Bitcoin fails to break $60K as June CPI signals Fed rate cuts: What now?

- Bitcoin fell lower after a softer June CPI data.

- Analysts claimed a bullish reversal was likely for BTC.

On the 11th of June, Bitcoin [BTC] mirrored US stock equities losses, especially Big Tech, following a softer June CPI (Consumer Price Index) print.

BTC failed to reclaim the $60K level and dropped below $58K after the inflation data.

The June CPI data was cooler at 3.0%, compared to 3.3% in May, meaning the overall weighted consumer price for a basket of goods and services eased slightly.

Will a likely September Fed rate cut boost Bitcoin?

The softer June inflation could confirm the recent disinflation trend, boosting the odds of the Fed rate cuts later in the year. This could be positive for risk assets, including the crypto market.

However, after the CPI data, investors reportedly rotated out of Big Tech stocks, sending them lower alongside BTC as they grabbed small-cap US stocks.

Interestingly, Quinn Thompson, founder of crypto hedge fund Lekker Capital, claimed that “small-cap outperformance” could still strengthen Bitcoin’s recovery. He noted,

“Small cap outperformance tends to coincide with crypto strength. Let’s see if the macro can overpower the #Bitcoin supply overhang.”

The above chart revealed a positive correlation between small-cap performance, tracked by iShares Russell 2000 ETF (IWM), and BTC.

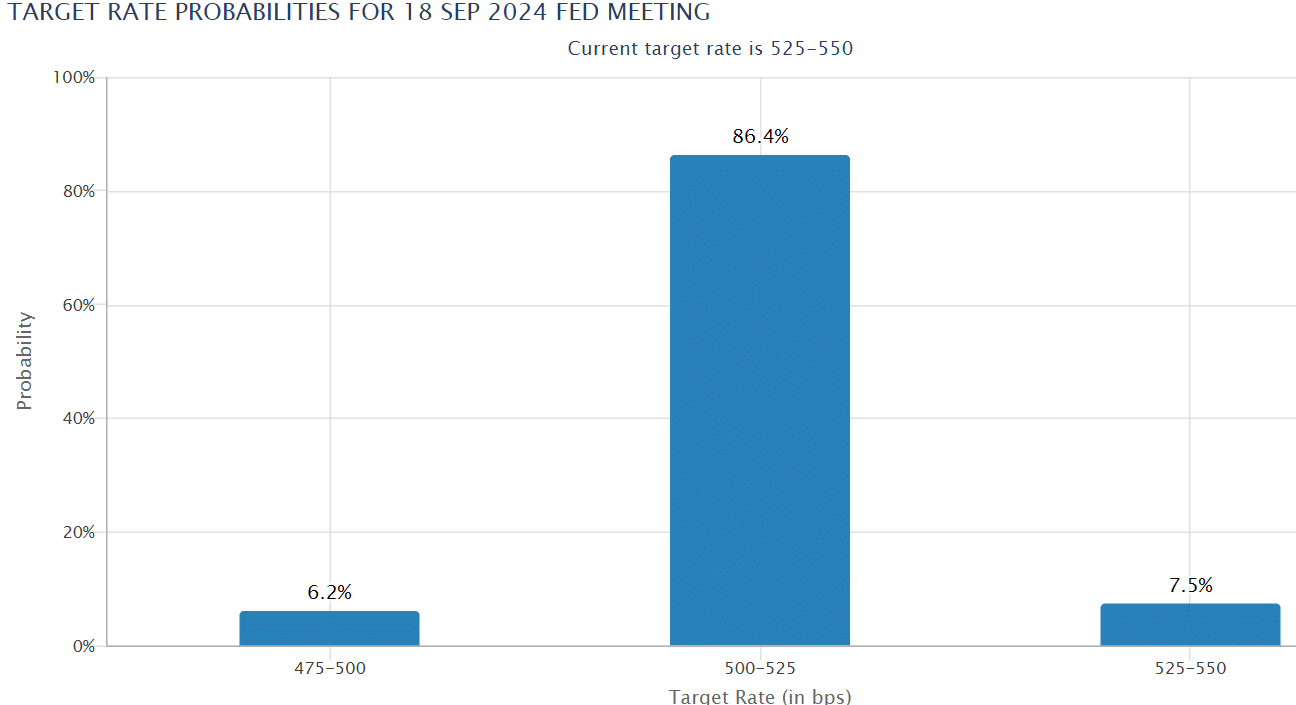

In the meantime, the odds of Fed rate cuts in September surged above 80% as of press time, following the softer June inflation.

The improving macro prospects, however, could be dented by Bitcoin supply overhang, especially from the German government sell-offs, as cautioned by Thompson.

But, as of the 12th of July, German holdings were less than 10K BTC out of 50K BTC held in mid-June, which meant its supply pressure could ease significantly by next week.

So, what’s next for BTC price in the short term?

BTC’s next price target

Based on a likely easing supply pressure, upcoming Ethereum [ETH] ETF, and softer CPI, QCP Capital analysts projected that BTC could break above its current sideways movement.

According to renowned BTC analyst Stockmoney Lizards, a retest of $50K-52K could be possible before the $64K target is reached.