Bitcoin falls below $60,000 as ‘extreme fear’ grips the market – What now?

- A look at how Bitcoin is faring in an extreme fear environment.

- Why liquidations may have played a role in pushing BTC below $60k.

Bitcoin [BTC] has once again pulled back below the $60,000 price range after a brief recovery last week. This comes just days after the market started to regain optimism for a recovery.

The current Bitcoin price performance is a reflection of the prevailing sentiment. The Bitcoin/crypto fear and greed sentiment dropped from fear to extreme fear in the last 24 hours.

This has subsequently resulted in the flow of liquidity from the cryptocurrency.

This outcome suggests that the market may not be out of the woods yet after last week’s crash. BTC’s short-lived rally saw it push as high as $62,754 during Thursday’s trading session. It had a press time price of $58,172, a 7.58% drop from its weekly high.

The latest retracement occurred at the RSI mid-point. This is important because it signals an increased focus on short-term profit-taking among Bitcoin traders. After all, the market is currently going through a phase of heightened uncertainty.

There have been growing concerns about the state of the global economic markets after the recent unwind of the Japanese Yen carry trade.

Some analysts fear that more economic fallout might be on the way. This also comes amid rising FUD regarding a recession.

More fuel for the bears?

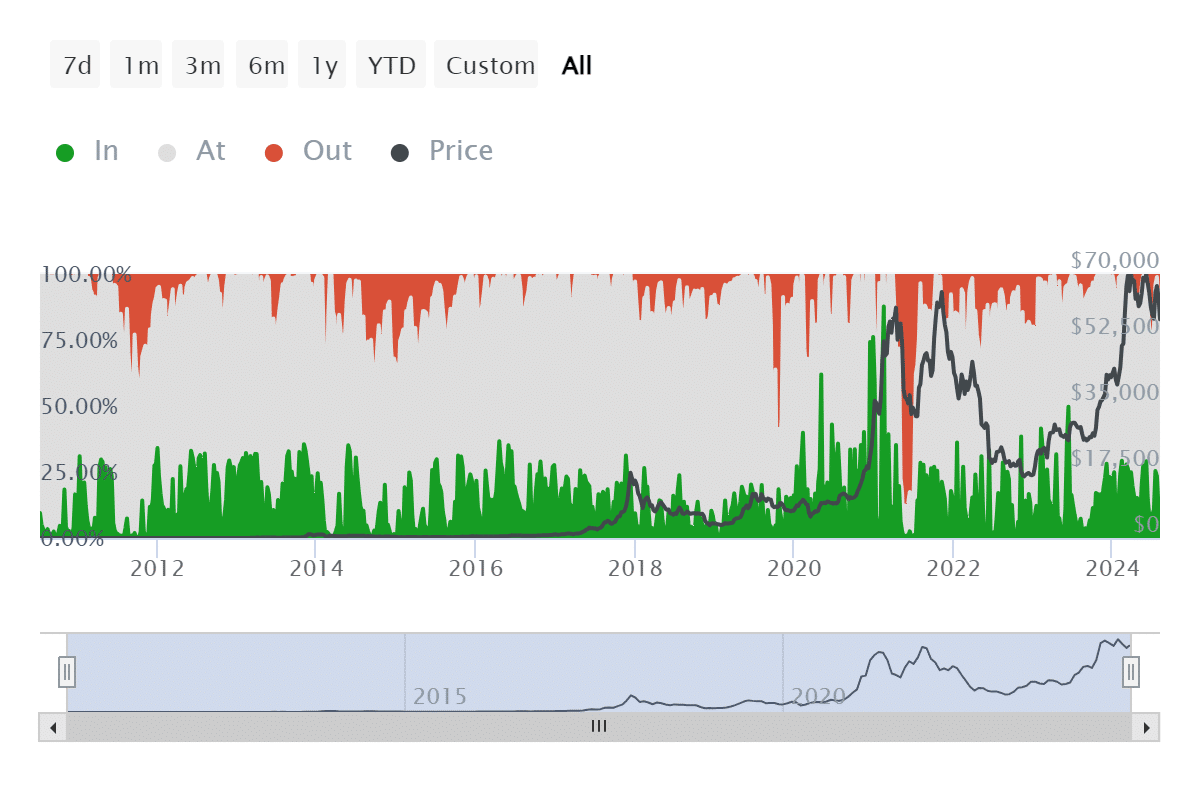

An assessment of Bitcoin from a liquidity perspective reveals potential exposure to liquidations. Our assessment revealed that addresses out of the money peaked at 20.3% which is roughly 10.84 million addresses at the height of the recent dip on 5th August.

The number of addresses out of the money as of 11th August was 7.14 million (13.38%).

Roughly 3.7 million addresses had injected liquidity into Bitcoin near recent lows. Meanwhile, the recent hype that quickly pushed BTC may have encouraged more hype and appetite for leverage.

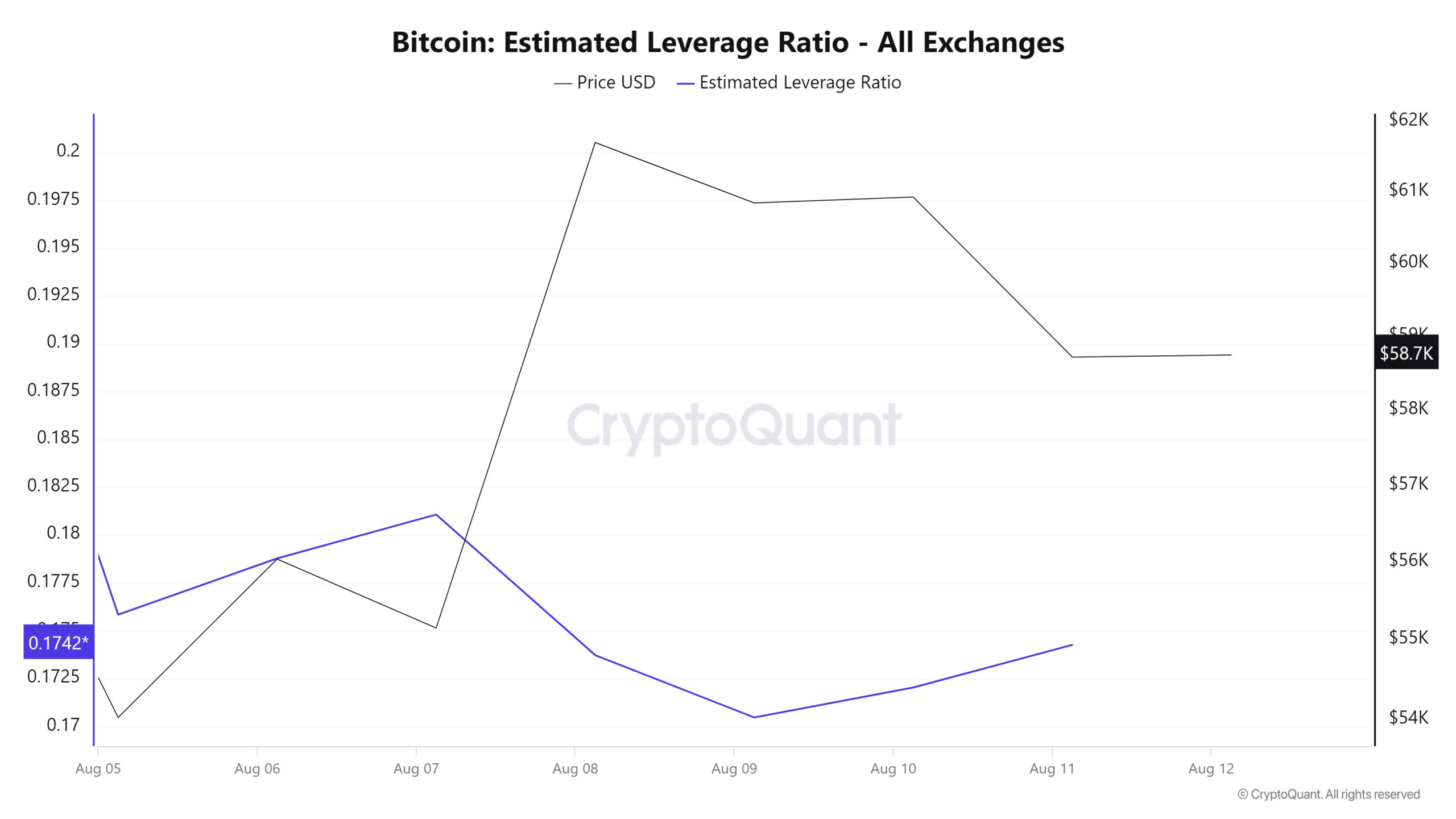

BTC’s estimated leverage ratio registered an uptick between 9th and 11th August.

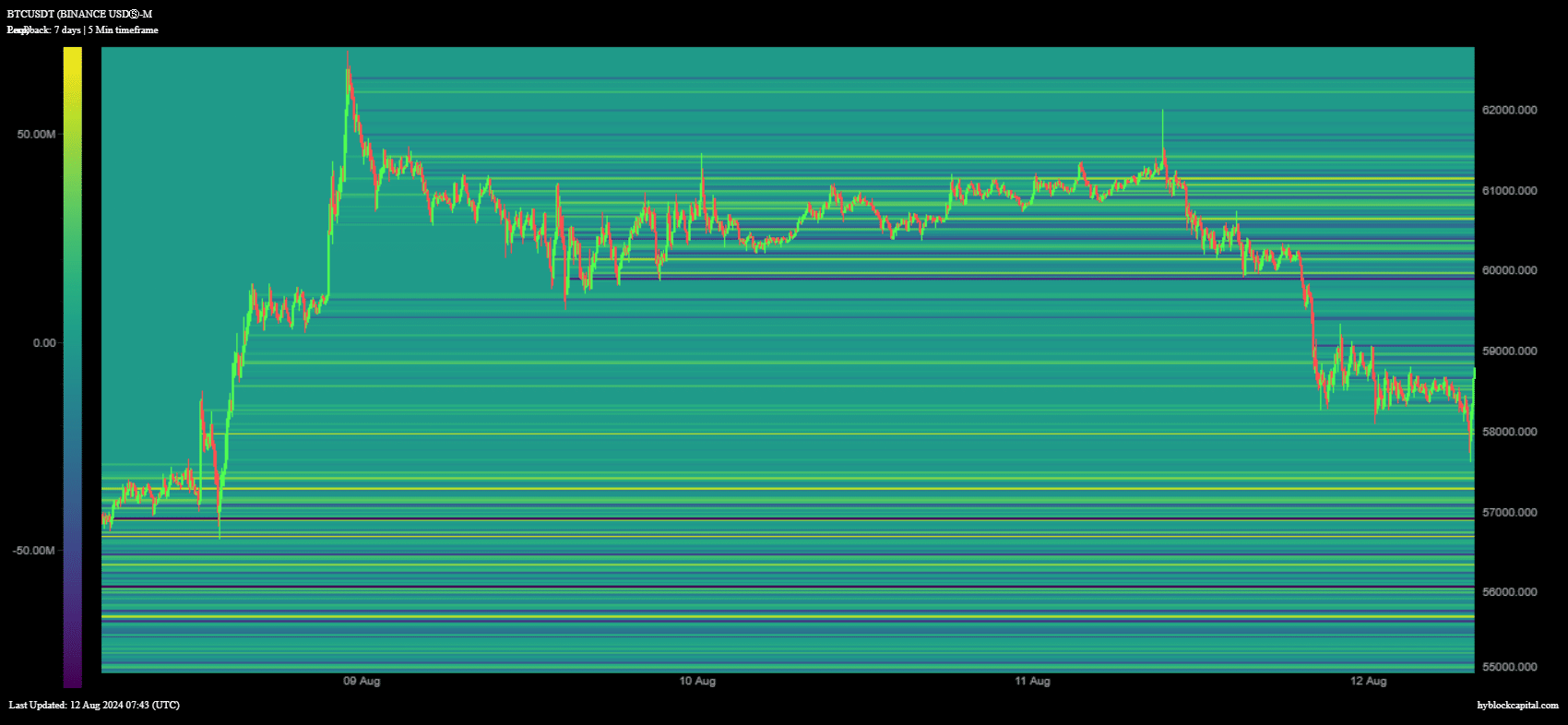

Bullish expectations and leverage may have created a conducive environment for another wave of liquidations. BTC net longs peaked at $53.92 million on 11th August at around the $61,129 price range.

This was just before a strong bearish move that pushed the price below $60,000.

Source: HyblockCapital

Is your portfolio green? Check out the BTC Profit Calculator

These findings indicate that leveraged longs liquidations might have heavily influenced BTC’s price action in the last 2 days.

While liquidations may have played into Bitcoin’s current dip below the $60,000 price, there is no doubt that the market risks more downside if sentiment remains weak.