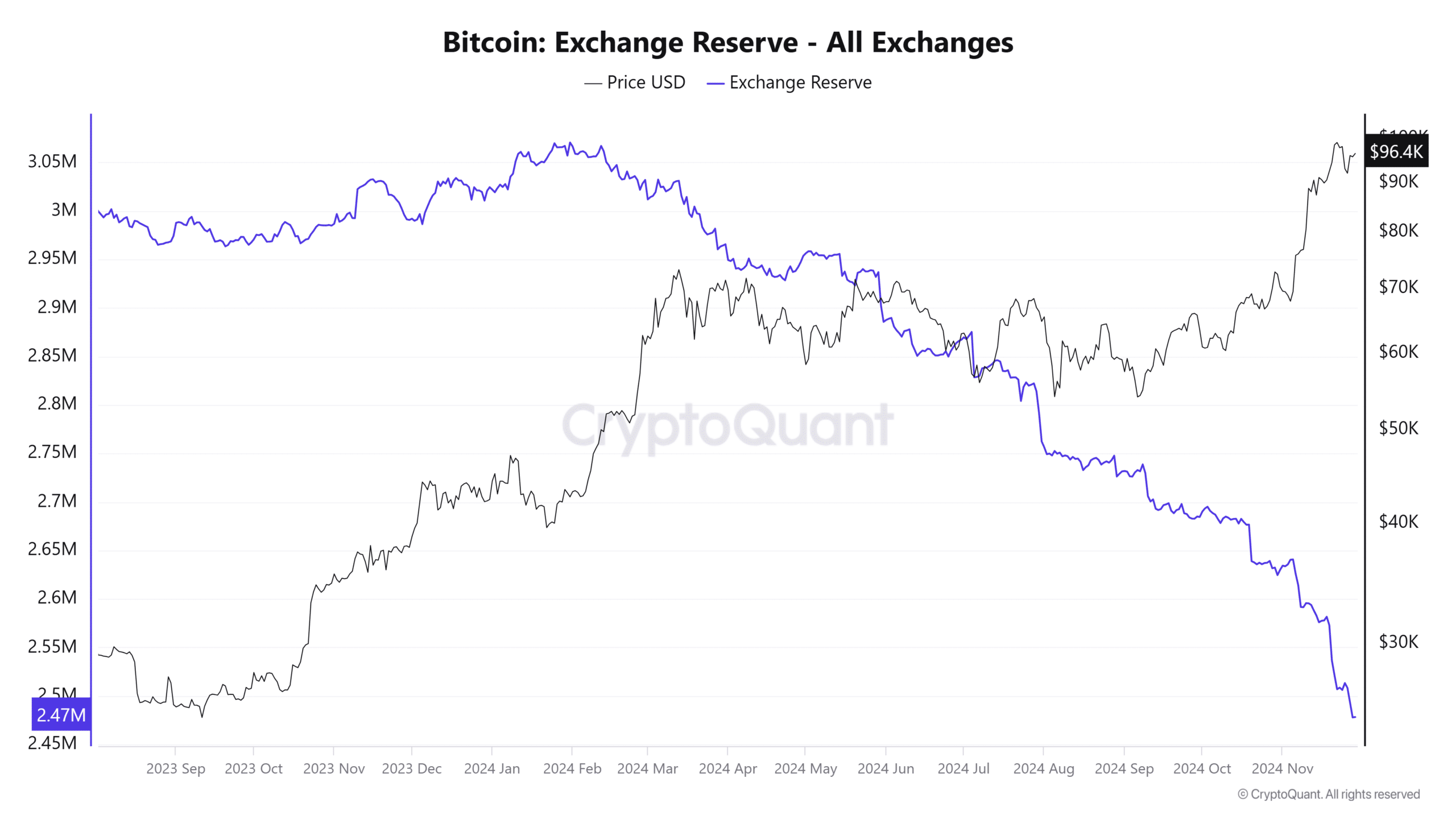

BTC supply on exchanges drops further

Data from CryptoQuant reports a continued decline in Bitcoin availability on cryptocurrency exchanges. The Exchange Reserve has fallen by 0.61% in the past 24 hours and 1.53% over the last week.

A drop in Exchange Reserve typically indicates a reduced circulating supply of BTC on exchanges, a factor that often supports price increases due to scarcity.

This decline has played a role in BTC’s recent gains on the daily chart. However, the sustainability of this rally remains uncertain, with AMBCrypto outlining key factors to watch.

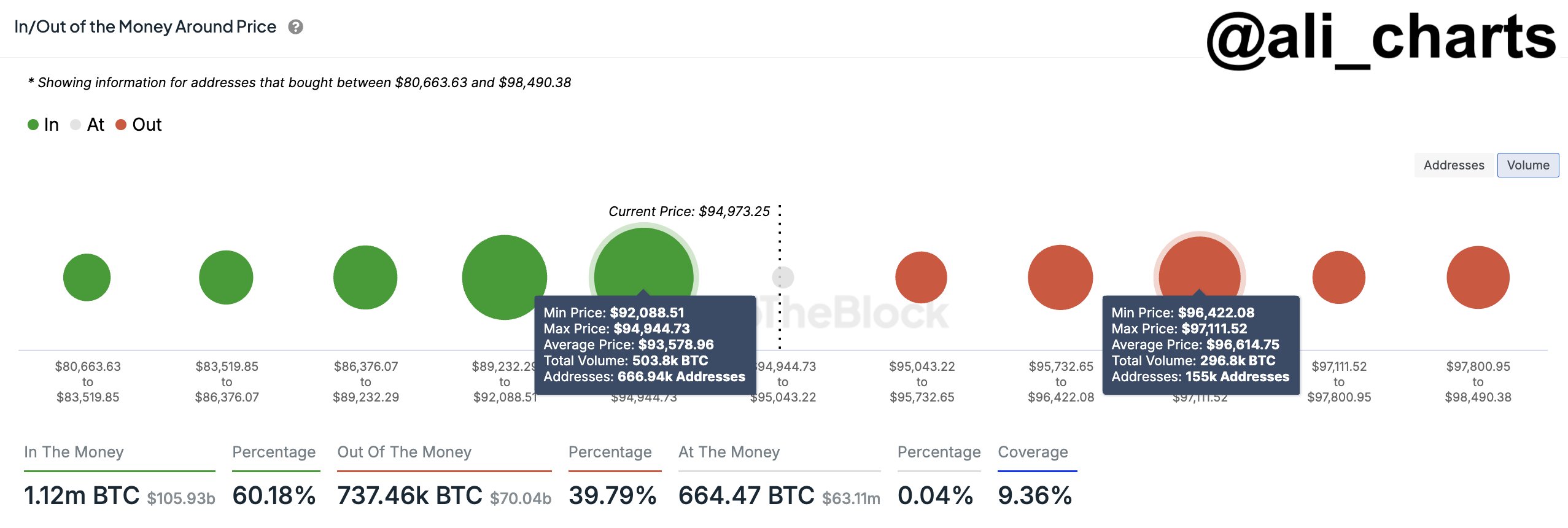

Selling pressure builds as BTC hits supply zone

According to analyst Ali, BTC is at a critical juncture, having entered a supply zone at $96,614.75. Here, significant selling pressure exists, with sell orders totaling 296.8K BTC.

If BTC faces a drop, Ali highlighted the importance of the next key demand zone at $93,578.96, where buy orders for 503.8K BTC from 666.94 addresses are concentrated.

He stated:

“Staying above this support level is a must to prevent these holders from selling.”

While the stronger buy orders at this level suggest it could hold, the outcome depends on the intensity of selling pressure.

AMBCrypto also noted a warning sign, with a sharp rise in BTC inflows to exchanges—2,678 BTC moved in the last 24 hours—adding weight to the possibility of a price decline.

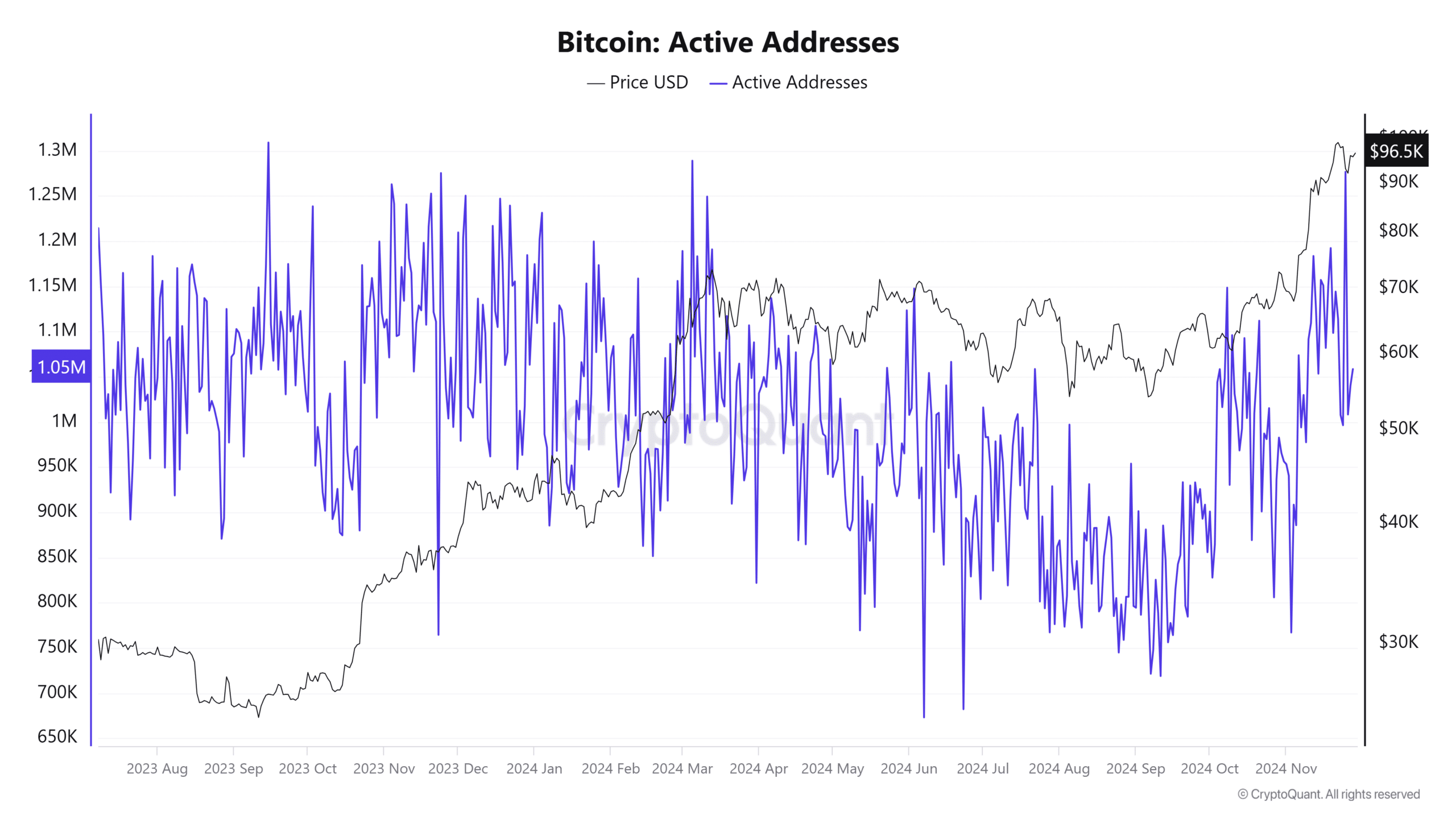

Retail participation weakens

Retail investors, who play a major role in asset price movements, show signs of weakening interest as the number of active addresses has significantly declined by 35,03%.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

A drop in active addresses typically means reduced buying activity, which could contribute to a potential price dip for BTC, possibly toward the earlier-mentioned demand zone.

If the demand zone maintains its current buy order volume and address activity, a price reversal from that level remains possible.