Bitcoin falls below $70K as FOMC ‘refuses to hike’ interest rates

- The FOMC’s rate decision draws criticism; Peter Schiff and David Solomon predict ‘no cuts’ soon.

- The crypto market faces a downturn — resilience is observed, with a focus on long-term strategies.

Amidst concerns about the rising inflation in the U.S., the Federal Reserve has decided to hold interest rates steady.

Minutes from the Federal Open Market Committee (FOMC) meeting revealed policymakers’ apprehension about easing rates.

The minutes pointed to the fact that despite some progress, inflation has remained above the FOMC’s 2% target, with many consumer sentiment surveys showing growing worries about future inflation.

FOMC’s decision receives criticism

Criticizing the decision, Peter Schiff, CEO and Chief Global Strategist of Euro Pacific Capital, in an X (formerly Twitter) post, noted,

Joining a similar train of thought, David Solomon, CEO of Goldman Sachs Group Inc., stated at a Boston College event that he currently predicted “zero” rate cuts. He said,

“I still don’t see the data that’s compelling to see we’re going to cut rates here.”

Negative impact on the crypto market

Needless to say, experts began questioning the effects of the FOMC’s decision on the overall market conditions.

The impact was notably negative, as evidenced by its direct effect on leading cryptocurrencies.

On the 22nd of May, Bitcoin [BTC] dropped below the $70K mark, and Ethereum [ETH], which had recently surged from $3,064 to $3,790, turned red as well.

In fact, at the time of writing, most top coins showed red bars on the daily charts.

Positive sentiments persist

Despite the crypto market bleeding, @cryptosanthoshK, a Crypto & DeFi Analyst, noted,

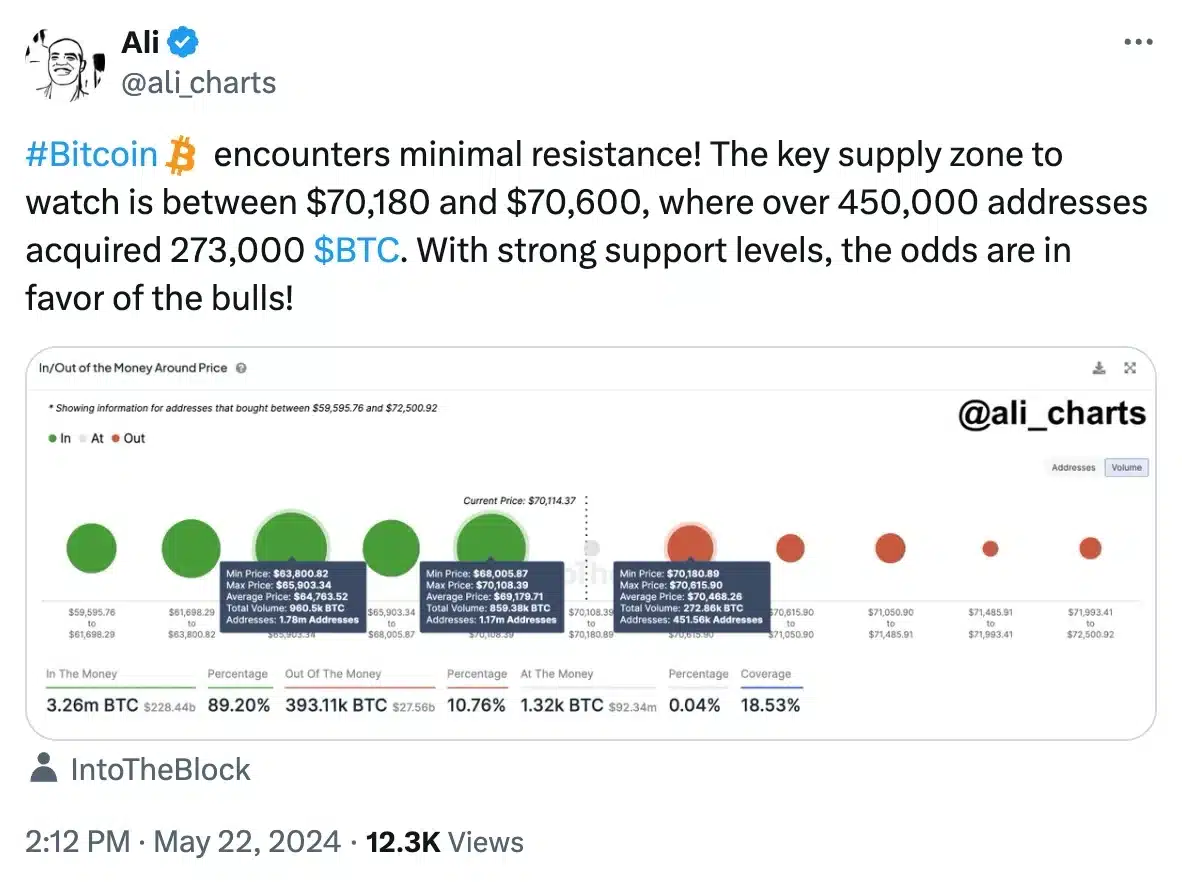

Ali Martinez, the technical and on-chain analyst, echoed a similar sentiment and said,

Glassnode’s Bitcoin liveliness metric further confirmed this, by showing a rise in coinday creation versus destruction, indicating a shift towards long-term holding over profit-taking.

Expecting ETH to experience a significant price increase due to the anticipation of an exchange-traded fund (ETF) approval, Satoshi Flipper, an investor/trader added,

“$ETH will deliver an epic ETF pump this week. Market prices can’t stay irrational forever.”

Stock market declined

Despite the prevailing positive sentiment surrounding cryptocurrencies, attention should also be paid to the performance of the stock market, which experienced a decline on the 22nd of May.

The Dow Jones Industrial Average dropped by 201.95 points, or 0.51%, closing at 39,671.04, marking its worst session of the month.

Similarly, the S&P 500 fell by 0.27% to reach 5,307.01, while the Nasdaq Composite, focusing on tech stocks, recorded a loss of 0.18%, ending at 16,801.54.

![Chainlink [LINK] price prediction - Watch out for a defense of THIS key level!](https://ambcrypto.com/wp-content/uploads/2025/04/Evans-17-min-400x240.png)